Question: Provide solution for December 31, 2022 values 13) A U.S-based MNC has a subsidiary in China where the local currency is the Renminbi (RMB). The

Provide solution for December 31, 2022 values

Provide solution for December 31, 2022 values

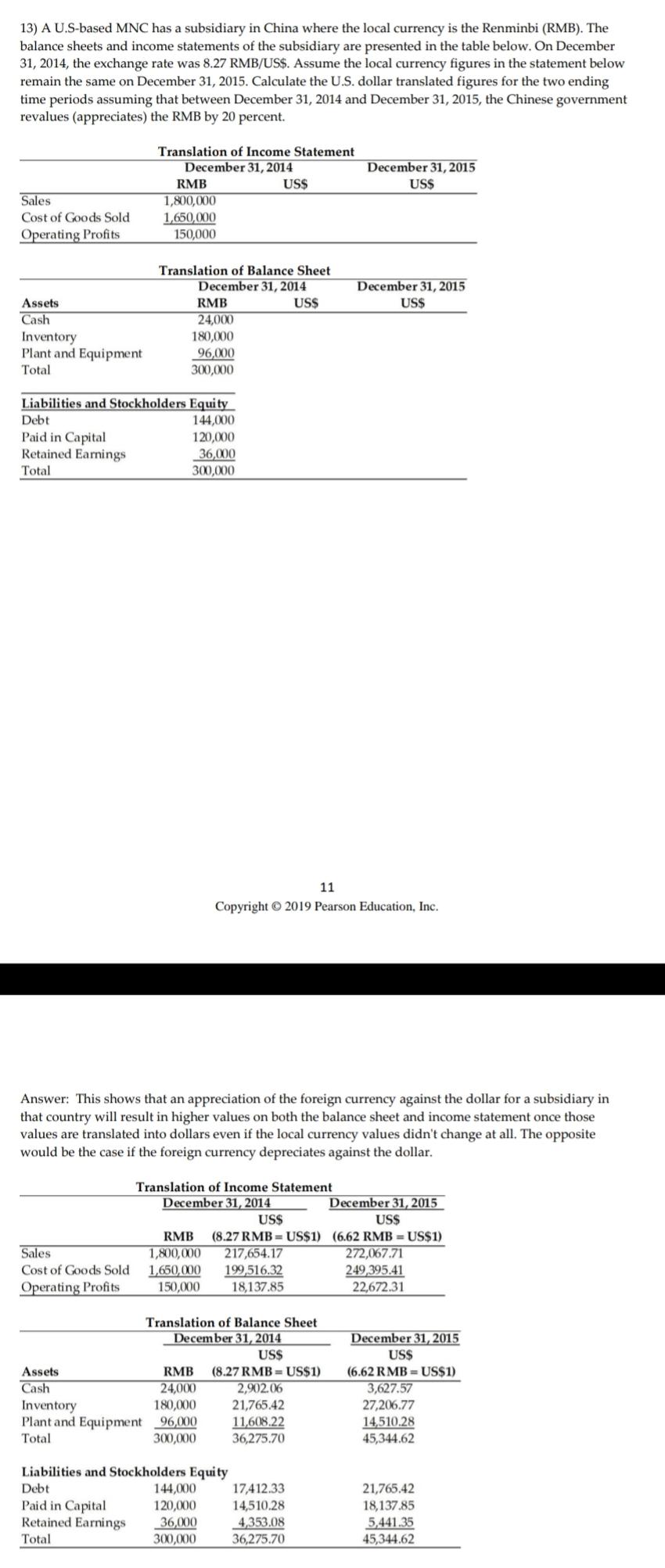

13) A U.S-based MNC has a subsidiary in China where the local currency is the Renminbi (RMB). The balance sheets and income statements of the subsidiary are presented in the table below. On December 31, 2014, the exchange rate was 8.27 RMB/US\$. Assume the local currency figures in the statement below remain the same on December 31, 2015. Calculate the U.S. dollar translated figures for the two ending time periods assuming that between December 31, 2014 and December 31, 2015, the Chinese government revalues (appreciates) the RMB by 20 percent. 11 Copyright (1) 2019 Pearson Education, Inc. Answer: This shows that an appreciation of the foreign currency against the dollar for a subsidiary in that country will result in higher values on both the balance sheet and income statement once those values are translated into dollars even if the local currency values didn't change at all. The opposite would be the case if the foreign currency depreciates against the dollar. 13) A U.S-based MNC has a subsidiary in China where the local currency is the Renminbi (RMB). The balance sheets and income statements of the subsidiary are presented in the table below. On December 31, 2014, the exchange rate was 8.27 RMB/US\$. Assume the local currency figures in the statement below remain the same on December 31, 2015. Calculate the U.S. dollar translated figures for the two ending time periods assuming that between December 31, 2014 and December 31, 2015, the Chinese government revalues (appreciates) the RMB by 20 percent. 11 Copyright (1) 2019 Pearson Education, Inc. Answer: This shows that an appreciation of the foreign currency against the dollar for a subsidiary in that country will result in higher values on both the balance sheet and income statement once those values are translated into dollars even if the local currency values didn't change at all. The opposite would be the case if the foreign currency depreciates against the dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts