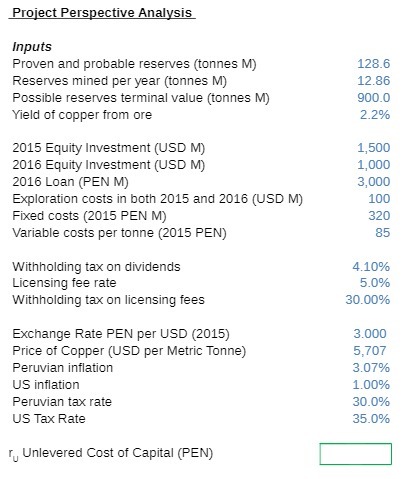

Question: Project Perspective Analysis Inputs Proven and probable reserves (tonnes M) Reserves mined per year (tonnes M) Possible reserves terminal value (tonnes M) Yield of

Project Perspective Analysis Inputs Proven and probable reserves (tonnes M) Reserves mined per year (tonnes M) Possible reserves terminal value (tonnes M) Yield of copper from ore 2015 Equity Investment (USD M) 2016 Equity Investment (USD M) 2016 Loan (PEN M) Exploration costs in both 2015 and 2016 (USD M) Fixed costs (2015 PEN M) Variable costs per tonne (2015 PEN) Withholding tax on dividends Licensing fee rate Withholding tax on licensing fees Exchange Rate PEN per USD (2015) Price of Copper (USD per Metric Tonne) Peruvian inflation US inflation Peruvian tax rate US Tax Rate TU Unlevered Cost of Capital (PEN) 128.6 12.86 900.0 2.2% 1,500 1,000 3,000 100 320 85 4.10% 5.0% 30.00% 3.000 5,707 3.07% 1.00% 30.0% 35.0%

Step by Step Solution

There are 3 Steps involved in it

Project Perspective Analysis Copper Mine This analysis examines the project from various perspectives to assess its feasibility and potential risks Fi... View full answer

Get step-by-step solutions from verified subject matter experts