Question: Provide substantial information for your reasoning. Include the solutions for calculation. Problem 1: For the last seven months, r$-1.77% and rP=0.75%. What would be

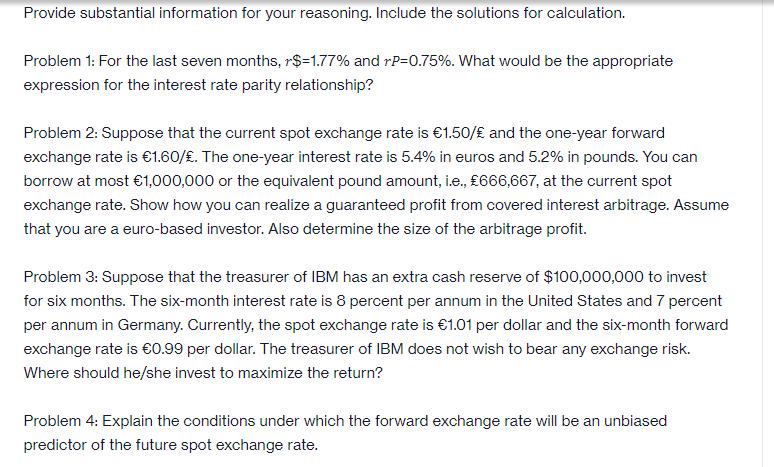

Provide substantial information for your reasoning. Include the solutions for calculation. Problem 1: For the last seven months, r$-1.77% and rP=0.75%. What would be the appropriate expression for the interest rate parity relationship? Problem 2: Suppose that the current spot exchange rate is 1.50/ and the one-year forward exchange rate is 1.60/. The one-year interest rate is 5.4% in euros and 5.2% in pounds. You can borrow at most 1,000,000 or the equivalent pound amount, i.e., 666,667, at the current spot exchange rate. Show how you can realize a guaranteed profit from covered interest arbitrage. Assume that you are a euro-based investor. Also determine the size of the arbitrage profit. Problem 3: Suppose that the treasurer of IBM has an extra cash reserve of $100,000,000 to invest for six months. The six-month interest rate is 8 percent per annum in the United States and 7 percent per annum in Germany. Currently, the spot exchange rate is 1.01 per dollar and the six-month forward exchange rate is 0.99 per dollar. The treasurer of IBM does not wish to bear any exchange risk. Where should he/she invest to maximize the return? Problem 4: Explain the conditions under which the forward exchange rate will be an unbiased predictor of the future spot exchange rate.

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Problem 1 r rP r rP r 177 075 177 r 002 The interest rate parity relationship states that the interest rate on a foreign currency denominated asset sh... View full answer

Get step-by-step solutions from verified subject matter experts