Question: Provide the correct answer (A, B, C, or D) to the following. Q1. In futures exchange, speculators long Futures contracts on the S&P 500 Index;

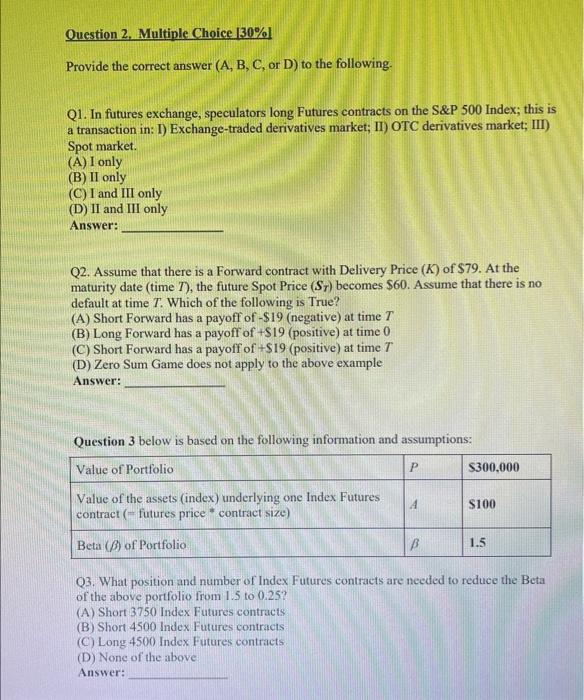

Provide the correct answer (A, B, C, or D) to the following. Q1. In futures exchange, speculators long Futures contracts on the S\&P 500 Index; this is a transaction in: I) Exchange-traded derivatives market; II) OTC derivatives market; III) Spot market. (A) I only (B) II only (C) I and III only (D) II and III only Answer: Q2. Assume that there is a Forward contract with Delivery Price (K) of $79. At the maturity date (time T ), the future Spot Price (ST) becomes $60. Assume that there is no default at time T. Which of the following is True? (A) Short Forward has a payoff of - $19 (negative) at time T (B) Long Forward has a payoff of +$19 (positive) at time 0 (C) Short Forward has a payoff of +$19 (positive) at time T (D) Zero Sum Game does not apply to the above example Answer: Question 3 below is based on the following information and assumptions: Q3. What position and number of Index Futures contracts are needed to reduce the Beta of the above porffolio from 1.5 to 0.25 ? (A) Short 3750 Index Futures contracts (B) Short 4500 lndex Futures contracts (C) Long 4500 Index Futures contracts (D) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts