Question: Propose ONE option combination strategy that involves more than one option contract for the A$ commercial paper for the currency risk faced by this exposure.

Propose ONE option combination strategy that involves more than one option contract for the A$ commercial paper for the currency risk faced by this exposure. ADM's management has expressed a desire to retain some of the upside benefits that hedging with options can permit but without paying a lot of money in option premiums. That is, your recommended strategies should provide a "reasonably effective" hedge but keep the option premium payment limited to a "reasonable amount" (it does not have to be zero!). As the strategist, it is up to you what you consider "reasonable" for this purpose. You must also describe the benefits and possible shortcomings of your proposed option strategies. You must use actual option data to illustrate your option strategies.

Calculate the number of contracts required for the strategy and provide the strike prices and total premium costs.

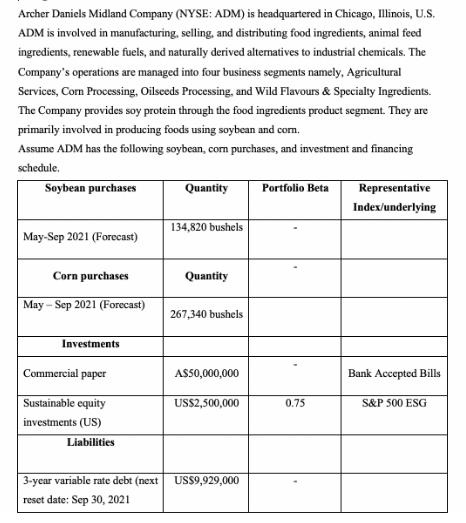

Archer Daniels Midland Company (NYSE: ADM) is headquartered in Chicago, Illinois, U.S. ADM is involved in manufacturing, selling, and distributing food ingredients, animal feed ingredients, renewable fuels, and naturally derived alternatives to industrial chemicals. The Company's operations are managed into four business segments namely, Agricultural Services, Corn Processing, Oilseeds Processing, and Wild Flavours & Specialty Ingredients. The Company provides soy protein through the food ingredients product segment. They are primarily involved in producing foods using soybean and corn. Assume ADM has the following soybean, corn purchases, and investment and financing schedule. Soybean purchases May-Sep 2021 (Forecast) Corn purchases May-Sep 2021 (Forecast) Investments Commercial paper Sustainable equity investments (US) Liabilities Quantity 134,820 bushels Quantity 267,340 bushels A$50,000,000 US$2,500,000 3-year variable rate debt (next US$9,929,000 reset date: Sep 30, 2021 Portfolio Beta 0.75 Representative Index/underlying Bank Accepted Bills S&P 500 ESG

Step by Step Solution

3.37 Rating (144 Votes )

There are 3 Steps involved in it

Option Combination Strategy for ADMs Currency Risk Objective To hedge ADMs 50 million commercial paper exposure while retaining some upside potential ... View full answer

Get step-by-step solutions from verified subject matter experts