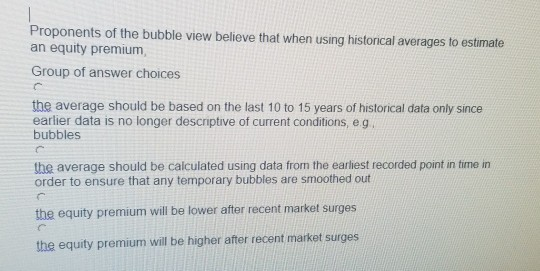

Question: Proponents of the bubble view believe that when using historical averages to estimate an equity premium Group of answer choices the average should be based

Proponents of the bubble view believe that when using historical averages to estimate an equity premium Group of answer choices the average should be based on the last 10 to 15 years of historical data only since earlier data is no longer descriptive of current conditions, eg bubbles the average should be calculated using data from the earliest recorded point in time in order to ensure that any temporary bubbles are smoothed out the equity premium will be lower after recent market surges the equity premium will be higher after recent market surges

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock