Question: provide complete solution please i will rate thumbs up Problem 14. A branch of a foreign corporation engaged in service business reported the following income

provide complete solution please i will rate thumbs up

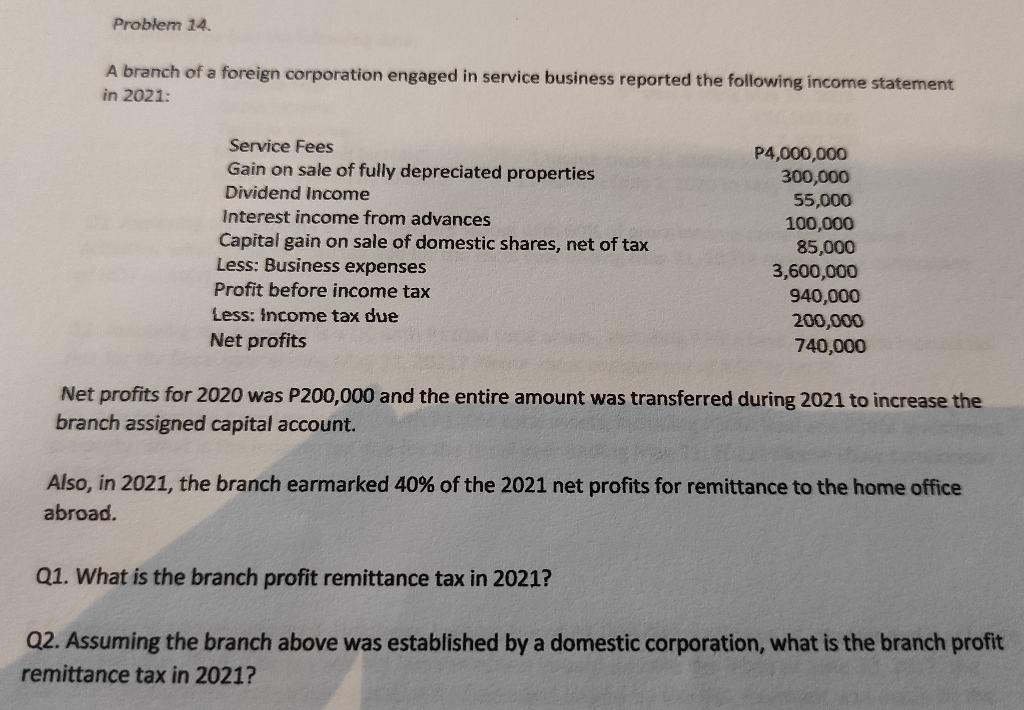

Problem 14. A branch of a foreign corporation engaged in service business reported the following income statement in 2021: Service Fees Gain on sale of fully depreciated properties Dividend Income Interest income from advances Capital gain on sale of domestic shares, net of tax Less: Business expenses Profit before income tax Less: income tax due Net profits P4,000,000 300,000 55,000 100,000 85,000 3,600,000 940,000 200,000 740,000 Net profits for 2020 was P200,000 and the entire amount was transferred during 2021 to increase the branch assigned capital account. Also, in 2021, the branch earmarked 40% of the 2021 net profits for remittance to the home office abroad. Q1. What is the branch profit remittance tax in 2021? Q2. Assuming the branch above was established by a domestic corporation, what is the branch profit remittance tax in 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts