Question: Provide full answer B C 1 2 3 4 5 6 7 8 5% pa 8% pa 3% p.a. 9 12 13 Your bank's London

Provide full answer

Provide full answer

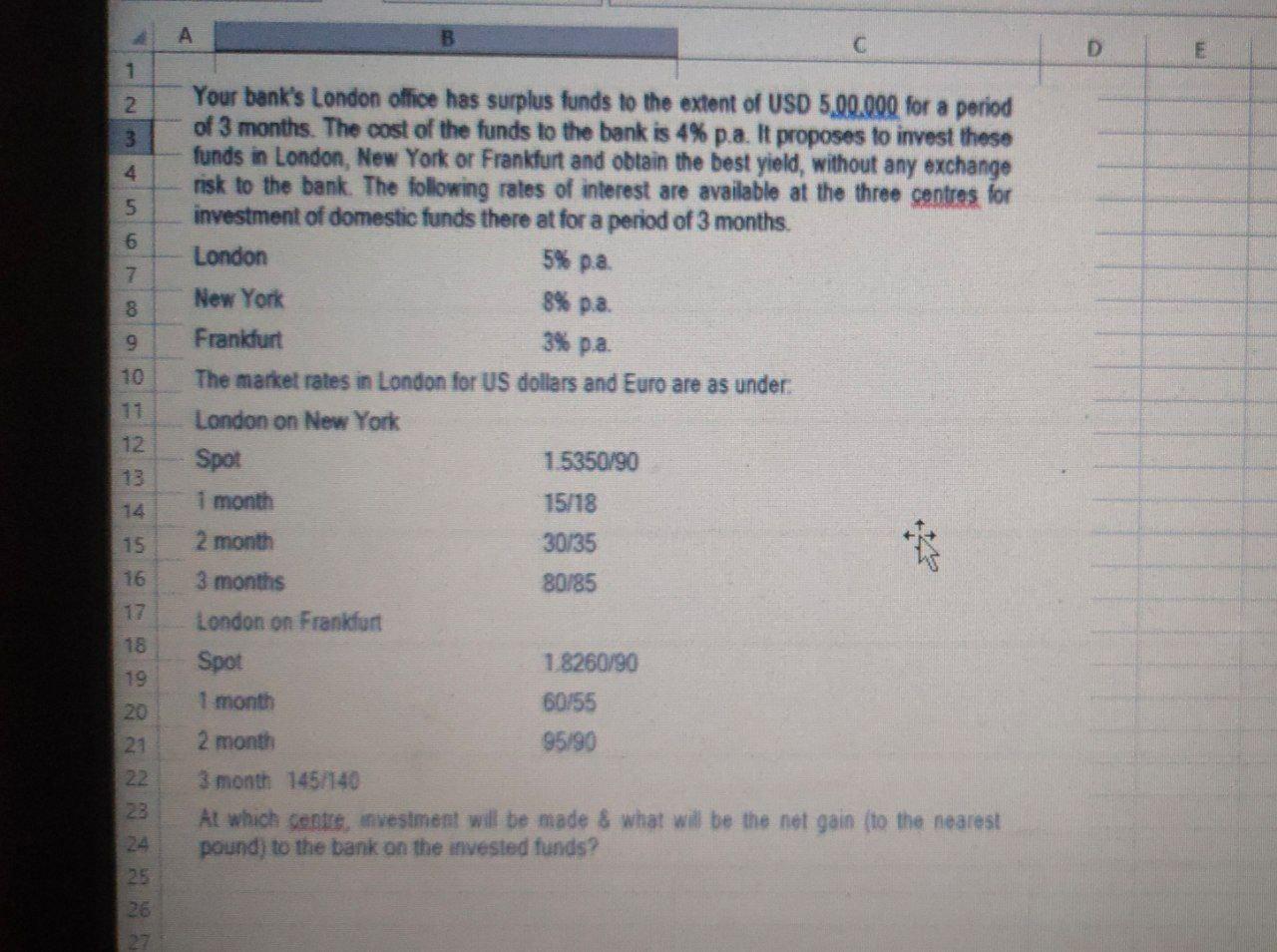

B C 1 2 3 4 5 6 7 8 5% pa 8% pa 3% p.a. 9 12 13 Your bank's London office has surplus funds to the extent of USD 5,00.000 for a period of 3 months. The cost of the funds to the bank is 4% pa. It proposes to invest these funds in London, New York or Frankfurt and obtain the best yield, without any exchange risk to the bank. The following rates of interest are available at the three centres for investment of domestic funds there at for a period of 3 months. London New York Frankfurt The market rates in London for US dollars and Euro are as under London on New York Spot 1.5350/90 1 month 15/18 2 month 30/35 3 months 80/85 London on Frankfurt 1.8260/90 1 month 60/55 2 month 95/90 3 month 145/140 At which cente, investment will be made & what will be the net gain (to the nearest pound) to the bank on the invested funds? 15 16 17 18 Spot 19 20 21 22 28 24 25 26 27

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts