Question: Provide answers with solutions: 9 A A) True B) False 55) Wrap account does not allow for individual shares to be held directly by the

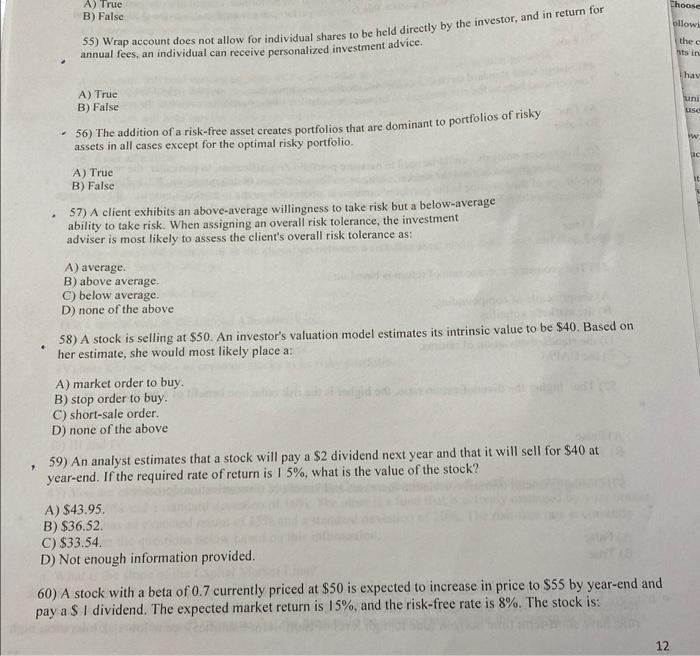

B) False 55) Wrap account does not allow for individual shares to be held directly by the investor, and in return for annual fees, an individual can receive personalized investment advice. A) True B) False 56) The addition of a risk-free asset creates portfolios that are dominant to portfolios of risky assets in all cases except for the optimal risky portfolio. A) True B) False - 57) A client exhibits an above-average willingness to take risk but a below-average ability to take risk. When assigning an overall risk tolerance, the investment adviser is most likely to assess the client's overall risk tolerance as: A) average. B) above average. C) below average. D) none of the above 58) A stock is selling at $50. An investor's valuation model estimates its intrinsic value to be $40. Based on her estimate, she would most likely place a: A) market order to buy. B) stop order to buy. C) short-sale order. D) none of the above 59) An analyst estimates that a stock will pay a $2 dividend next year and that it will sell for $40 at year-end. If the required rate of return is 15%, what is the value of the stock? A) $43.95 B) $36.52. C) $33.54 D) Not enough information provided. 60) A stock with a beta of 0.7 currently priced at $50 is expected to increase in price to $55 by year-end and pay a $1 dividend. The expected market return is 15%, and the risk-free rate is 8%. The stock is: A) underpriced, so short it. B underpriced, so buy it. C) properly priced, so buy it. D) overpriced, so do not buy it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts