Question: Provide what is asked in the problem Problem 4 (Adopted): You are engaged in the audit a new client, at the close of its first

Provide what is asked in the problem

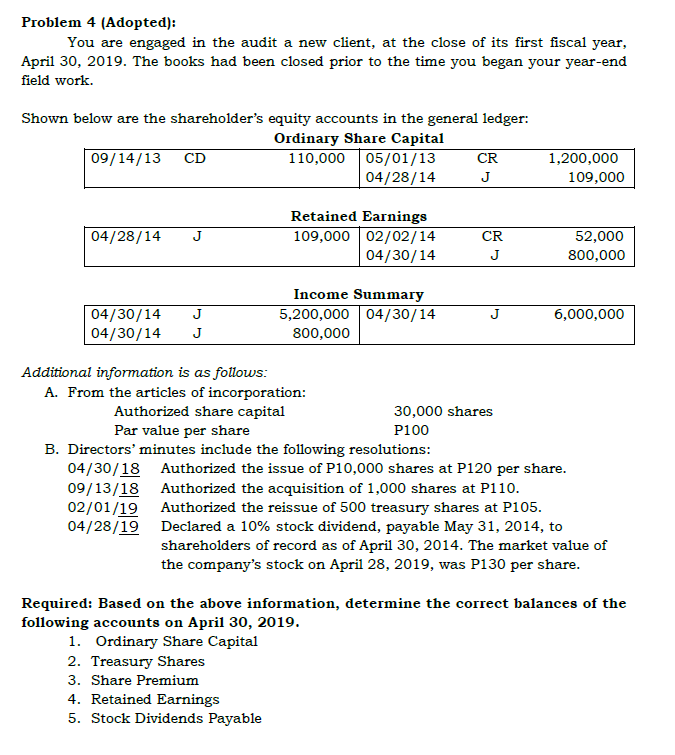

Problem 4 (Adopted): You are engaged in the audit a new client, at the close of its first fiscal year, April 30, 2019. The books had been closed prior to the time you began your year-end field work. Shown below are the shareholder's equity accounts in the general ledger: Ordinary Share Capital 09/14/13 CD 110,000 05/01/13 CR 1,200,000 04/28/14 J 109,000 Retained Earnings 04/28/14 J 109,000 |02/02/14 CR 52,000 04/30/14 J 800,000 Income Summary 04/30/14 C 5,200,000 |04/30/14 J 6,000,000 04/30/14 800,000 Additional information is as follows: A. From the articles of incorporation: Authorized share capital 30,000 shares Par value per share P100 B. Directors' minutes include the following resolutions: 04/30/18 Authorized the issue of P10,000 shares at P120 per share. 09/13/18 Authorized the acquisition of 1,000 shares at P1 10. 02/01/19 Authorized the reissue of 500 treasury shares at P105. 04/28/19 Declared a 10% stock dividend, payable May 31, 2014, to shareholders of record as of April 30, 2014. The market value of the company's stock on April 28, 2019, was P130 per share. Required: Based on the above information, determine the correct balances of the following accounts on April 30, 2019. 1. Ordinary Share Capital 2. Treasury Shares 3. Share Premium 4. Retained Earnings 5. Stock Dividends Payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts