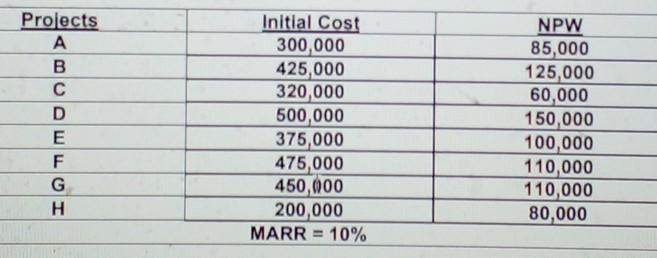

Question: Projects B D E F G H Initial Cost 300,000 425,000 320,000 500,000 375,000 475,000 450,000 200,000 MARR = 10% NPW 85,000 125,000 60,000 150,000

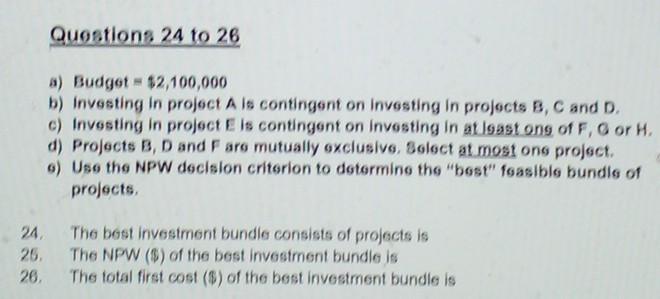

Projects B D E F G H Initial Cost 300,000 425,000 320,000 500,000 375,000 475,000 450,000 200,000 MARR = 10% NPW 85,000 125,000 60,000 150,000 100,000 110,000 110,000 80,000 IQTM Questions 24 to 26 a) Budget - $2,100,000 b) Investing in project Als contingent on Investing in projects B, C and D. c) Investing in project Els contingent on Investing in at least ong of F, or H. d) Projects B, D and F are mutually exclusive, Boloct at most ono project. 6) Use the NPW decision criterion to determine the "best" feasible bundle of projects 24 26 26 The best investment bundle consists of projects is The NPW ($) of the best investment bundle is The total first cost (8) of the best investment bundle is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts