Question: Provide the following answers for this study guide. Chapter 10 (26 points) Classification of items as direct materials, direct labor and factory overhead (product costs)

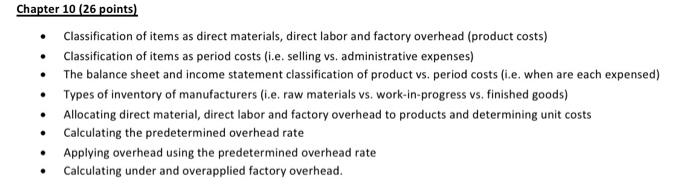

Chapter 10 (26 points) Classification of items as direct materials, direct labor and factory overhead (product costs) Classification of items as period costs (i.e. selling vs. administrative expenses) The balance sheet and income statement classification of product vs. period costs (ie. when are each expensed) Types of inventory of manufacturers (i.e. raw materials vs. work-in-progress vs. finished goods) Allocating direct material, direct labor and factory overhead to products and determining unit costs Calculating the predetermined overhead rate Applying overhead using the predetermined overhead rate Calculating under and overapplied factory overhead

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts