Question: PROVIDE TAX FORMS! complete using 2019 tax forms Tim and Sarah Lawrence are married and file a joint return. Tim's Social Security number is 123-45-6789,

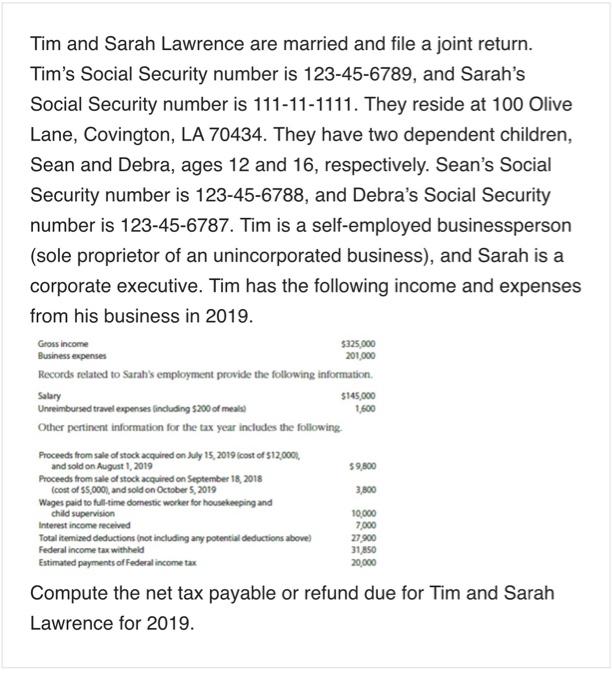

Tim and Sarah Lawrence are married and file a joint return. Tim's Social Security number is 123-45-6789, and Sarah's Social Security number is 111-11-1111. They reside at 100 Olive Lane, Covington, LA 70434. They have two dependent children, Sean and Debra, ages 12 and 16, respectively. Sean's Social Security number is 123-45-6788, and Debra's Social Security number is 123-45-6787. Tim is a self-employed businessperson (sole proprietor of an unincorporated business), and Sarah is a corporate executive. Tim has the following income and expenses from his business in 2019. Gross income $325,000 Business expenses 201.000 Records related to Sarah's employment provide the following information Salary $145,000 Unreimbursed travel expenses including $200 of meals 1600 Other pertinent information for the tax year includes the following Proceeds from sale of stock acquired on July 15, 2019 fcost of $12,0001, and sold on August 1, 2019 59,800 Proceeds from sale of stock acquired on September 18, 2018 cost of $5,000), and sold on October 5, 2019 Wages paid to full-time domestic worker for housekeeping and child supervision 10,000 Interest income received 7,000 Total itemized deductions (not including any potential deductions above) 27.900 Federal income tax withheld 31850 Estimated payments of Federal income tax 20.000 Compute the net tax payable or refund due for Tim and Sarah Lawrence for 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts