Question: provide formulas please! will thumbs up :) 1 You are offered an annuity that will pay you $7,500 at the end of each quarter for

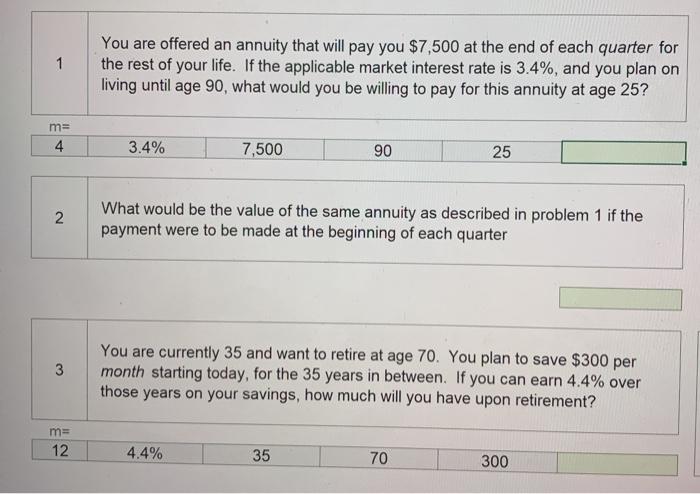

1 You are offered an annuity that will pay you $7,500 at the end of each quarter for the rest of your life. If the applicable market interest rate is 3.4%, and you plan on living until age 90, what would you be willing to pay for this annuity at age 25? m= 4 3.4% 7,500 90 25 2. What would be the value of the same annuity as described in problem 1 if the payment were to be made at the beginning of each quarter 3 You are currently 35 and want to retire at age 70. You plan to save $300 per month starting today, for the 35 years in between. If you can earn 4.4% over those years on your savings, how much will you have upon retirement? m= 12 4.4% 35 70 300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts