Question: Properly solve and please solve fast don't have time. QUESTION 18 The current price of a non-dividend-paying stock is $60. Over the next six months

Properly solve and please solve fast don't have time.

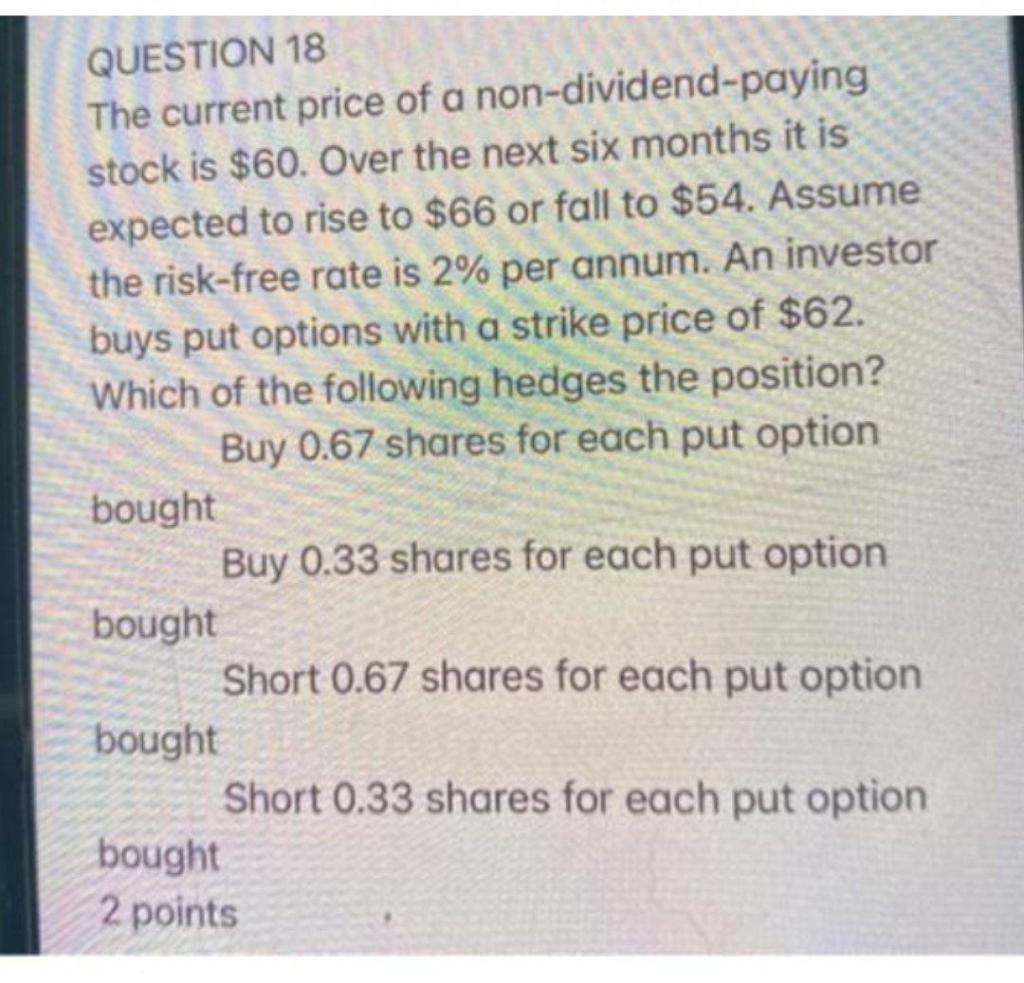

QUESTION 18 The current price of a non-dividend-paying stock is $60. Over the next six months it is expected to rise to $66 or fall to $54. Assume the risk-free rate is 2% per annum. An investor buys put options with a strike price of $62. Which of the following hedges the position? Buy 0.67 shares for each put option bought Buy 0.33 shares for each put option bought Short 0.67 shares for each put option bought Short 0.33 shares for each put option bought 2 points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts