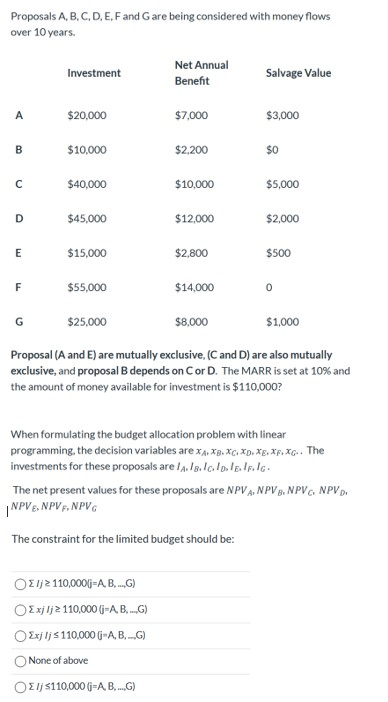

Question: Proposals A, B, C, D, E, F and G are being considered with money flows over 10 years. Investment Net Annual Benefit Salvage Value $20,000

Proposals A, B, C, D, E, F and G are being considered with money flows over 10 years. Investment Net Annual Benefit Salvage Value $20,000 $7,000 $3,000 $10,000 $2,200 $40,000 $10,000 $5,000 $45,000 $12,000 $2,000 $15,000 $2,800 $500 $55,000 $14,000 $25,000 $8,000 $1,000 Proposal (A and E) are mutually exclusive, (C and D) are also mutually exclusive, and proposal B depends on Cor D. The MARR is set at 10% and the amount of money available for investment is $110,000? When formulating the budget allocation problem with linear programming, the decision variables are XA.X.X.X.X.X.XG.. The investments for these proposals are lA.l.lol. IIp. I. The net present values for these proposals are NPVA NPV . NPV NPVD. NPVE, NPV, NPVG The constraint for the limited budget should be: O lj 110,000[j=A, B...G) 2 xj lj2 110,000 (j=A, B...) Exjljs 110,000 (-A, B, ...) None of above OLI 5110,000 (j=A, B...) Proposals A, B, C, D, E, F and G are being considered with money flows over 10 years. Investment Net Annual Benefit Salvage Value $20,000 $7,000 $3,000 $10,000 $2,200 $40,000 $10,000 $5,000 $45,000 $12,000 $2,000 $15,000 $2,800 $500 $55,000 $14,000 $25,000 $8,000 $1,000 Proposal (A and E) are mutually exclusive, (C and D) are also mutually exclusive, and proposal B depends on Cor D. The MARR is set at 10% and the amount of money available for investment is $110,000? When formulating the budget allocation problem with linear programming, the decision variables are XA.X.X.X.X.X.XG.. The investments for these proposals are lA.l.lol. IIp. I. The net present values for these proposals are NPVA NPV . NPV NPVD. NPVE, NPV, NPVG The constraint for the limited budget should be: O lj 110,000[j=A, B...G) 2 xj lj2 110,000 (j=A, B...) Exjljs 110,000 (-A, B, ...) None of above OLI 5110,000 (j=A, B...)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts