Question: * Projected cost in 2 0 2 5 : $ 1 7 5 . 0 0 Analyze VCC s current situation and provide feasible

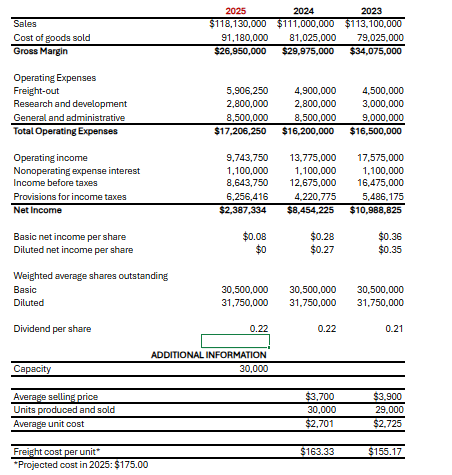

Projected cost in : $ Analyze VCCs current situation and provide feasible solutions to their current issues that balance the delicate relationships with the OEM, suppliers, shareholders, and customers. Estimate to paragraphs Provide an analysis of VCCs position within the existing supply chain and the strengths and weaknesses of its current production process flow, some of which may have been exposed through its adoption of Lean principles and a large number of potential product combinations. Estimate to paragraphsUse the excel file Prepare VCCs proform income statement, balance sheet, statement of cash flows, and unit cost information for integrating the terms of the new contract and your proposed solutions for VCC When preparing the pro forma statements. You should also assume: There are no planned additional investments in manufacturing equipment, meaning annual deprecation will remain at levels. Your calculations should be based on productive weeks per year. Overtime, if needed, is paid at of labor cost current labor costs are $ per hour Freight costs are expected to increase to $ per unit for all units shipped in There are no changes in research and development costs, general administrative expenses, and interest expense. Compute and compare the following ratios: working capital, current ratio, inventory turnover, debt toassets ratio, debttoequity ratio, times interest earned, return on sales, asset turnover ratio, return on assets, return on equity, and earnings per share for and These ratios should be used to support your proposed solutions. Prepare a horizontal trend analysis comparing the and income statements. Prepare a vertical trend analysis of the pro forma income statement. Include a conclusion of all findings include a reference to ratios and rationale involving the proforma financial statements. Estimate to paragraphs

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock