Question: # projectmanagement an example 1. Project Feasibility Analysis is an important tool to ensure investments in a project has been seriously considered before embarking on

#projectmanagement

an example

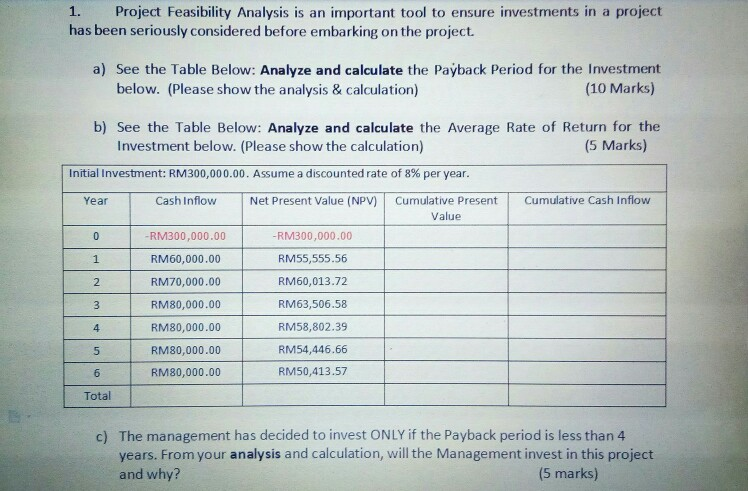

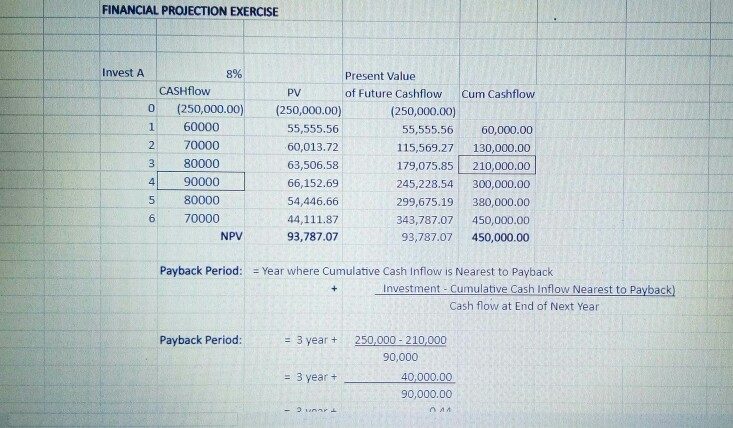

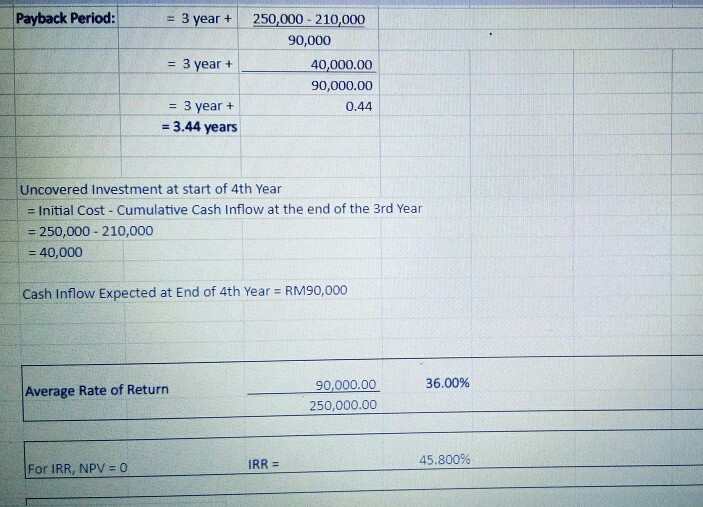

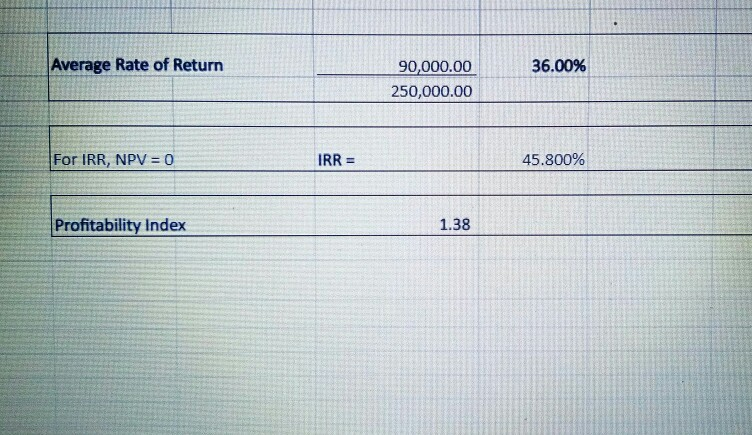

1. Project Feasibility Analysis is an important tool to ensure investments in a project has been seriously considered before embarking on the project. a) See the Table Below: Analyze and calculate the Payback Period for the Investment below. (Please show the analysis & calculation) (10 Marks) b) See the Table Below: Analyze and calculate the Average Rate of Return for the Investment below. (Please show the calculation) (5 Marks) Initial Investment: RM300,000.00. Assume a discounted rate of 8% per year. Year Cash Inflow Net Present Value (NPV) Cumulative Present Cumulative Cash Inflow Value 0 -RM300,000.00 -RM300,000.00 RM60,000.00 RM55,555.56 2 RM70,000.00 RM60,013.72 3 RM80,000.00 RM63,506.58 1 4 RM80,000.00 RM58,802.39 5 RM80,000.00 RM80,000.00 RM54,446.66 RM50,413.57 6 Total c) The management has decided to invest ONLY if the Payback period is less than 4 years. From your analysis and calculation, will the Management invest in this project and why? (5 marks) FINANCIAL PROJECTION EXERCISE Invest A a 1 2 8% CASHflow (250,000.00) 60000 70000 80000 90000 80000 70000 NPV 3 Present Value PV of Future Cashflow Cum Cashflow (250,000.00) (250,000.00) 55,555.56 55,555.56 60,000.00 60,013.72 115,569.27 130,000.00 63,506.58 179,075.85 210,000.00 66,152.69 245,228.54 300,000.00 54,446.66 299,675.19 380,000.00 44,111.87 343,787.07 450,000.00 93,787.07 93,787.07 450,000.00 4 5 6 Payback Period: = Year where Cumulative Cash Inflow is Nearest to Payback Investment - Cumulative Cash Inflow Nearest to Payback) Cash flow at End of Next Year Payback Period: = 3 year + = 3 year + 250,000 - 210,000 90,000 40,000.00 90,000.00 HAP Payback Period: 3 year + 3 year + 250,000 - 210,000 90,000 40,000.00 90,000.00 0.44 = 3 year + = 3.44 years Uncovered Investment at start of 4th Year = Initial Cost - Cumulative Cash Inflow at the end of the 3rd Year = 250,000 -210,000 = 40,000 Cash Inflow Expected at End of 4th Year = RM90,000 36.00% Average Rate of Return 90,000.00 250,000.00 45.800% For IRR, NPV = 0 IRR = Average Rate of Return 36.00% 90,000.00 250,000.00 For IRR, NPV = 0 IRR = 45.800% Profitability Index 1.38

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock