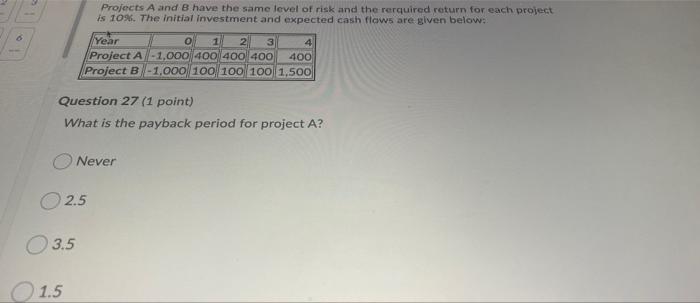

Question: Projects A and B have the same level of risk and the required return for each project is 10%. The initial Investment and expected cash

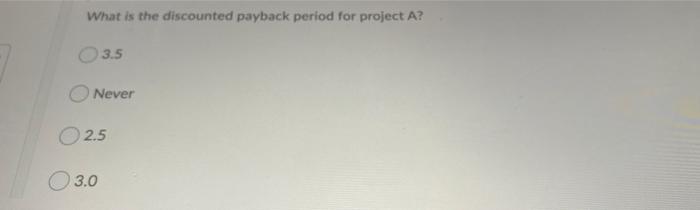

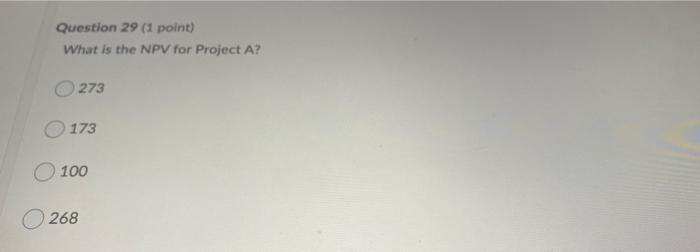

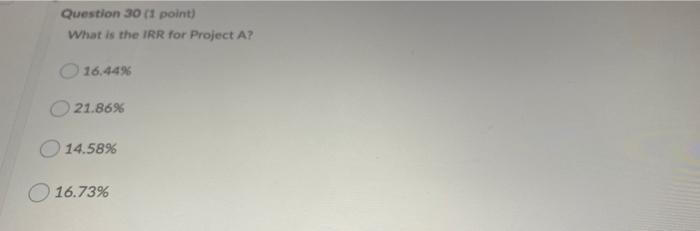

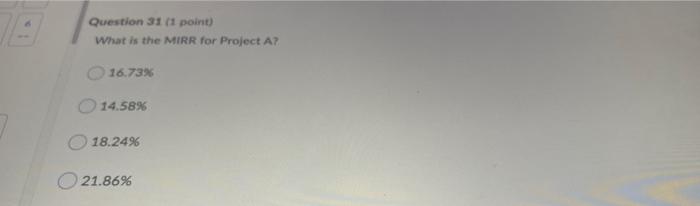

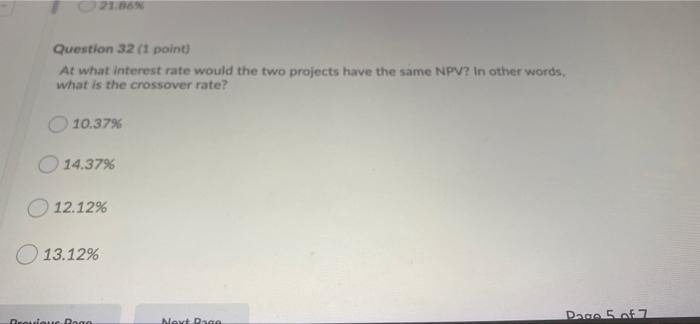

Projects A and B have the same level of risk and the required return for each project is 10%. The initial Investment and expected cash flaws are given below: 6 4 Year o 1 2 3 Project A/-1,000|400|400 400 400 Project B-1,000 100 100 100 1.500 Question 27 (1 point) What is the payback period for project A? Never 2.5 3.5 1.5 What is the discounted payback period for project A? 3.5 Never 2.5 3.0 Question 29 (1 point) What is the NPV for Project A? 273 173 100 268 Question 30 (1 point) What is the IRR for Project A? 16,44% 21.86% 14.58% 16.73% Question 31 (1 point) What is the MIRR for Project A? 16.73% 14.5896 18.24% 21.86% Question 32 (1 point) At what interest rate would the two projects have the same NPV? In other words, what is the crossover rate? 10.37% 14.3796 12.12% 13.12% Dace 5 of 7 Prowane Page NevD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts