Question: Prove 7.5 he created organis d mutation oper be created. Initi d externally. Difference between two forward payoffs = S(T) - Fr(0) - (S(T) -

Prove 7.5

Prove 7.5

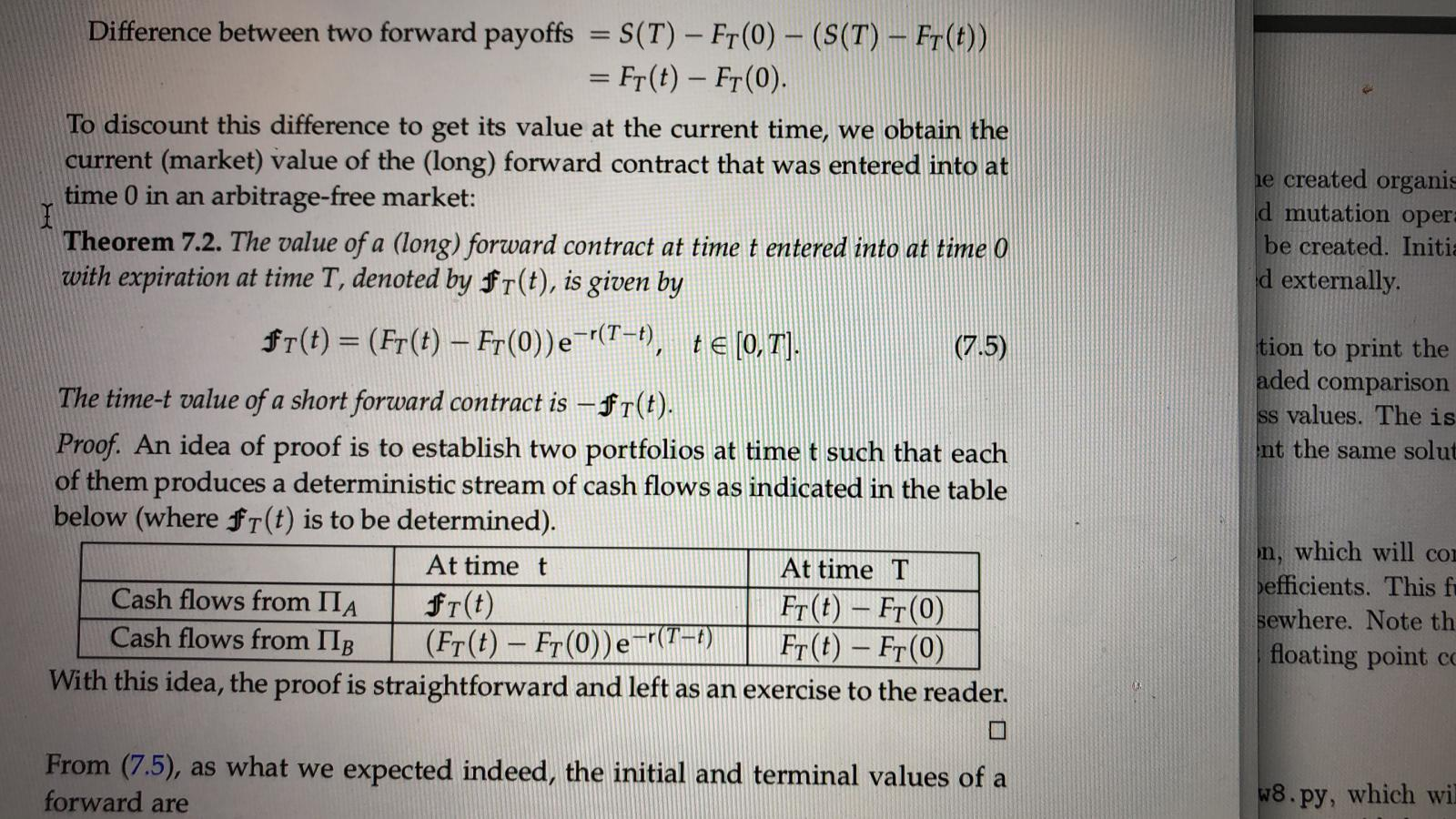

he created organis d mutation oper be created. Initi d externally. Difference between two forward payoffs = S(T) - Fr(0) - (S(T) - Fr(t)) = Fr(t) - Fr(0). To discount this difference to get its value at the current time, we obtain the current (market) value of the (long) forward contract that was entered into at time 0 in an arbitrage-free market: Theorem 7.2. The value of a (long) forward contract at time t entered into at time 0 with expiration at time T, denoted by fr(t), is given by fr(t) = (Fr(t) Fy(0))e='(79, (0,T]. (7.5) The time-t value of a short forward contract is fr(t). Proof. An idea of proof is to establish two portfolios at time t such that each of them produces a deterministic stream of cash flows as indicated in the table below (where ft(t) is to be determined). At time t MARIRAMANALOG At time T Cash flows from la f1(t) Fr(t) - Fr(0) Cash flows from II (Fr(t) - Fr(0)) e-(T-) | Fr(t) - Fr(0) With this idea, the proof is straightforward and left as an exercise to the reader. tion to print the aded comparison ss values. The is int the same solut n, which will com pefficients. This f sewhere. Note th floating point c From (7.5), as what we expected indeed, the initial and terminal values of a forward are w8.py, which wi he created organis d mutation oper be created. Initi d externally. Difference between two forward payoffs = S(T) - Fr(0) - (S(T) - Fr(t)) = Fr(t) - Fr(0). To discount this difference to get its value at the current time, we obtain the current (market) value of the (long) forward contract that was entered into at time 0 in an arbitrage-free market: Theorem 7.2. The value of a (long) forward contract at time t entered into at time 0 with expiration at time T, denoted by fr(t), is given by fr(t) = (Fr(t) Fy(0))e='(79, (0,T]. (7.5) The time-t value of a short forward contract is fr(t). Proof. An idea of proof is to establish two portfolios at time t such that each of them produces a deterministic stream of cash flows as indicated in the table below (where ft(t) is to be determined). At time t MARIRAMANALOG At time T Cash flows from la f1(t) Fr(t) - Fr(0) Cash flows from II (Fr(t) - Fr(0)) e-(T-) | Fr(t) - Fr(0) With this idea, the proof is straightforward and left as an exercise to the reader. tion to print the aded comparison ss values. The is int the same solut n, which will com pefficients. This f sewhere. Note th floating point c From (7.5), as what we expected indeed, the initial and terminal values of a forward are w8.py, which wi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts