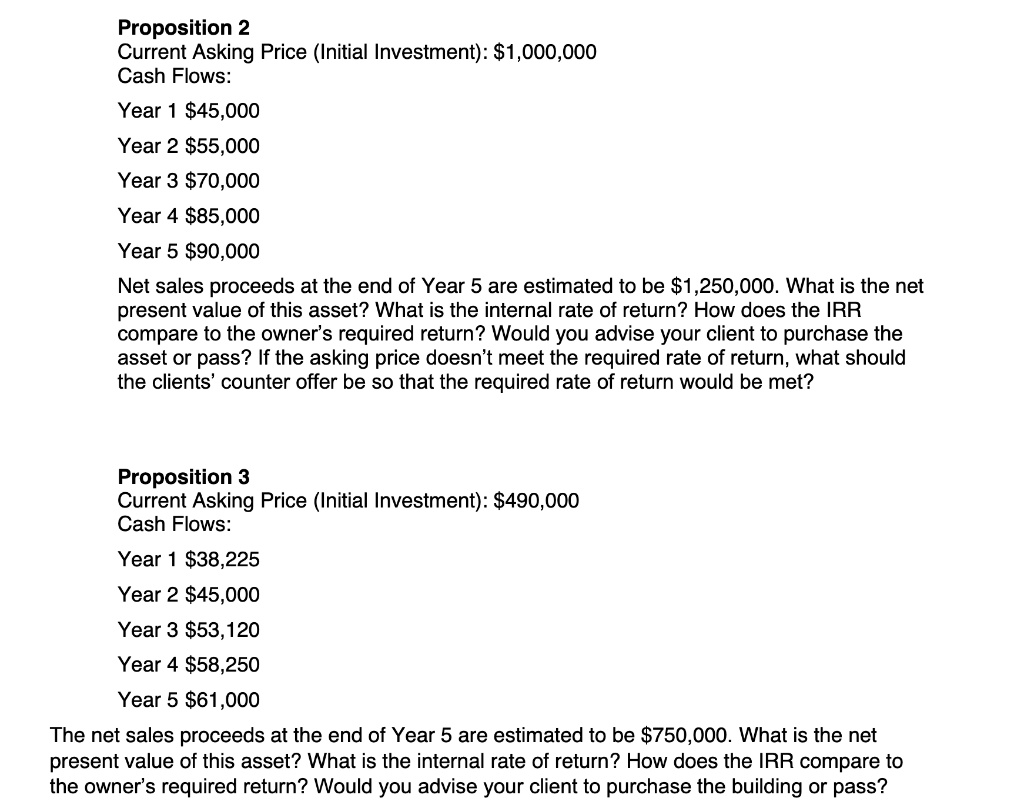

Question: Proposition 2 Current Asking Price (Initial Investment): $1,000,000 Cash Flows: Year 1 $45,000 Year 2 $55,000 Year 3 $70,000 Year 4 $85,000 Year 5 $90,000

Proposition 2 Current Asking Price (Initial Investment): $1,000,000 Cash Flows: Year 1 $45,000 Year 2 $55,000 Year 3 $70,000 Year 4 $85,000 Year 5 $90,000 Net sales proceeds at the end of Year 5 are estimated to be $1,250,000. What is the net present value of this asset? What is the internal rate of return? How does the IRR compare to the owner's required return? Would you advise your client to purchase the asset or pass? If the asking price doesn't meet the required rate of return, what should the clients' counter offer be so that the required rate of return would be met? Proposition 3 Current Asking Price (Initial Investment): $490,000 Cash Flows: Year 1 $38,225 Year 2 $45,000 Year 3 $53,120 Year 4 $58,250 Year 5 $61,000 The net sales proceeds at the end of Year 5 are estimated to be $750,000. What is the net present value of this asset? What is the internal rate of return? How does the IRR compare to the owner's required return? Would you advise your client to purchase the building or pass? Proposition 2 Current Asking Price (Initial Investment): $1,000,000 Cash Flows: Year 1 $45,000 Year 2 $55,000 Year 3 $70,000 Year 4 $85,000 Year 5 $90,000 Net sales proceeds at the end of Year 5 are estimated to be $1,250,000. What is the net present value of this asset? What is the internal rate of return? How does the IRR compare to the owner's required return? Would you advise your client to purchase the asset or pass? If the asking price doesn't meet the required rate of return, what should the clients' counter offer be so that the required rate of return would be met? Proposition 3 Current Asking Price (Initial Investment): $490,000 Cash Flows: Year 1 $38,225 Year 2 $45,000 Year 3 $53,120 Year 4 $58,250 Year 5 $61,000 The net sales proceeds at the end of Year 5 are estimated to be $750,000. What is the net present value of this asset? What is the internal rate of return? How does the IRR compare to the owner's required return? Would you advise your client to purchase the building or pass

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts