Question: provide entries and calculations example entry with arrows Give an example journal entry for each of the following transactions recorded in proper general journal form,

provide entries and calculations

example entry with arrows

example entry with arrows

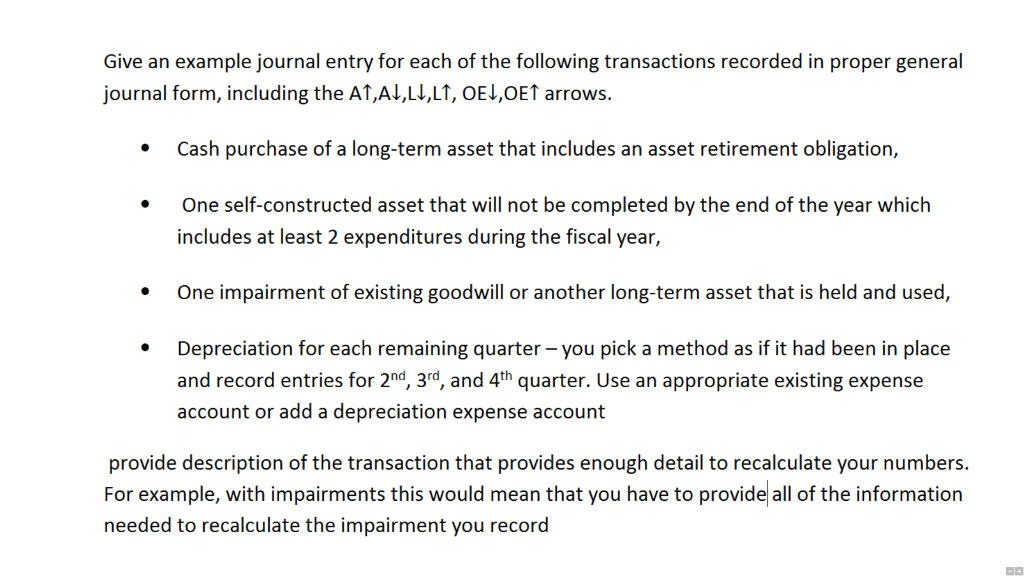

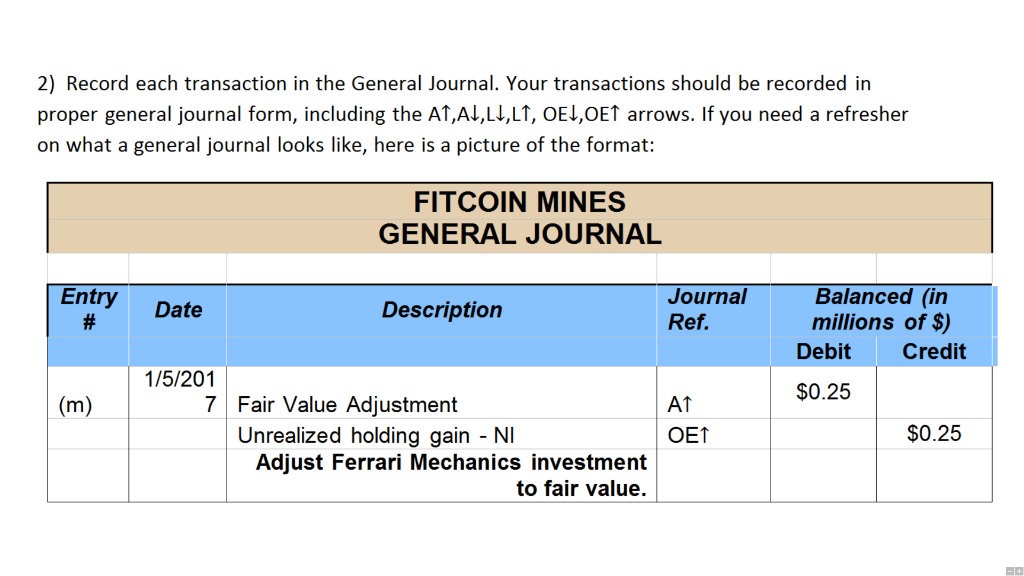

Give an example journal entry for each of the following transactions recorded in proper general journal form, including the AT, AI,Lt,LT, OEJOEf arrows. Cash purchase of a long-term asset that includes an asset retirement obligation, One self-constructed asset that will not be completed by the end of the year which includes at least 2 expenditures during the fiscal year, One impairment of existing goodwill or another long-term asset that is held and used, Depreciation for each remaining quarter - you pick a method as if it had been in place and record entries for 2nd, 3rd, and 4th quarter. Use an appropriate existing expense account or add a depreciation expense account late your provide description of the transaction that provides enough detail to ers. For example, with impairments this would mean that you have to provide all of the information needed to recalculate the impairment you record + 2) Record each transaction in the General Journal. Your transactions should be recorded in proper general journal form, including the AT,AL,LI,LT, OEI, OEf arrows. If you need a refresher on what a general journal looks like, here is a picture of the format: FITCOIN MINES GENERAL JOURNAL Entry Date Journal Ref. # Description Balanced (in millions of $) Debit Credit $0.25 (m) 1/5/201 7 Fair Value Adjustment Unrealized holding gain - NI Adjust Ferrari Mechanics investment to fair value. AT OET $0.25 -14 Give an example journal entry for each of the following transactions recorded in proper general journal form, including the AT, AI,Lt,LT, OEJOEf arrows. Cash purchase of a long-term asset that includes an asset retirement obligation, One self-constructed asset that will not be completed by the end of the year which includes at least 2 expenditures during the fiscal year, One impairment of existing goodwill or another long-term asset that is held and used, Depreciation for each remaining quarter - you pick a method as if it had been in place and record entries for 2nd, 3rd, and 4th quarter. Use an appropriate existing expense account or add a depreciation expense account late your provide description of the transaction that provides enough detail to ers. For example, with impairments this would mean that you have to provide all of the information needed to recalculate the impairment you record + 2) Record each transaction in the General Journal. Your transactions should be recorded in proper general journal form, including the AT,AL,LI,LT, OEI, OEf arrows. If you need a refresher on what a general journal looks like, here is a picture of the format: FITCOIN MINES GENERAL JOURNAL Entry Date Journal Ref. # Description Balanced (in millions of $) Debit Credit $0.25 (m) 1/5/201 7 Fair Value Adjustment Unrealized holding gain - NI Adjust Ferrari Mechanics investment to fair value. AT OET $0.25 -14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts