Question: Project X involves a new type of graphite composite in-line skate wheel that can be sold 6,000 units per year at $1,000 each. The variable

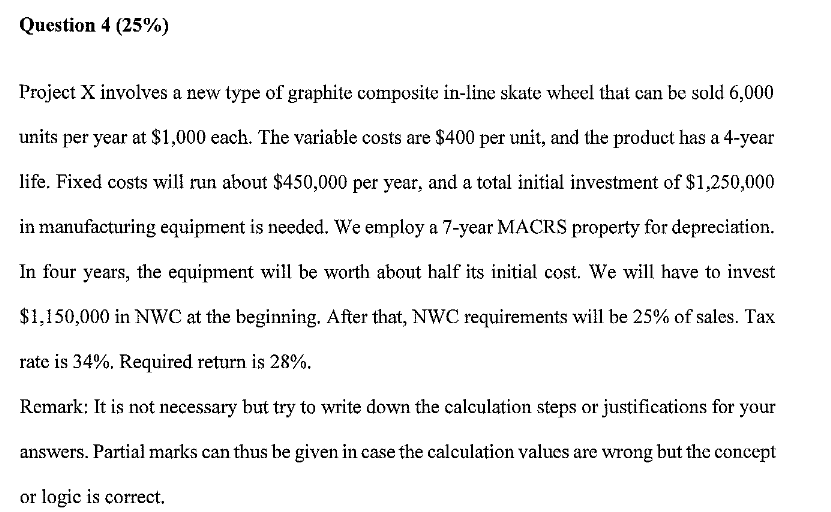

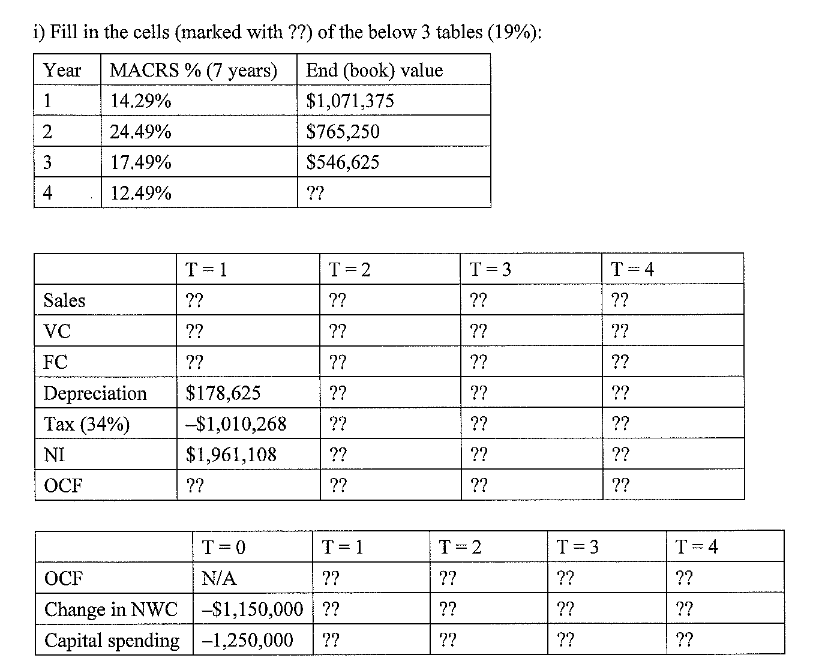

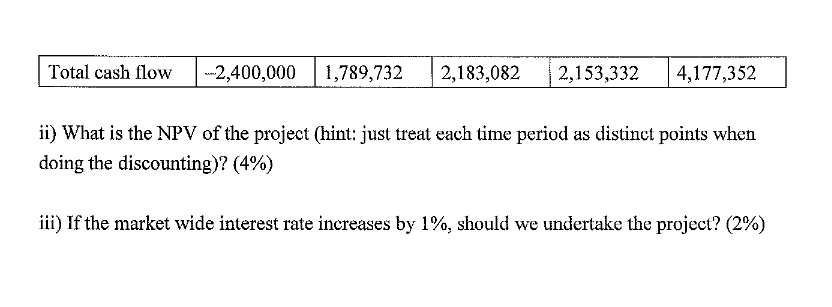

Project X involves a new type of graphite composite in-line skate wheel that can be sold 6,000 units per year at $1,000 each. The variable costs are $400 per unit, and the product has a 4-year life. Fixed costs will run about $450,000 per year, and a total initial investment of $1,250,000 in manufacturing equipment is needed. We employ a 7-year MACRS property for depreciation. In four years, the equipment will be worth about half its initial cost. We will have to invest $1,150,000 in NWC at the beginning. After that, NWC requirements will be 25% of sales. Tax rate is 34%. Required return is 28%. Remark: It is not necessary but try to write down the calculation steps or justifications for your answers. Partial marks can thus be given in case the calculation values are wrong but the concept or logic is correct. i) Fill in the cells (marked with ??) of the below 3 tables (19\%): ii) What is the NPV of the project (hint: just treat each time period as distinct points when doing the discounting)? (4\%) iii) If the market wide interest rate increases by 1%, should we undertake the project? (2\%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts