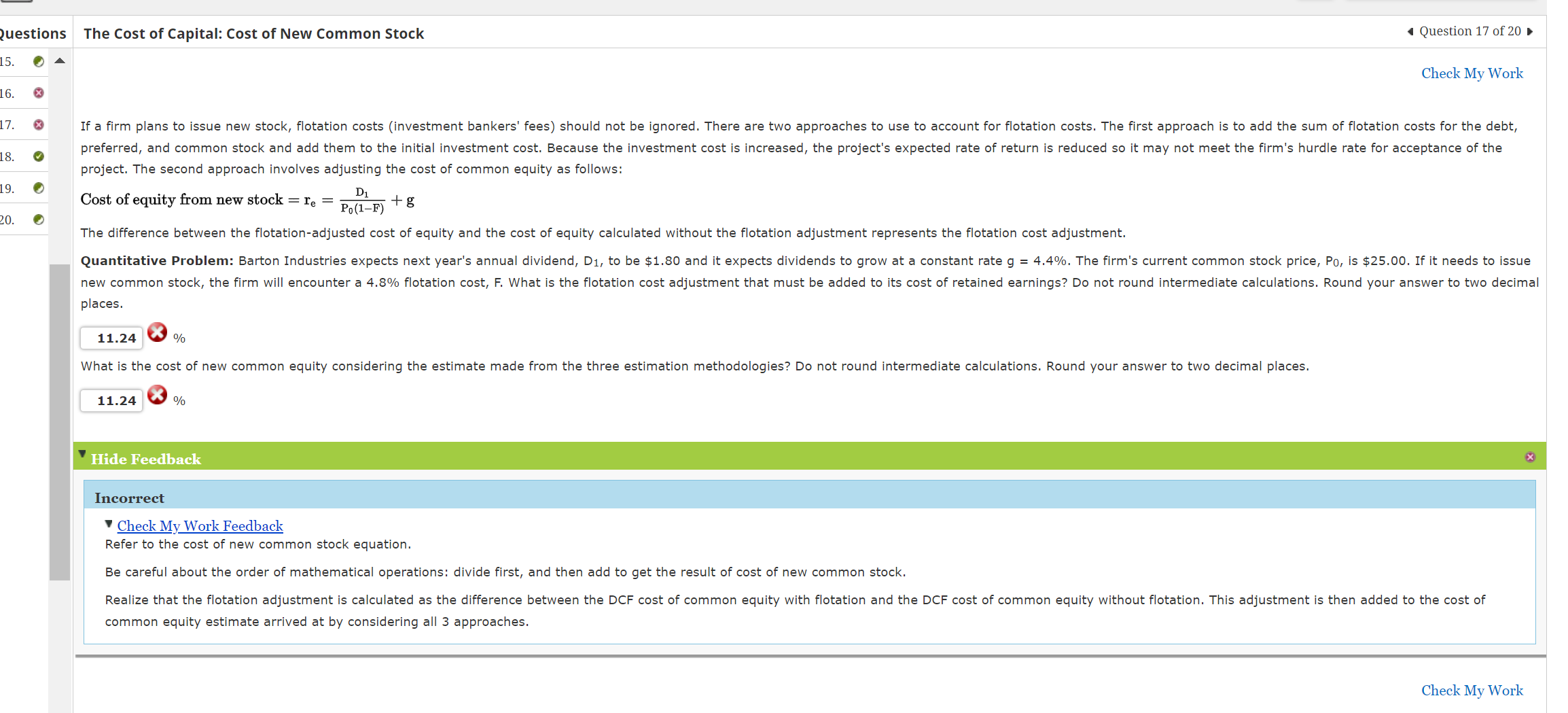

Question: project. The second approach involves adjusting the cost of common equity as follows: Cost of equity from new stock =re=P0(1F)D1+g The difference between the flotation-adjusted

project. The second approach involves adjusting the cost of common equity as follows: Cost of equity from new stock =re=P0(1F)D1+g The difference between the flotation-adjusted cost of equity and the cost of equity calculated without the flotation adjustment represents the flotation cost adjustment. places. % What is the cost of new common equity considering the estimate made from the three estimation methodologies? Do not round intermediate calculations. Round your answer to two decimal places. % Thide Feedback Incorrect Check My Work Feedback Refer to the cost of new common stock equation. Be careful about the order of mathematical operations: divide first, and then add to get the result of cost of new common stock. common equity estimate arrived at by considering all 3 approaches. project. The second approach involves adjusting the cost of common equity as follows: Cost of equity from new stock =re=P0(1F)D1+g The difference between the flotation-adjusted cost of equity and the cost of equity calculated without the flotation adjustment represents the flotation cost adjustment. places. % What is the cost of new common equity considering the estimate made from the three estimation methodologies? Do not round intermediate calculations. Round your answer to two decimal places. % Thide Feedback Incorrect Check My Work Feedback Refer to the cost of new common stock equation. Be careful about the order of mathematical operations: divide first, and then add to get the result of cost of new common stock. common equity estimate arrived at by considering all 3 approaches

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts