Question: Property M requires a $ 3 5 , 0 0 0 initial investment and will provide three cash flows of $ 1 5 , 0

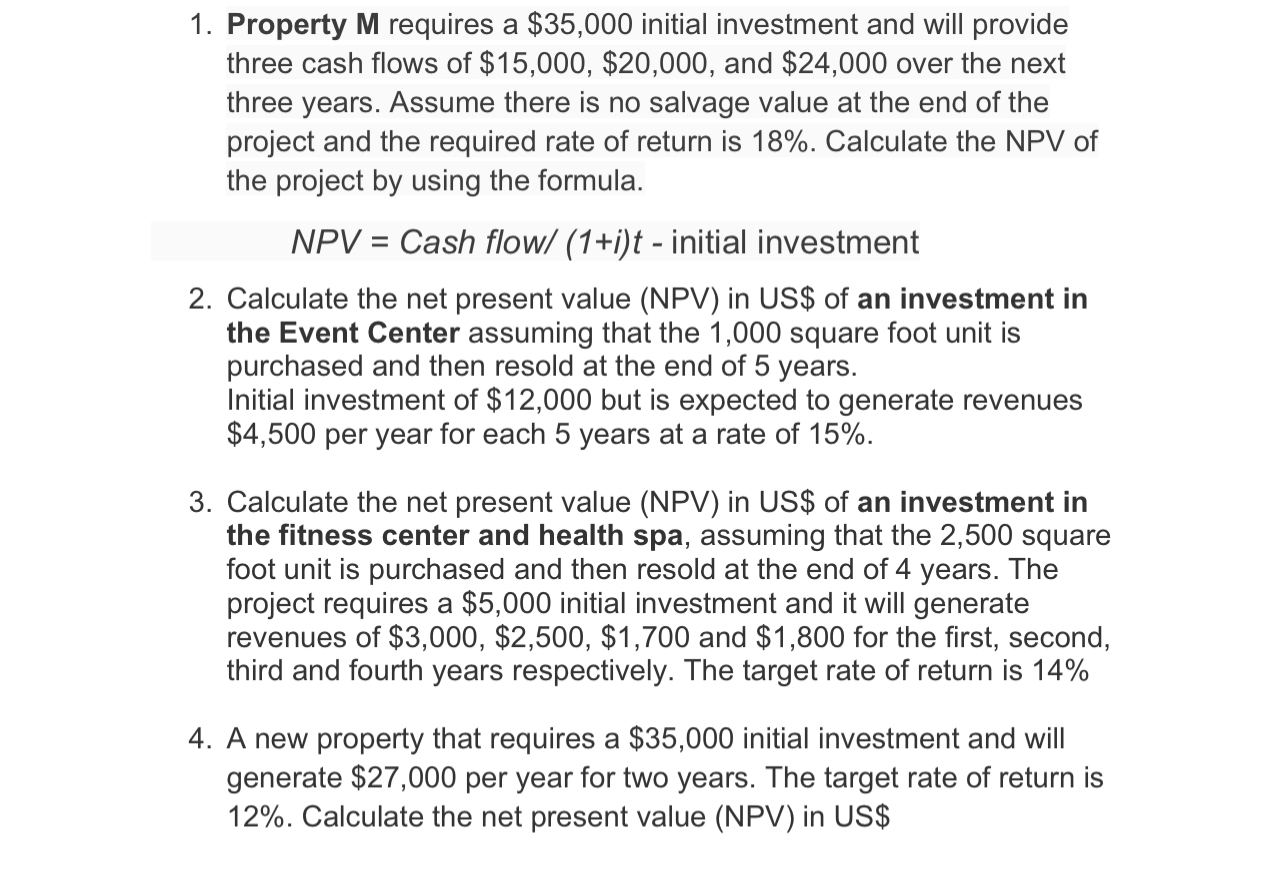

Property M requires a $ initial investment and will provide three cash flows of $$ and $ over the next three years. Assume there is no salvage value at the end of the project and the required rate of return is Calculate the NPV of the project by using the formula.

Cash flo initial investment

Calculate the net present value NPV in US$ of an investment in the Event Center assuming that the square foot unit is purchased and then resold at the end of years. Initial investment of $ but is expected to generate revenues $ per year for each years at a rate of

Calculate the net present value NPV in US$ of an investment in the fitness center and health spa, assuming that the square foot unit is purchased and then resold at the end of years. The project requires a $ initial investment and it will generate revenues of $$$ and $ for the first, second, third and fourth years respectively. The target rate of return is

A new property that requires a $ initial investment and will generate $ per year for two years. The target rate of return is Calculate the net present value NPV in US$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock