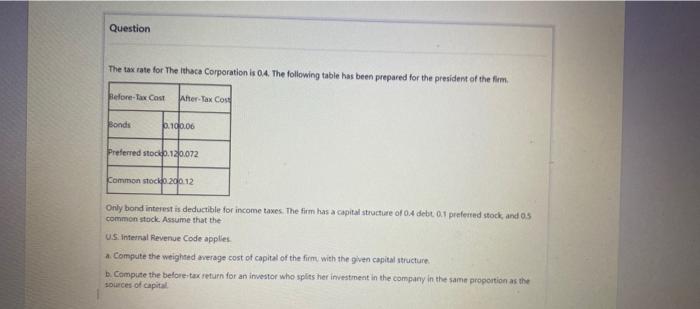

Question: provide step by step solution The tax rate for The ithaca Corporation is 0.4. The following table has been prepared for the president af the

The tax rate for The ithaca Corporation is 0.4. The following table has been prepared for the president af the fim. Orly bond interest is deductible for income taxes. The firm has a capital structure of 0.4 debt. 0.1 preferied stock, and o.s common stock Assume shat the US. internal Revenue Code applies. a. Compuite the weighted werage cost of capital of the firm with the given capital structure: B. Compiate the beloleitax refurn for an inuestor who spits her investinent in the company in the same proportion as the soluces of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts