Pronghorn Corporation leased equipment to Larkspur, Inc. on January 1, 2020. The lease agreement called for annual

Question:

Pronghorn Corporation leased equipment to Larkspur, Inc. on January 1, 2020. The lease agreement called for annual rental payments of $1,179 at the beginning of each year of the 3-year lease. The equipment has an economic useful life of 7 years, a fair value of $8,900, a book value of $6,900, and Pronghorn expects a residual value of $6,400 at the end of the lease term. Pronghorn set the lease payments with the intent of earning a 5% return, though Larkspur is unaware of the rate implicit in the lease and has an incremental borrowing rate of 7%. There is no bargain purchase option, ownership of the lease does not transfer at the end of the lease term, and the asset is not of a specialized nature.

a) Determine the nature of the lease to both Pronghorn and Larkspur.

-The lease is a/an ___________ lease to Larkspur.

-The lease is a/an ___________ lease to Pronghorn

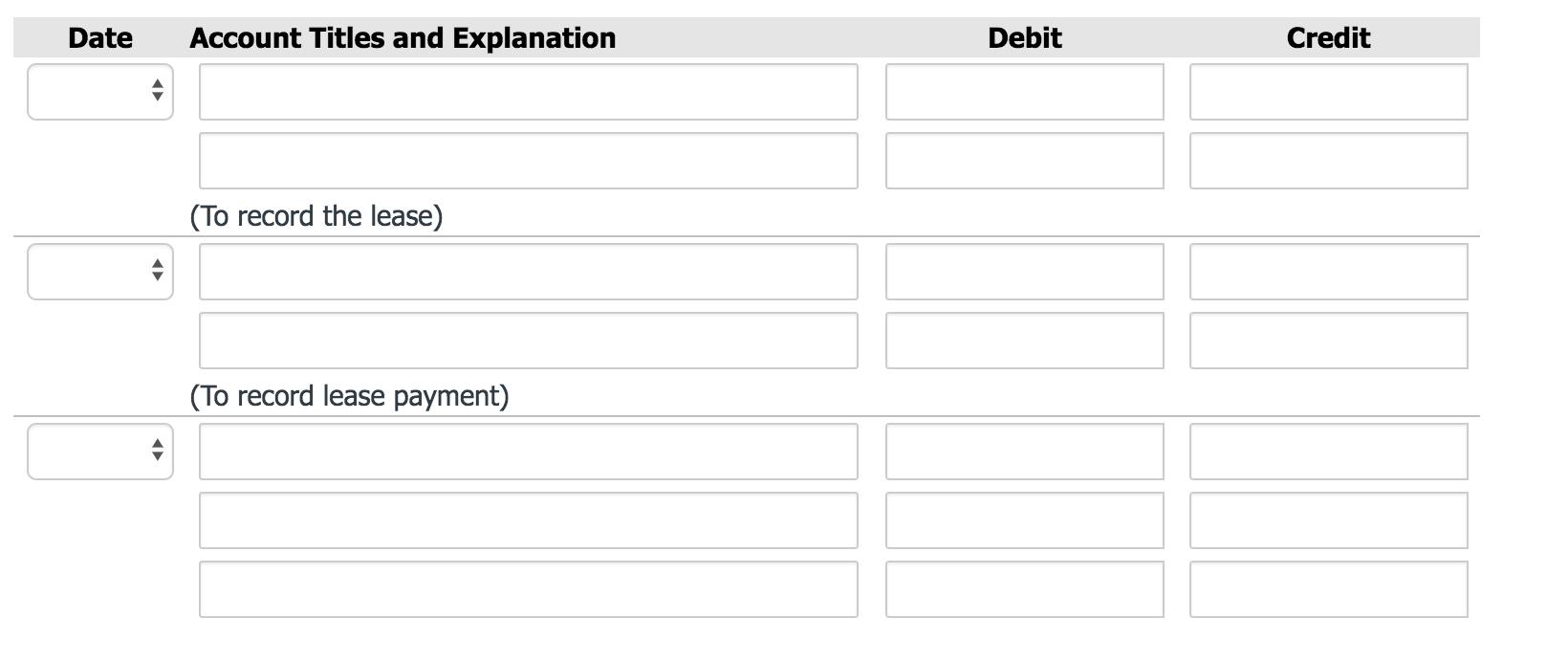

b) Prepare all necessary journal entries for Larkspur in 2020.

c) How would the measurement of the lease liability and right-of-use asset be affected if, as a result of the lease contract, Larkspur was also required to pay $600 in commissions, prepay $700 in addition to the first rental payment, and pay $250 of insurance each year? (Round answers to 0 decimal places, e.g. 5,275.)

- Lease liability $_______________

-right-of-use-asset $________________

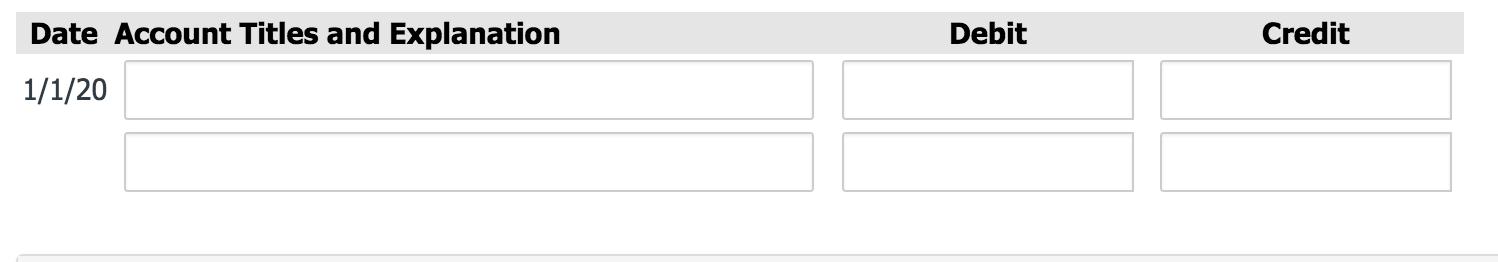

d) Suppose, instead of a 3-year lease term, Larkspur and Pronghorn agree to a one-year lease with a payment of $1,179 at the start of the lease. Prepare necessary journal entry for Larkspur in 2020.

Intermediate Accounting

ISBN: 978-0078025839

9th edition

Authors: J. David Spiceland, James Sepe , Mark Nelson , Wayne Thomas