Question: Projects A and B are mutually exclusive and have an initial cost of $78,000 each. Project A provides cash inflows of $32,000 a year for

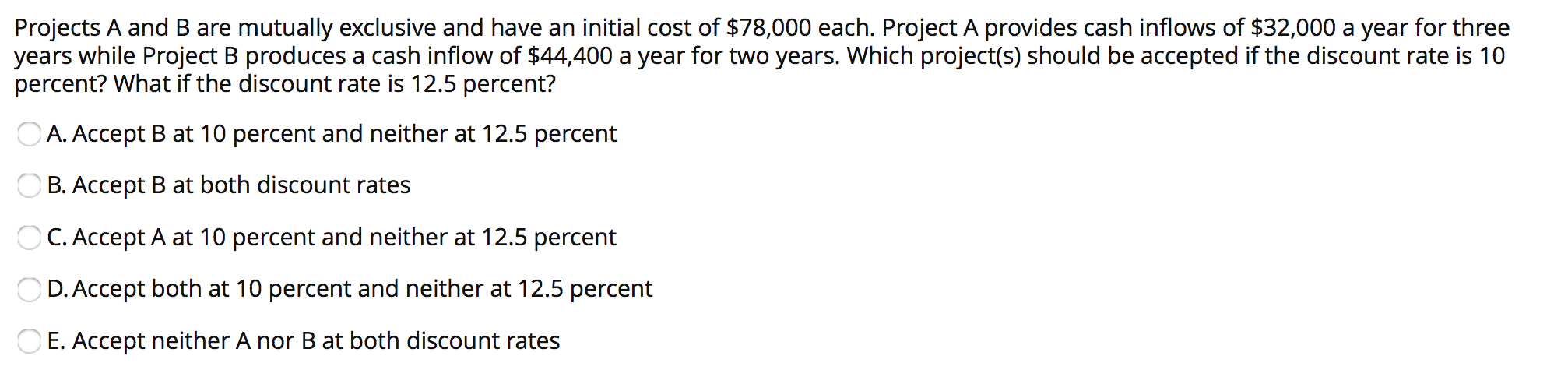

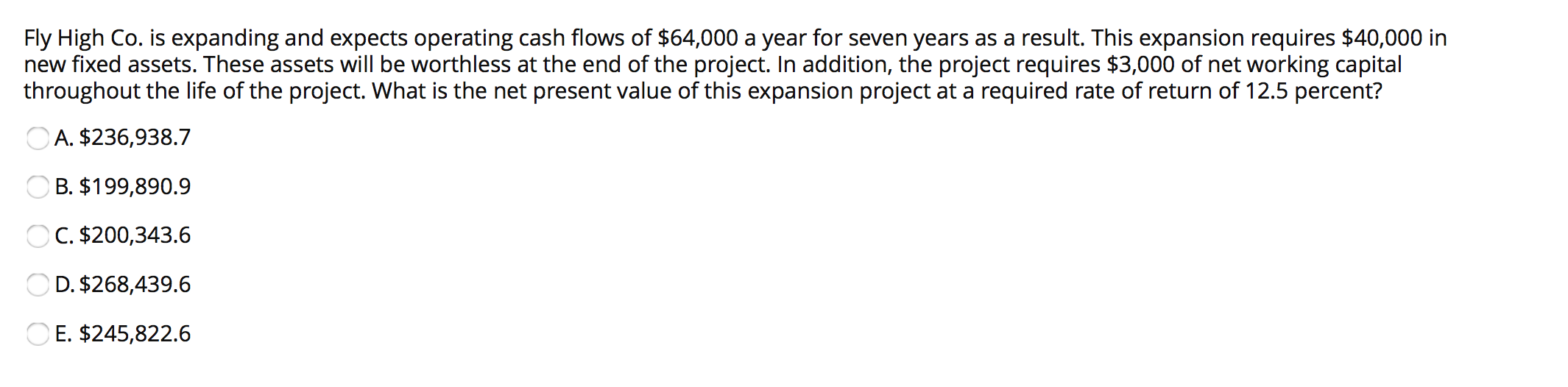

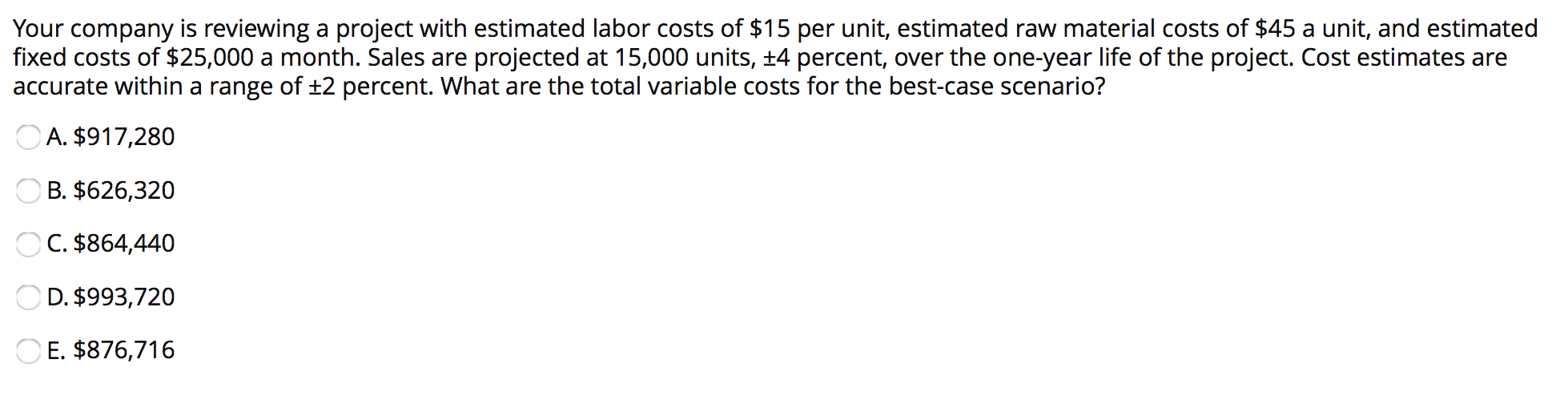

Projects A and B are mutually exclusive and have an initial cost of $78,000 each. Project A provides cash inflows of $32,000 a year for three years while Project B produces a cash inflow of $44,400 a year for two years. Which project(s) should be accepted if the discount rate is 10 percent? What if the discount rate is 12.5 percent? A. Accept B at 10 percent and neither at 12.5 percent B. Accept B at both discount rates C. Accept A at 10 percent and neither at 12.5 percent D. Accept both at 10 percent and neither at 12.5 percent E. Accept neither A nor B at both discount rates Fly High Co. is expanding and expects operating cash flows of $64,000 a year for seven years as a result. This expansion requires $40,000 in new fixed assets. These assets will be worthless at the end of the project. In addition, the project requires $3,000 of net working capital throughout the life of the project. What is the net present value of this expansion project at a required rate of return of 12.5 percent? A. $236,938.7 B. $199,890.9 C. $200,343.6 OD. $268,439.6 E. $245,822.6 Your company is reviewing a project with estimated labor costs of $15 per unit, estimated raw material costs of $45 a unit, and estimated fixed costs of $25,000 a month. Sales are projected at 15,000 units, +4 percent, over the one-year life of the project. Cost estimates are accurate within a range of +2 percent. What are the total variable costs for the best-case scenario? A. $917,280 B. $626,320 C. $864,440 OD. $993,720 E. $876,716

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts