Question: Projects 1 and 2 have similar outlays, although the patterns of future cash flows are different. The cash flows as well as the NPV and

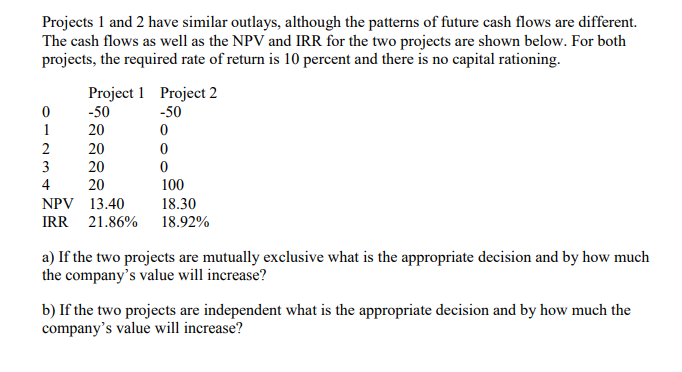

Projects 1 and 2 have similar outlays, although the patterns of future cash flows are different. The cash flows as well as the NPV and IRR for the two projects are shown below. For both projects, the required rate of return is 10 percent and there is no capital rationing. a) If the two projects are mutually exclusive what is the appropriate decision and by how much the company's value will increase? b) If the two projects are independent what is the appropriate decision and by how much the company's value will increase

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock