Question: Provide the answer for the part that I got wrong and explain what I did wrong. Exercise 24-23A (Algo) Assigning joint product costs LO C2

Provide the answer for the part that I got wrong and explain what I did wrong.

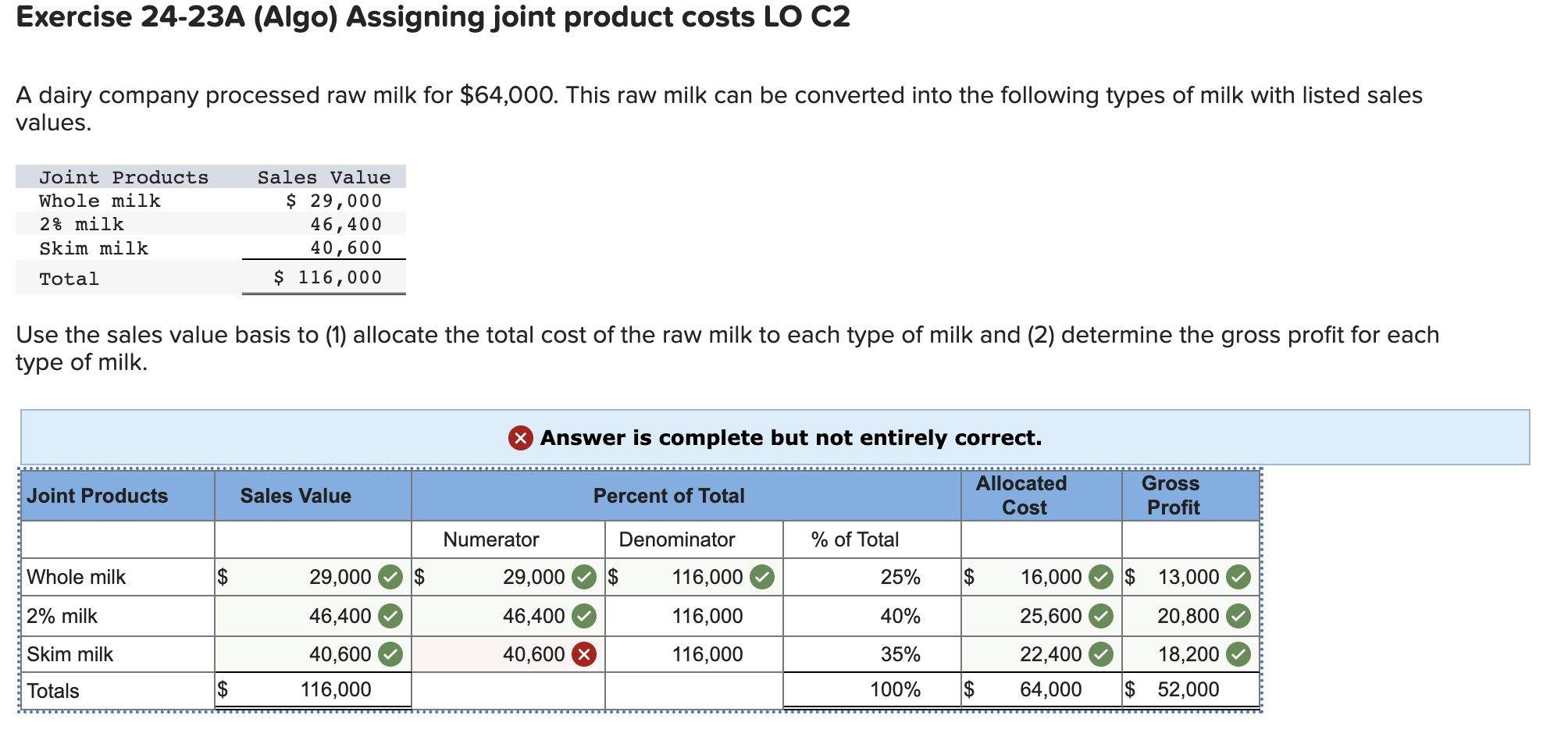

Exercise 24-23A (Algo) Assigning joint product costs LO C2 A dairy company processed raw milk for $64,000. This raw milk can be converted into the following types of milk with listed sales values. Joint Products Whole milk 2% milk Skim milk Sales Value $ 29,000 46,400 40,600 $ 116,000 Total Use the sales value basis to (1) allocate the total cost of the raw milk to each type of milk and (2) determine the gross profit for each type of milk. X Answer is complete but not entirely correct. Joint Products Sales Value Percent of Total Allocated Cost Gross Profit Numerator Denominator % of Total Whole milk $ 29,000 $ $ 116,000 25% $ 16,000 $ 13,000 29,000 46,400 2% milk 46,400 116,000 40% 25,600 20,800 Skim milk 40,600 40,600 X 116,000 35% 18,200 22,400 64,000 Totals $ 116,000 100% $ $ 52,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts