Question: Projected Operations for Albion Computers PLC: Case 3 ($1.40/) Projected Operations for Albion Computers PLC: Benchmark Case ($1.60/) aThe unit variable cost, 650, comprises 330

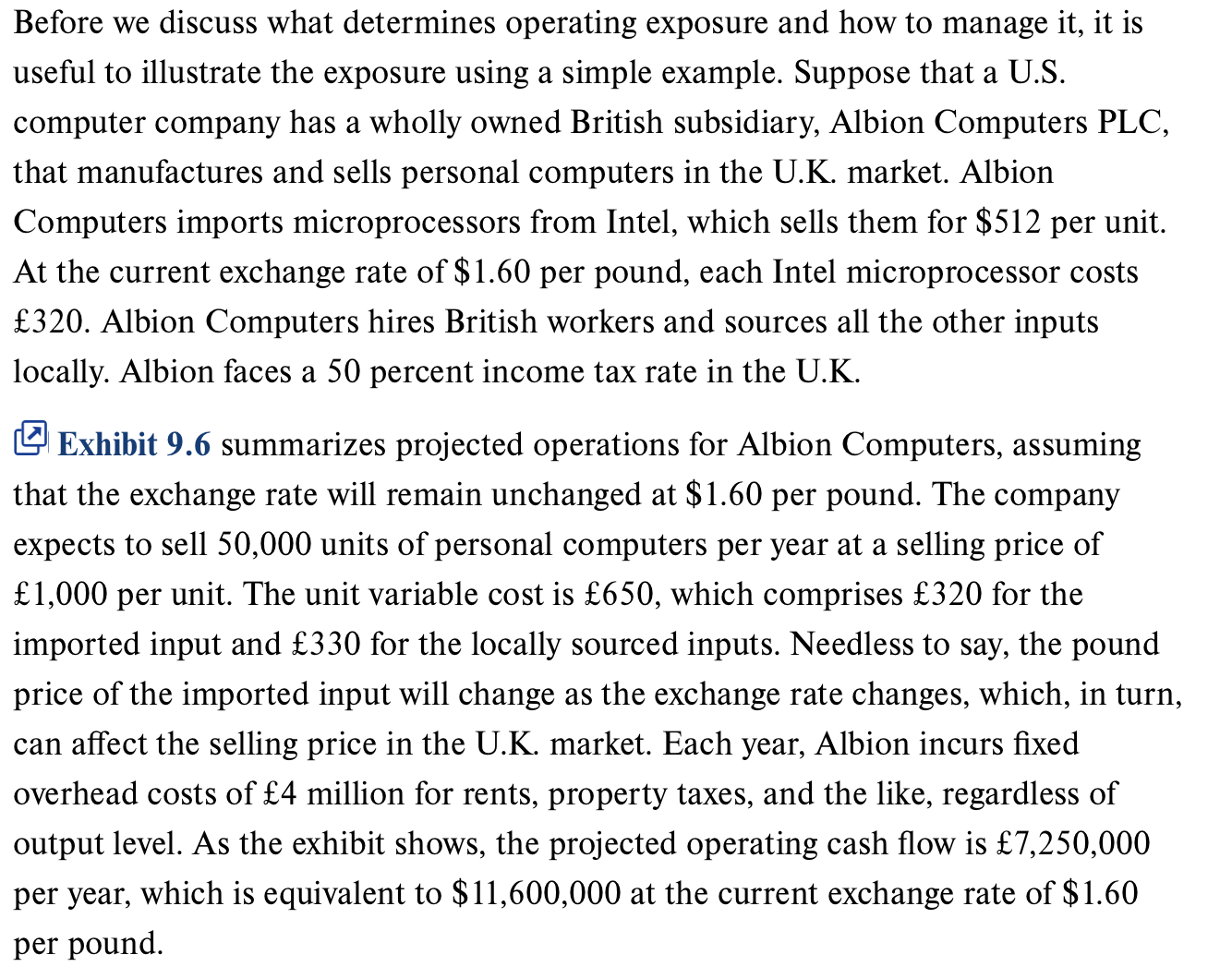

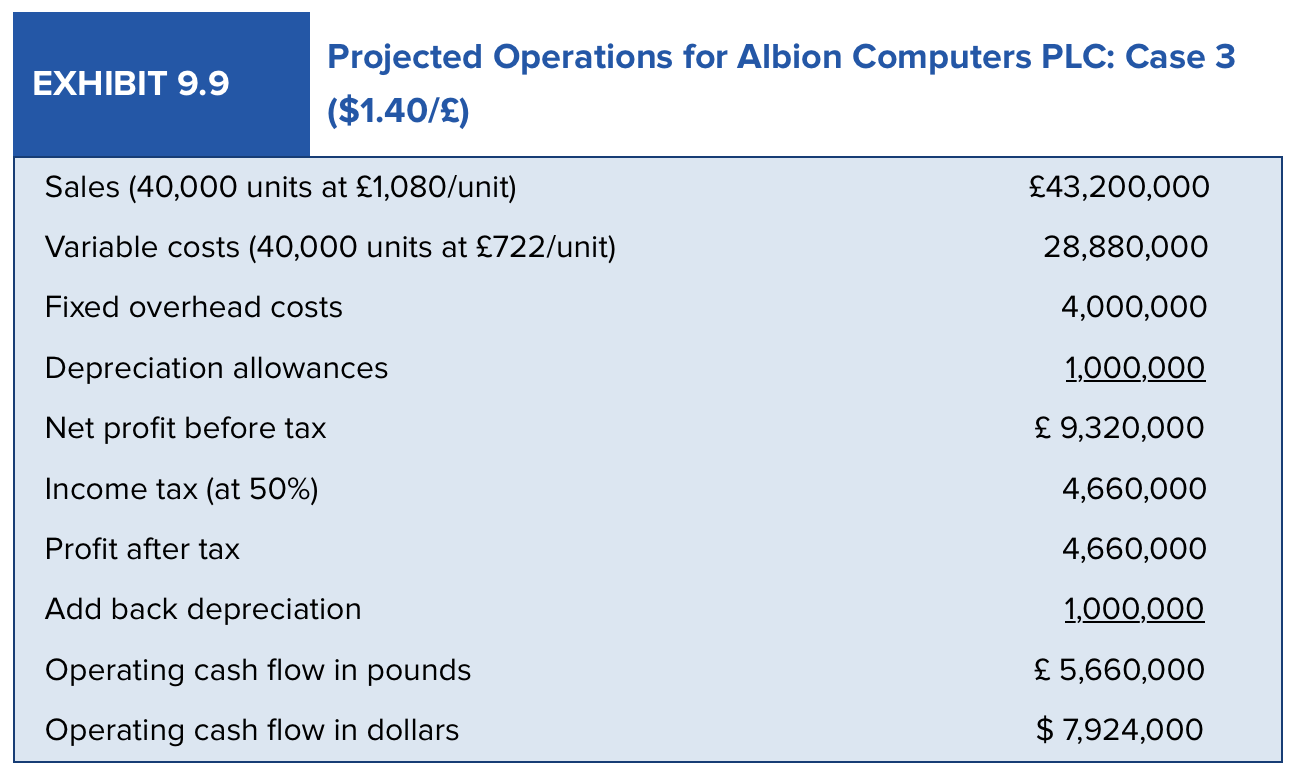

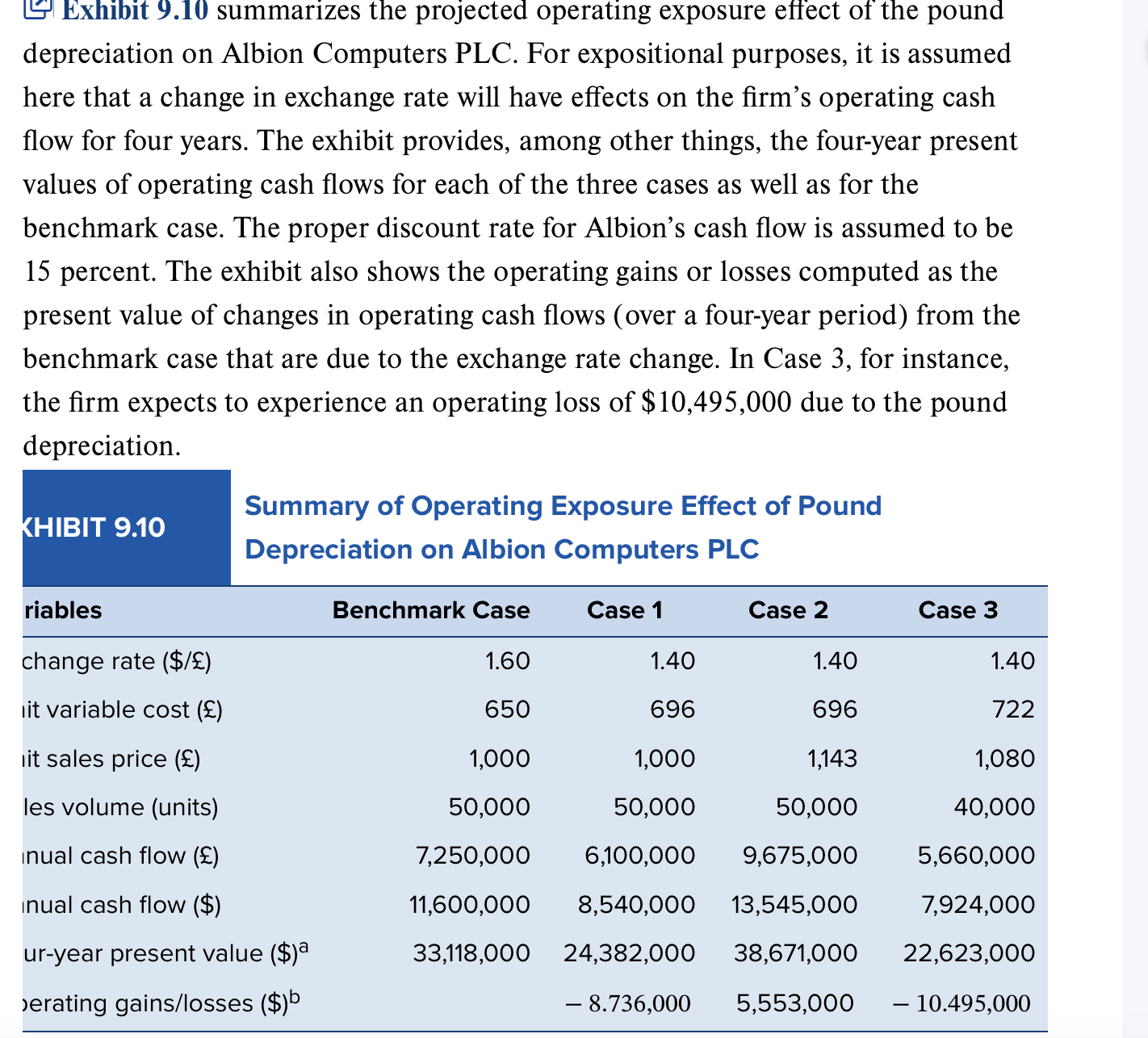

Projected Operations for Albion Computers PLC: Case 3 (\$1.40/) Projected Operations for Albion Computers PLC: Benchmark Case (\$1.60/) aThe unit variable cost, 650, comprises 330 for the locally sourced inputs and 320 for the imported input, which is priced in dollars, i.e., $512. At the exchange rate of $1.60/, the imported part costs 320. We now turn to Case 3 where the selling price, sales volume, and the prices of both locally sourced and imported inputs change following the Page 273 pound depreciation. In particular, we assume that both the selling price and the price of locally sourced inputs increase at the rate of 8 percent, reflecting the underlying inflation rate in the U.K. As a result, the selling price will be 1,080 per unit and the unit variable cost of locally sourced inputs will be 356. Since the price of the imported input is 366, the combined unit variable cost will be 722. Facing an elastic demand for its products, sales volume declines to 40,000 units per year after the price increase. As Exhibit 9.9 shows, Albion's projected operating cash flow is 5.66 