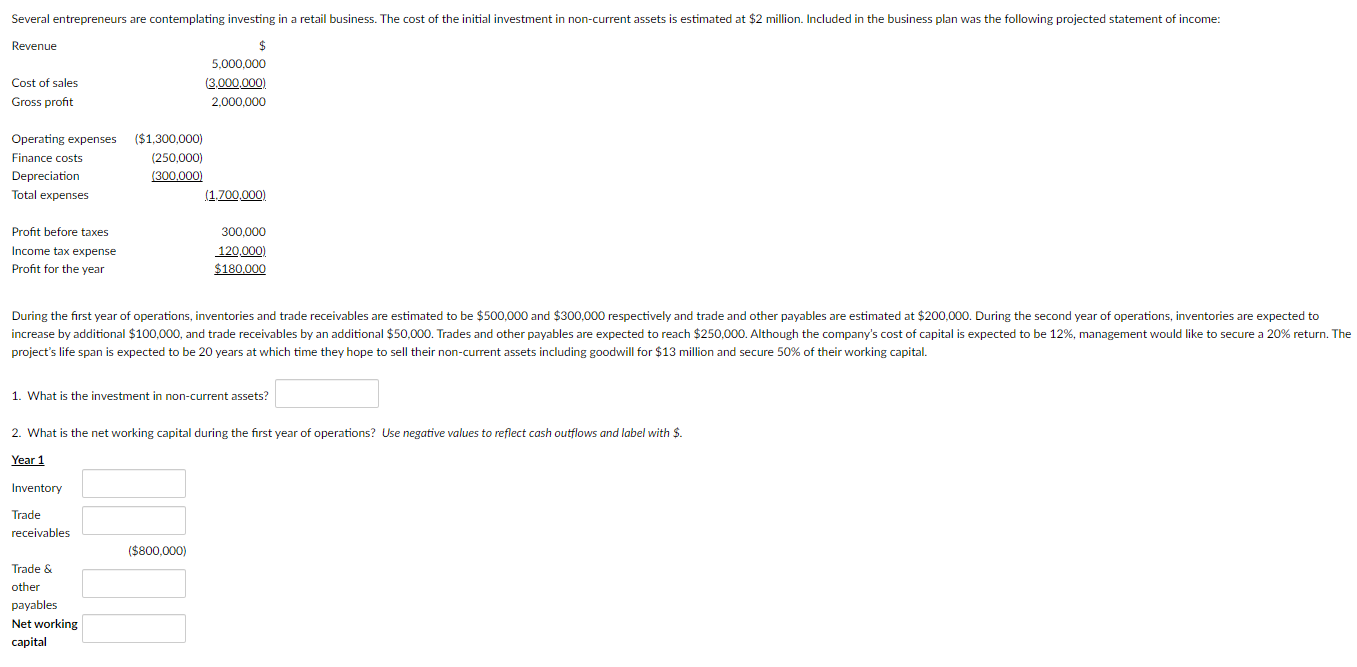

Question: project's life span is expected to be 20 years at which time they hope to sell their non-current assets including goodwill for $13 million and

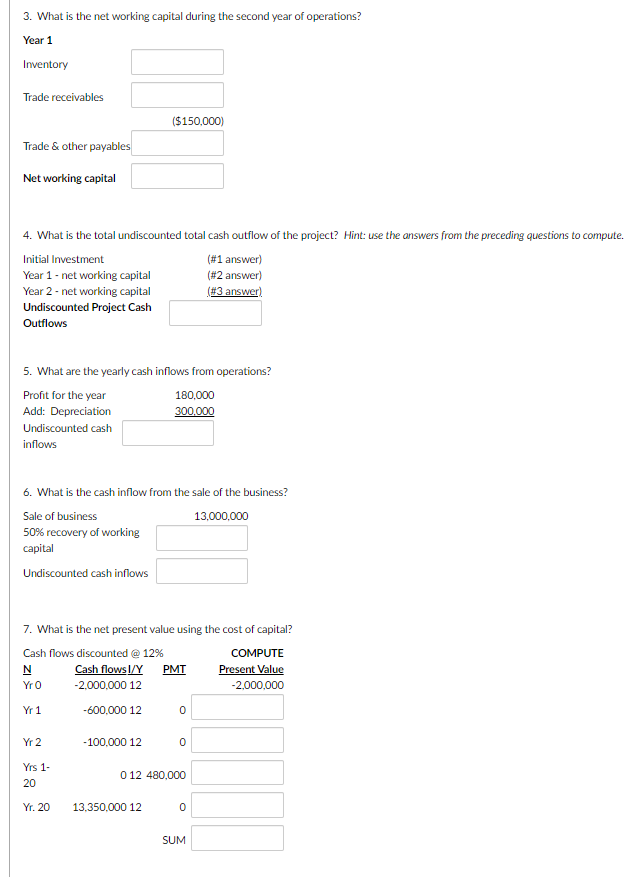

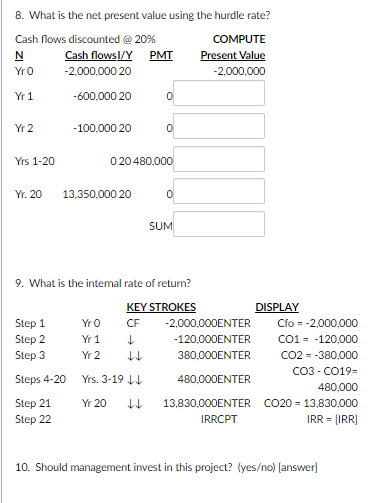

project's life span is expected to be 20 years at which time they hope to sell their non-current assets including goodwill for $13 million and secure 50% of their working capital. 1. What is the investment in non-current assets? 2. What is the net working capital during the first year of operations? Use negative values to reflect cash outflows and label with $. 8. What is the net present value using the hurdle rate? 9. What is the intemal rate of return? 10. Should management invest in this project? (yeso) [answer] project's life span is expected to be 20 years at which time they hope to sell their non-current assets including goodwill for $13 million and secure 50% of their working capital. 1. What is the investment in non-current assets? 2. What is the net working capital during the first year of operations? Use negative values to reflect cash outflows and label with $. 8. What is the net present value using the hurdle rate? 9. What is the intemal rate of return? 10. Should management invest in this project? (yeso) [answer]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts