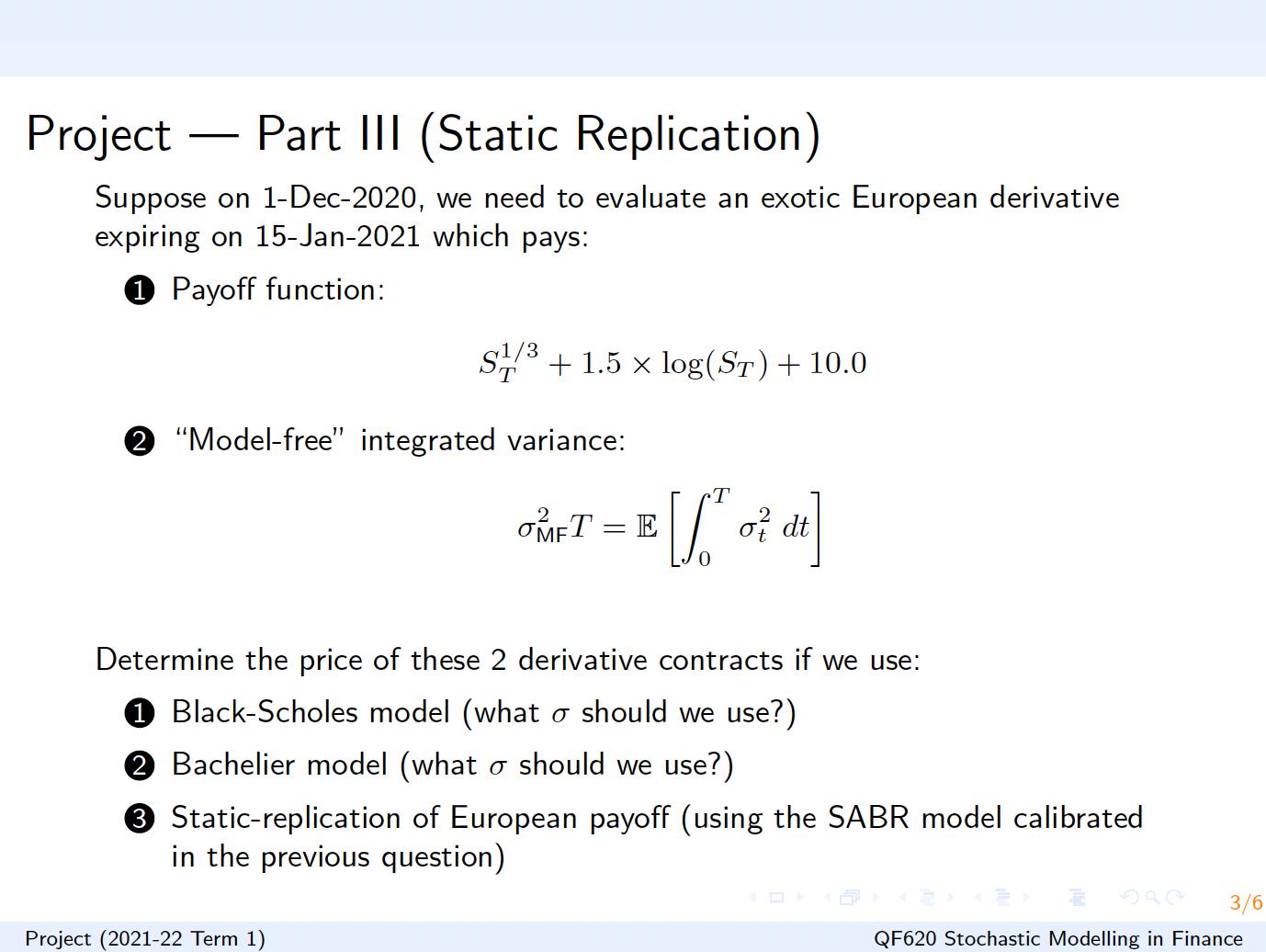

Question: Project Part III (Static Replication) Suppose on 1-Dec-2020, we need to evaluate an exotic European derivative expiring on 15-Jan-2021 which pays: 1 Payoff function:

Project Part III (Static Replication) Suppose on 1-Dec-2020, we need to evaluate an exotic European derivative expiring on 15-Jan-2021 which pays: 1 Payoff function: S +1.5 x log(ST) + 10.0 2 "Model-free" integrated variance: OMFT = E Project (2021-22 Term 1) T 3 [f" o dt] 0 Determine the price of these 2 derivative contracts if we use: 1 Black-Scholes model (what o should we use?) 2 Bachelier model (what o should we use?) 3 Static-replication of European payoff (using the SABR model calibrated in the previous question) 3/6 QF620 Stochastic Modelling in Finance

Step by Step Solution

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Determine the price of these 2 derivative contracts if we use BlackScholes model what should we use Heston model with Parameters 012 06 12 004 x0 004 CoxIngersollRoss model with Parameters 012 06 12 0... View full answer

Get step-by-step solutions from verified subject matter experts