million, which is equivalent to $7.924 million. The projected dollar cash flow under Case 3 is lower than that of the benchmark case by $3.676 million. Exhibit 9.10 summarizes the projected operating exposure effect of the pound depreciation on Albion Computers PLC. For expositional purposes, it is assumed here that a change in exchange rate will have effects on the firm's operating cash flow for four years. The exhibit provides, among other things, the four-year present values of operating cash flows for each of the three cases as well as for the benchmark case. The proper discount rate for Albion's cash flow is assumed to be 15 percent. The exhibit also shows the operating gains or losses computed as the present value of changes in operating cash flows (over a four-year period) from the benchmark case that are due to the exchange rate change. In Case 3, for instance, the firm expects to experience an operating loss of $10,495,000 due to the pound depreciation. Economic Exposure of Albion Computers PLC Consider Case 3 of Albion Computers PLC discussed in the chapter. Now, assume that the pound is expected to depreciate to $1.50 from the current level of $1.60 per pound. This implies that the pound cost of the imported part, that is, Intel's microprocessors, is 341(=,$512,/,$1.50). Other variables, such as the unit sales volume and the U.K. inflation rate, remain the same as in Case 3. a. Compute the projected annual cash flow in dollars. b. Compute the projected operating gains/losses over the four-year horizon as the discounted present value of change in cash flows, which is due to the pound depreciation, from the benchmark case presented in Exhibit 9.6. c. What actions, if any, can Albion take to mitigate the projected operating losses due to the pound depreciation? Before we discuss what determines operating exposure and how to manage it, it is useful to illustrate the exposure using a simple example. Suppose that a U.S. computer company has a wholly owned British subsidiary, Albion Computers PLC, that manufactures and sells personal computers in the U.K. market. Albion Computers imports microprocessors from Intel, which sells them for $512 per unit. At the current exchange rate of $1.60 per pound, each Intel microprocessor costs 320. Albion Computers hires British workers and sources all the other inputs locally. Albion faces a 50 percent income tax rate in the U.K. Exhibit 9.6 summarizes projected operations for Albion Computers, assuming that the exchange rate will remain unchanged at $1.60 per pound. The company expects to sell 50,000 units of personal computers per year at a selling price of 1,000 per unit. The unit variable cost is 650, which comprises 320 for the imported input and 330 for the locally sourced inputs. Needless to say, the pound price of the imported input will change as the exchange rate changes, which, in turn, can affect the selling price in the U.K. market. Each year, Albion incurs fixed overhead costs of 4 million for rents, property taxes, and the like, regardless of output level. As the exhibit shows, the projected operating cash flow is 7,250,000 per year, which is equivalent to $11,600,000 at the current exchange rate of $1.60 per pound. Now, consider the possible effect of a depreciation of the pound on the projected dollar operating cash flow of Albion Computers. Assume that the pound may depreciate from $1.60 to $1.40 per pound. The dollar operating cash flow may change following a pound depreciation due to: 1. The competitive effect: A pound depreciation may affect operating cash flow in pounds by altering the firm's competitive position in the marketplace. 2. The conversion effect: A given operating cash flow in pounds will be converted into a lower dollar amount after the pound depreciation. To get a feel of how the dollar operating cash flow may change as the exchange rate changes, consider the following cases with varying degrees of realism: Case 1: No variables change, except the price of the imported input. Case 2: The selling price as well as the price of the imported input changes, with no other changes. Case 3: All the variables change

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts