Question: PROTECTED VIEW Be careful files from the Internet can contain viruses. Unless you need to edi P18 CDEFGH NAME: PROBLEM SET 7 Chapter 15-Revenue Cycle

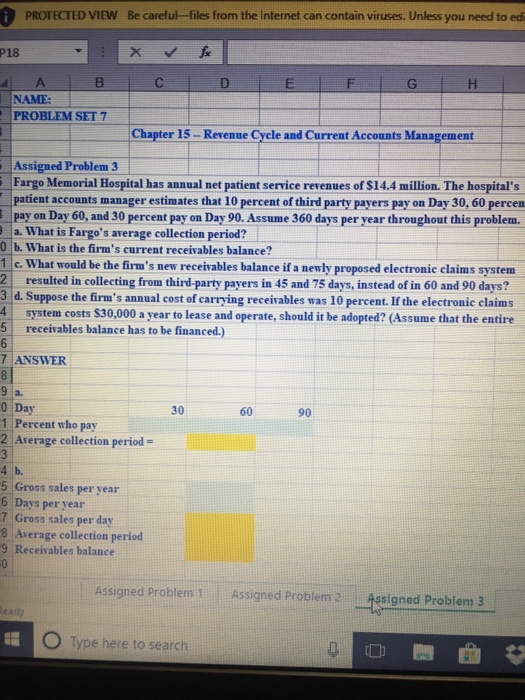

PROTECTED VIEW Be careful files from the Internet can contain viruses. Unless you need to edi P18 CDEFGH NAME: PROBLEM SET 7 Chapter 15-Revenue Cycle and Current Accounts Management Assigned Problem 3 Fargo Memorial Hospital has annual net patient service revenues of $14.4 million. The hospital's patient accounts manager estimates that 10 percent of third party payers pay on Day 30, 60 percen pay on Day 60, and 30 percent pay on Day 90. Assume 360 days per year throughout this problem. a. What is Fargo's average collection period? 0 b. What is the firm's current receivables balance? 1 c. What would be the firm's new receivables balance if a newly proposed electronic claims systenm 2 resulted in collecting from third-party payers in 45 and 75 days, instead of in 60 and 90 days? 3 d. Suppose the firm's annual cost of carrying receivables was 10 percent. If the electronic claims 4 system costs $30,000 a year to lease and operate, should it be adopted? (Assume that the entire 5 receivables balance has to be financed.) 6 7 ANSWER 0 Day 1 Percent who pay 2 Average collection period- 30 60 90 4 b. 5 Gross sales per year 6 Days per year 7 Gross sales per day 8 Average collection period 9 Receivables balance Assigned Problem 1 Assigned Problem 2 Assigned Problem 3 0 Type here to search PROTECTED VIEW Be careful files from the Internet can contain viruses. Unless you need to edi P18 CDEFGH NAME: PROBLEM SET 7 Chapter 15-Revenue Cycle and Current Accounts Management Assigned Problem 3 Fargo Memorial Hospital has annual net patient service revenues of $14.4 million. The hospital's patient accounts manager estimates that 10 percent of third party payers pay on Day 30, 60 percen pay on Day 60, and 30 percent pay on Day 90. Assume 360 days per year throughout this problem. a. What is Fargo's average collection period? 0 b. What is the firm's current receivables balance? 1 c. What would be the firm's new receivables balance if a newly proposed electronic claims systenm 2 resulted in collecting from third-party payers in 45 and 75 days, instead of in 60 and 90 days? 3 d. Suppose the firm's annual cost of carrying receivables was 10 percent. If the electronic claims 4 system costs $30,000 a year to lease and operate, should it be adopted? (Assume that the entire 5 receivables balance has to be financed.) 6 7 ANSWER 0 Day 1 Percent who pay 2 Average collection period- 30 60 90 4 b. 5 Gross sales per year 6 Days per year 7 Gross sales per day 8 Average collection period 9 Receivables balance Assigned Problem 1 Assigned Problem 2 Assigned Problem 3 0 Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts