Question: Provide an overview of specific and general anti-avoidance rules including concepts of residence, source of income and related elements of international tax, For each

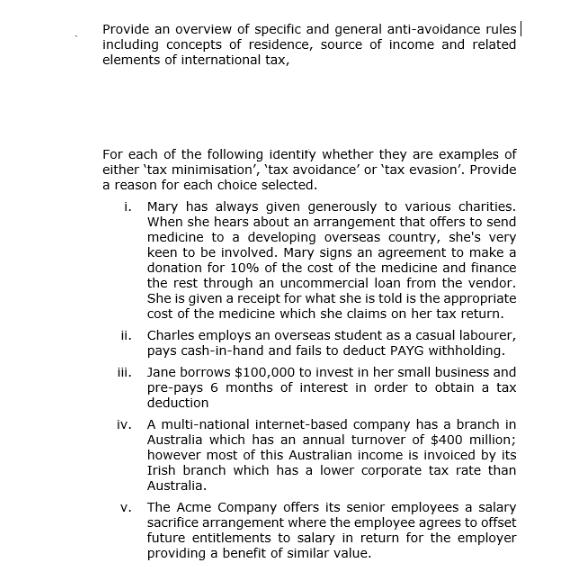

Provide an overview of specific and general anti-avoidance rules including concepts of residence, source of income and related elements of international tax, For each of the following identify whether they are examples of either 'tax minimisation', 'tax avoidance' or 'tax evasion'. Provide a reason for each choice selected. i. Mary has always given generously to various charities. When she hears about an arrangement that offers to send medicine to a developing overseas country, she's very keen to be involved. Mary signs an agreement to make a donation for 10% of the cost of the medicine and finance the rest through an uncommercial loan from the vendor. She is given a receipt for what she is told is the appropriate cost of the medicine which she claims on her tax return. ii. Charles employs an overseas student as a casual labourer, pays cash-in-hand and fails to deduct PAYG withholding. iii. Jane borrows $100,000 to invest in her small business and pre-pays 6 months of interest in order to obtain a tax deduction iv. A multi-national internet-based company has a branch in Australia which has an annual turnover of $400 million; however most of this Australian income is invoiced by its Irish branch which has a lower corporate tax rate than Australia. v. The Acme Company offers its senior employees a salary sacrifice arrangement where the employee agrees to offset future entitlements to salary in return for the employer providing a benefit of similar value.

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Here is an overview of specific and general antiavoidance rules in international tax and my analysis ... View full answer

Get step-by-step solutions from verified subject matter experts