Question: Provide solution to the following questions. Include all the working notes for both questions for full reward. A fund manager receives f4 million on 1

Provide solution to the following questions. Include all the working notes for both questions for full reward.

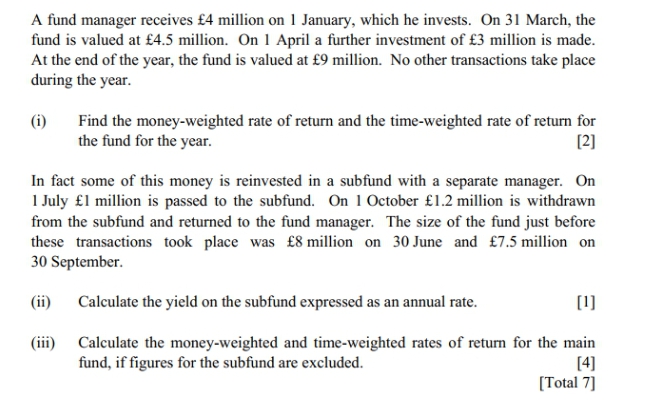

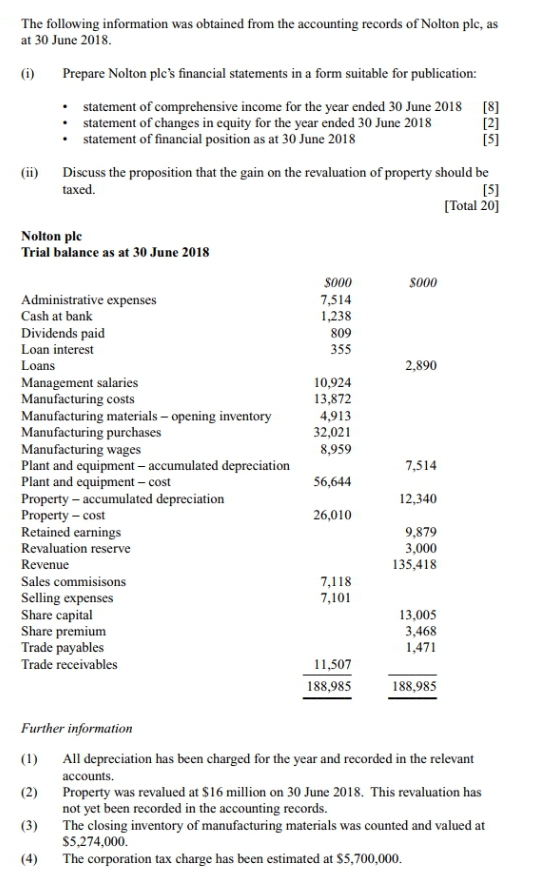

A fund manager receives f4 million on 1 January, which he invests. On 31 March, the fund is valued at f4.5 million. On 1 April a further investment of $3 million is made. At the end of the year, the fund is valued at $9 million. No other transactions take place during the year. (i) Find the money-weighted rate of return and the time-weighted rate of return for the fund for the year. [2] In fact some of this money is reinvested in a subfund with a separate manager. On I July El million is passed to the subfund. On 1 October El.2 million is withdrawn from the subfund and returned to the fund manager. The size of the fund just before these transactions took place was $8 million on 30 June and $7.5 million on 30 September. (ii) Calculate the yield on the subfund expressed as an annual rate. [1] (iii) Calculate the money-weighted and time-weighted rates of return for the main fund, if figures for the subfund are excluded. [4] [Total 7]The following information was obtained from the accounting records of Nolton plc, as at 30 June 2018. (i) Prepare Nolton ple's financial statements in a form suitable for publication: statement of comprehensive income for the year ended 30 June 2018 [8] statement of changes in equity for the year ended 30 June 2018 [2] . statement of financial position as at 30 June 2018 [5] (ii) Discuss the proposition that the gain on the revaluation of property should be taxed. [5] [Total 20] Nolton plc Trial balance as at 30 June 2018 $000 SO00 Administrative expenses 7,514 Cash at bank 1,238 Dividends paid 809 Loan interest 355 Loans 2,890 Management salaries 10,924 Manufacturing costs 13,872 Manufacturing materials - opening inventory 4,913 Manufacturing purchases 32,021 Manufacturing wages 8,959 Plant and equipment - accumulated depreciation 7,514 Plant and equipment - cost 56,644 Property - accumulated depreciation 12,340 Property - cost 26,010 Retained earnings 9,879 Revaluation reserve 3,000 Revenue 135,418 Sales commisisons 7,118 Selling expenses 7,101 Share capital 13,005 Share premium 3.468 Trade payables 1,471 Trade receivables 11,507 188,985 188,985 Further information (1) All depreciation has been charged for the year and recorded in the relevant accounts. (2) Property was revalued at $16 million on 30 June 2018. This revaluation has not yet been recorded in the accounting records. (3) The closing inventory of manufacturing materials was counted and valued at $5,274,000. (4) The corporation tax charge has been estimated at $5,700,000