Question: provide explanation please regarding the formula we will use - Security A currently trades on the Toronto stock exchange. In your opinion security A has

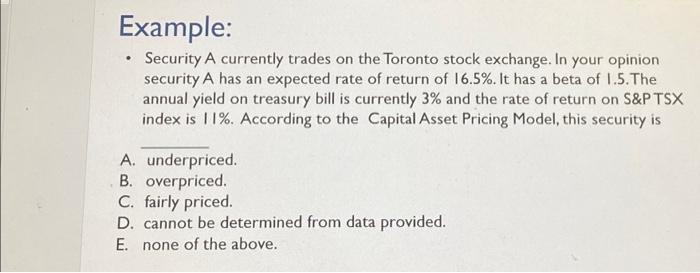

- Security A currently trades on the Toronto stock exchange. In your opinion security A has an expected rate of return of 16.5%. It has a beta of 1.5. The annual yield on treasury bill is currently 3% and the rate of return on S\&PTSX index is 11%. According to the Capital Asset Pricing Model, this security is A. underpriced. B. overpriced. C. fairly priced. D. cannot be determined from data provided. E. none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts