Question: Dec. 28 31 Wrote off accounts receivable as uncollectible: Regan, Co., $1,300; Owen Mac, $900; and Rain, Inc., $700 Recorded bad debts expense based

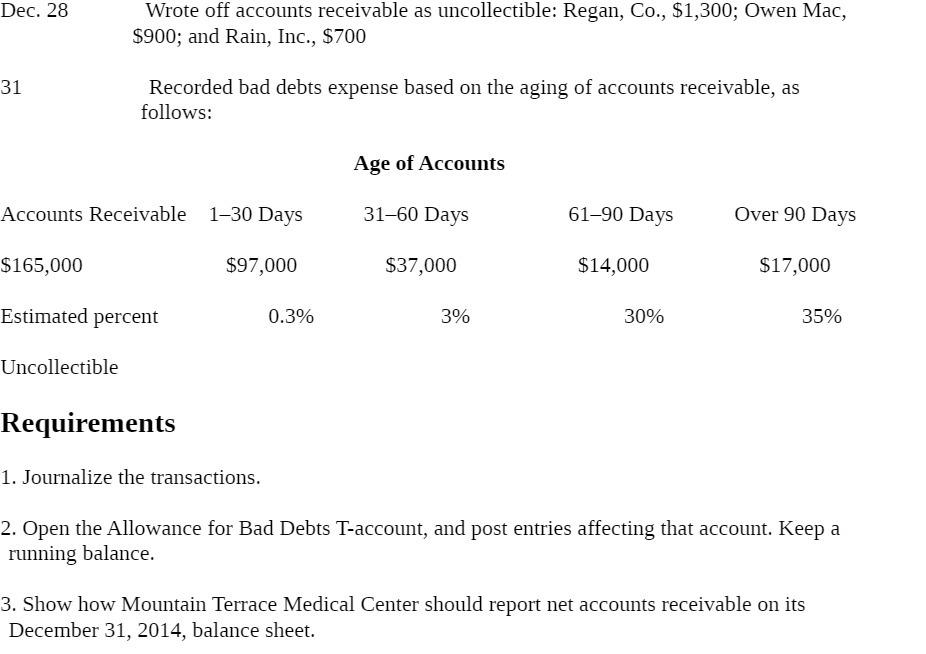

Dec. 28 31 Wrote off accounts receivable as uncollectible: Regan, Co., $1,300; Owen Mac, $900; and Rain, Inc., $700 Recorded bad debts expense based on the aging of accounts receivable, as follows: Age of Accounts Accounts Receivable 1-30 Days 31-60 Days 61-90 Days Over 90 Days $165,000 $97,000 $37,000 $14,000 $17,000 0.3% 3% 30% 35% Estimated percent Uncollectible Requirements 1. Journalize the transactions. 2. Open the Allowance for Bad Debts T-account, and post entries affecting that account. Keep a running balance. 3. Show how Mountain Terrace Medical Center should report net accounts receivable on its December 31, 2014, balance sheet.

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Journal Entries Dec 28 Debit Bad Debts Expense 2900 Credit Accounts Receivable 1300 Cre... View full answer

Get step-by-step solutions from verified subject matter experts