Question: Provide a Sensitivity and Scenario analysis. Best case, worst case. I want to buy a rental property for $300,000. The NOI (net operating income) will

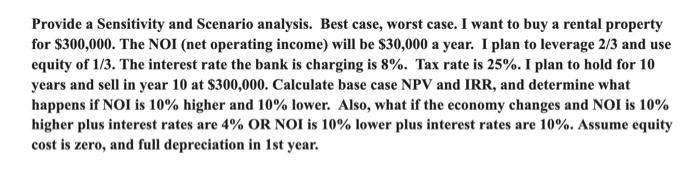

Provide a Sensitivity and Scenario analysis. Best case, worst case. I want to buy a rental property for $300,000. The NOI (net operating income) will be $30,000 a year. I plan to leverage 2/3 and use equity of 1/3. The interest rate the bank is charging is 8%. Tax rate is 25%. I plan to hold for 10 years and sell in year 10 at $300,000. Calculate base case NPV and IRR, and determine what happens if NOI is 10% higher and 10% lower. Also, what if the economy changes and NOI is 10% higher plus interest rates are 4% OR NOI is 10% lower plus interest rates are 10%. Assume equity cost is zero, and full depreciation in 1st year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts