Question: provided, complete the following information using the excel template provided. Enter the journal entries to record all of the business activity for the month of

provided, complete the following information using the excel template provided.

- Enter the journal entries to record all of the business activity for the month of May.

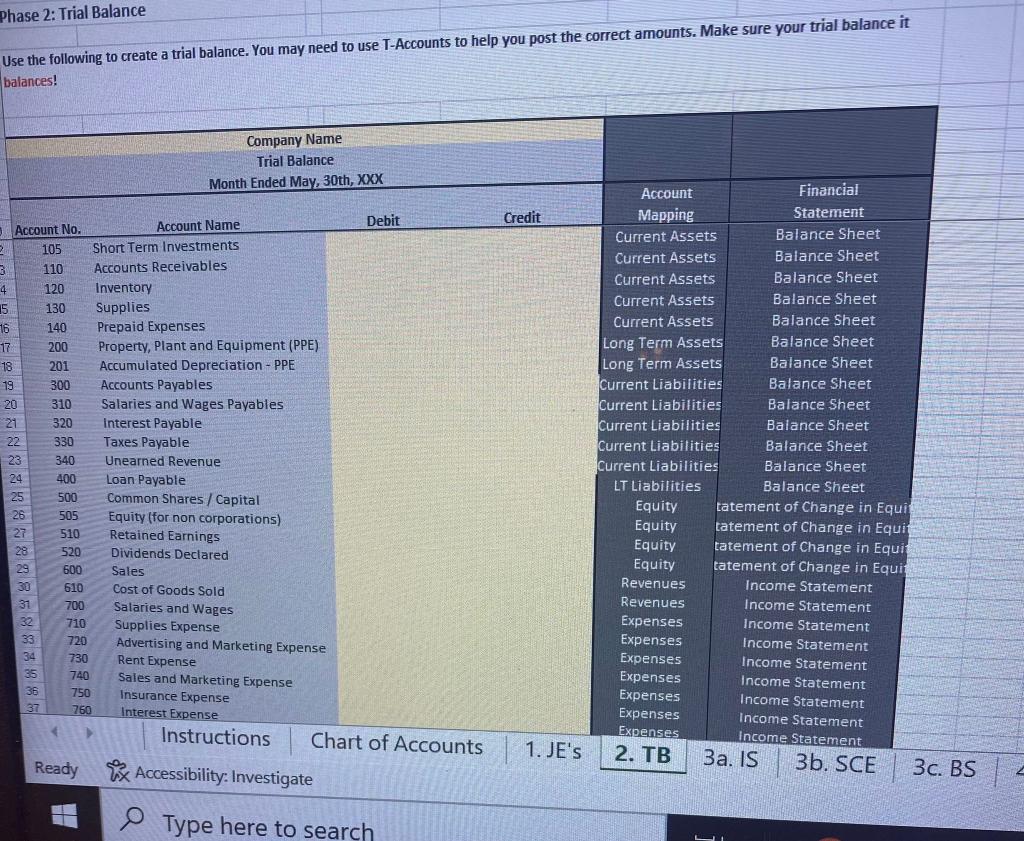

- Compile a trial balance from the journal entries.

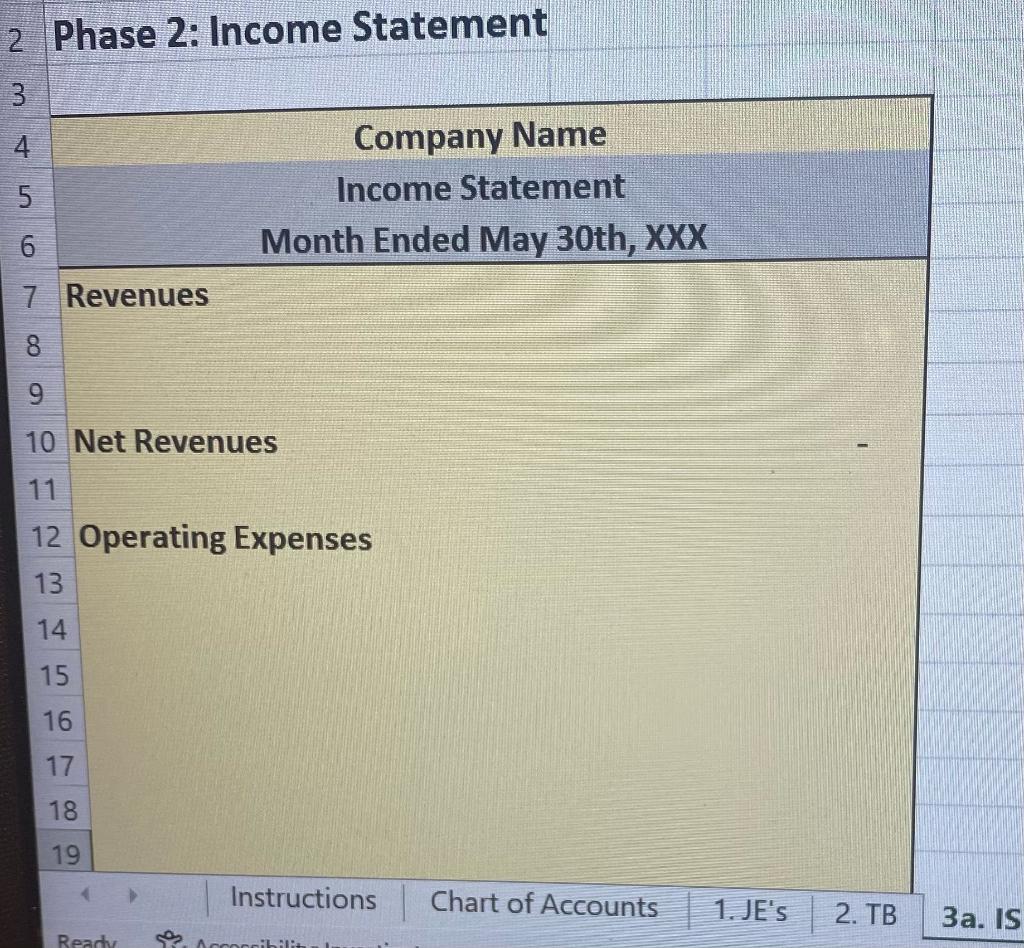

- Prepare the income statement, statement of changes in equity and balance sheet for your client.

- Prepare an email to the accountant to submit with the file. Discuss the following:

- As you are very ambitious and want to demonstrate your analytical skills, provide your insight on the financial performance of your clients first month of business.

- After completing the financial statements, the client sent another email to you (see Appendix A). Explain to the accountant how this new information would change the financial statements you already prepared.

| Trans No. | Trans Date | Description | Activity type (o,I,f) |

| 1 | May 1 | I invested $30,000 cash into my new business | F |

| 2 | May 3 | I bought equipment on account from a supply company name Espresso for $15,000 and paid $7000 | I |

| 3 | May 5 | I bought ingredients for $2,000 cash from Costco | O |

| 4 | May 6 | I bought furniture on account for $11,000, paid $5,000 as down payment | I |

| 5 | May 7 | Income for the week is $4,000 | O |

| 6 | May 9 | I bought baking and caf ingredients on account for $2,500 | O |

| 7 | May 11 | Full payment to Espresso for $8,000 which I issued a note for | I |

|

| May 14 | Income for the week is $8,000 | O |

|

| May 25 | Expenses: Utility $200- Salary $500- Taxes $150 | O |

|

| May 28 | Income for two weeks is $16,000 | 0 |

|

| May 30 | Withdrew cash for repair the coffee machine $1,500 | F |

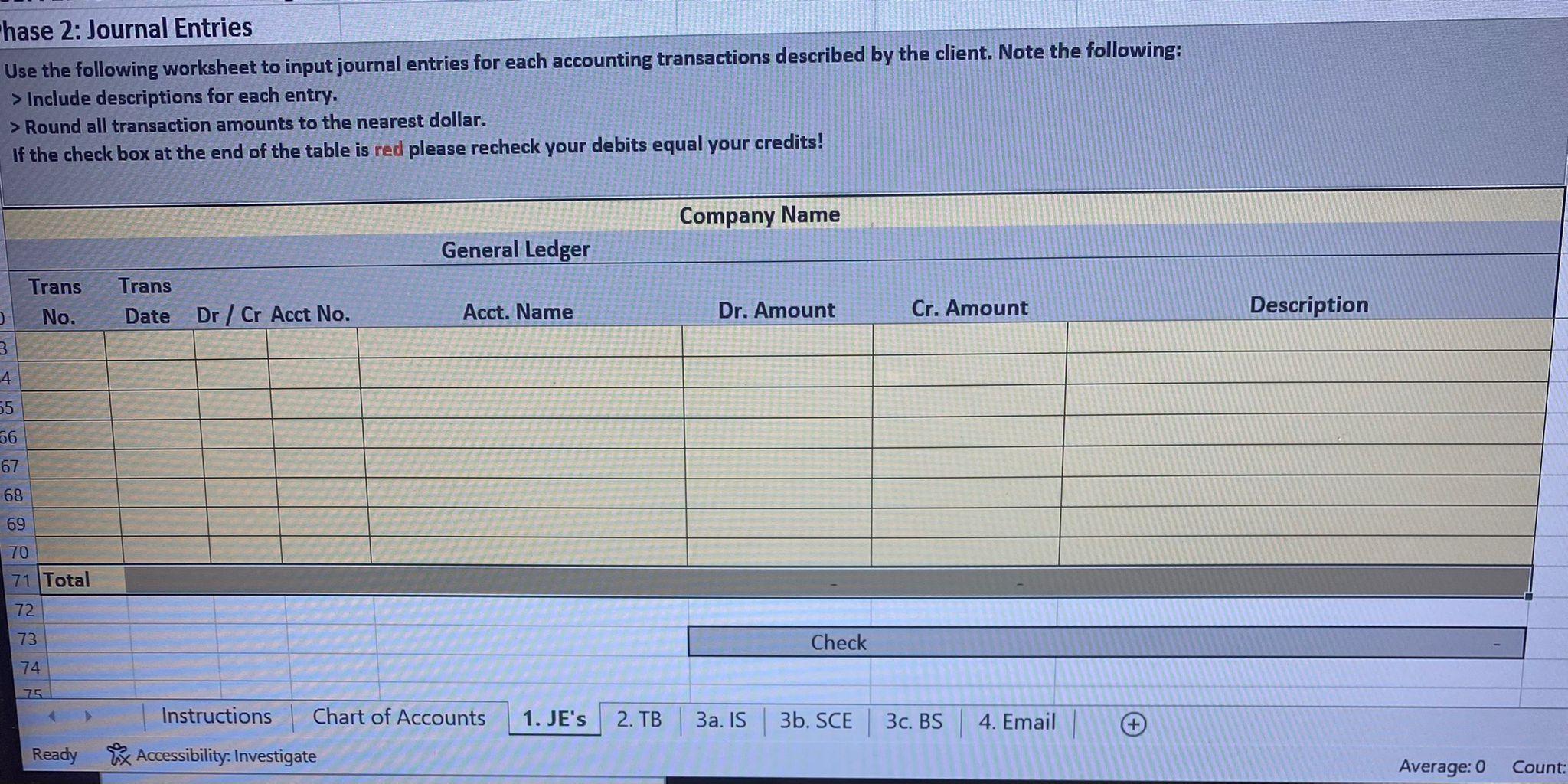

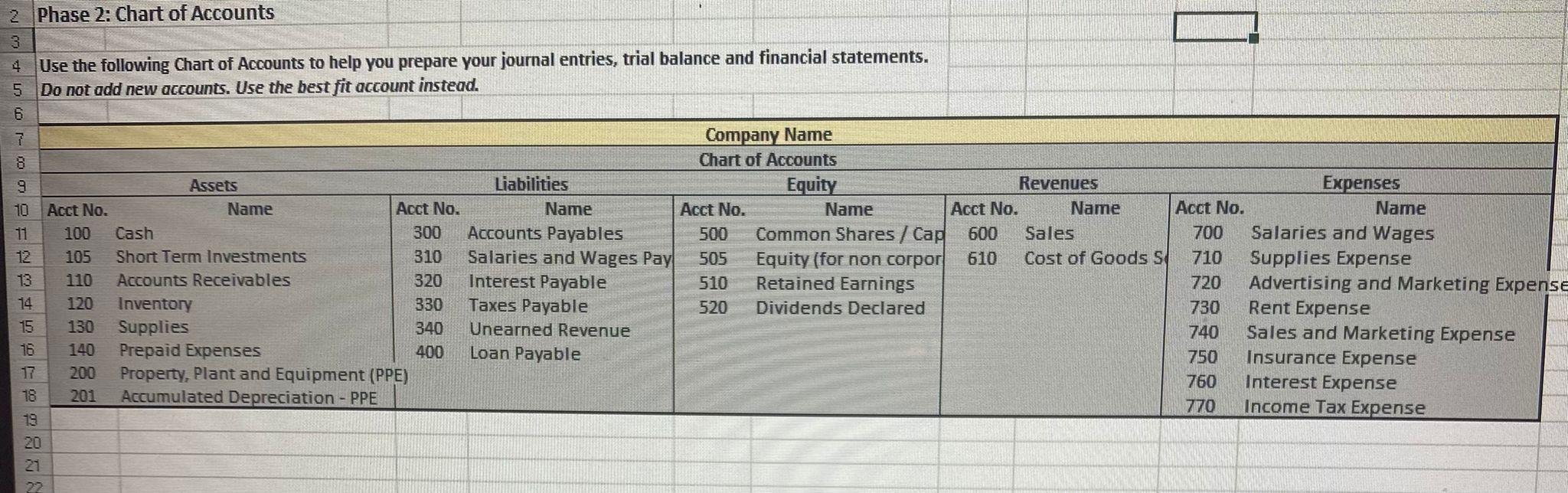

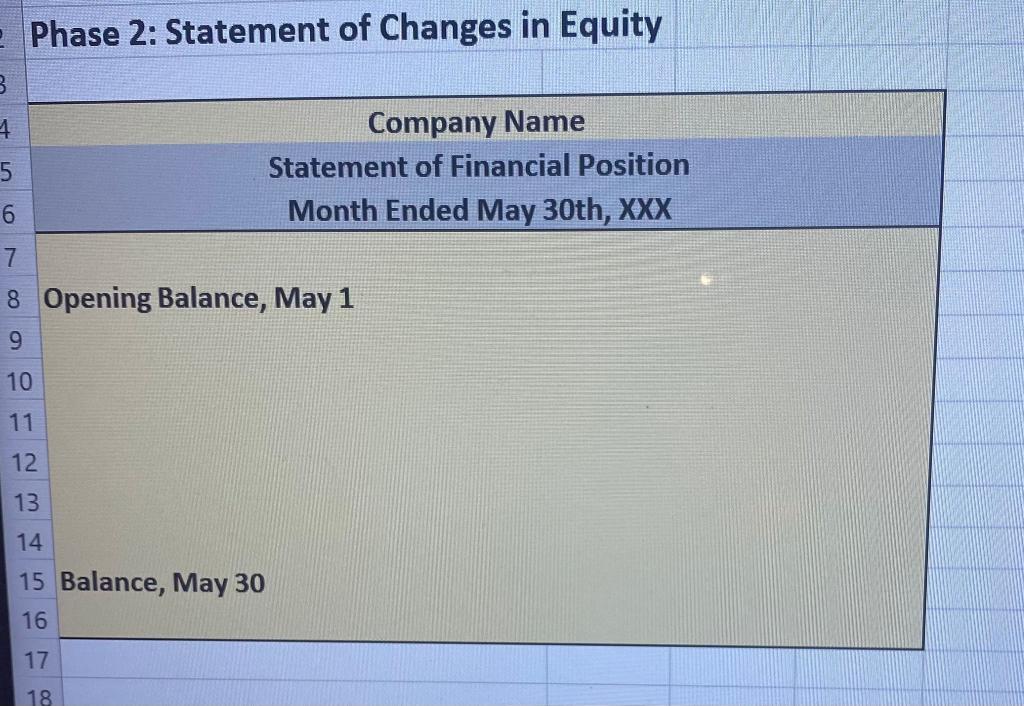

hase 2: Journal Entries Use the following worksheet to input journal entries for each accounting transactions described by the client. Note the following: > Include descriptions for each entry. > Round all transaction amounts to the nearest dollar. If the check box at the end of the table is red please recheck your debits equal your credits! Company Name General Ledger Trans No. Trans Date Dr / Cr Acct No. Acct. Name Dr. Amount Cr. Amount Description 3 4. 55 66 67 68 69 70 71 Total 72 73 Check 74 75 1. JE's 2. TB 3a. IS 3b. SCE 3c. BS 4. Email + Instructions Chart of Accounts Accessibility. Investigate Ready Average: 0 Count: 2 Phase 2: Chart of Accounts 3 4 Use the following Chart of Accounts to help you prepare your journal entries, trial balance and financial statements. 5 Do not add new accounts. Use the best fit account instead. 6 7 Company Name 8 Chart of Accounts 9 Assets Liabilities Equity Revenues Expenses Acct No. Name Acct No. Name Acct No. Name Acct No. Name Acct No. Name 100 Cash 300 Accounts Payables 500 Common Shares / Cap 600 Sales 700 Salaries and Wages 12 105 Short Term Investments 310 Salaries and Wages Pay 505 Equity (for non corpor 610 Cost of Goods S 710 Supplies Expense 110 Accounts Receivables 320 Interest Payable 510 Retained Earnings 720 Advertising and Marketing Expense 120 Inventory 330 Taxes Payable 520 Dividends Declared 730 Rent Expense 130 Supplies 340 Unearned Revenue 740 Sales and Marketing Expense 140 Prepaid Expenses 400 Loan Payable 750 Insurance Expense 200 Property, Plant and Equipment (PPE) 760 Interest Expense 201 Accumulated Depreciation - PPE 770 Income Tax Expense PENOPFAT 20 21 22 Phase 2: Trial Balance Use the following to create a trial balance. You may need to use T-Accounts to help you post the correct amounts. Make sure your trial balance it balances! Company Name Trial Balance Month Ended May, 30th, XXX Debit Account No. Account Name 2 105 Short Term Investments 3 110 Accounts Receivables 4 120 Inventory 15 130 Supplies 16 140 Prepaid Expenses 17 200 Property, Plant and Equipment (PPE) 18 201 Accumulated Depreciation - PPE 19 300 Accounts Payables 20 310 Salaries and Wages Payables 21 320 interest Payable 22 330 Taxes Payable 23 340 Unearned Revenue 24 400 Loan Payable 25 500 Common Shares / Capital 26 505 Equity (for non corporations) 27 510 Retained Earnings 28 520 Dividends Declared 29 600 Sales 30 610 Cost of Goods Sold 31 700 Salaries and Wages 32 710 Supplies Expense 33 720 Advertising and Marketing Expense 34 730 Rent Expense 35 740 Sales and Marketing Expense 36 750 Insurance Expense 37 760 Interest Expense Instructions Chart of Accounts Account Financial Credit Mapping Statement Current Assets Balance Sheet Current Assets Balance Sheet Current Assets Balance Sheet Current Assets Balance Sheet Current Assets Balance Sheet Long Term Assets Balance Sheet Long Term Assets Balance Sheet Current Liabilities Balance Sheet Current Liabilities Balance Sheet Current Liabilities Balance Sheet Current Liabilities Balance Sheet Current Liabilities Balance Sheet LT Liabilities Balance Sheet Equity tatement of Change in Equi Equity tatement of Change in Equit Equity tatement of Change in Equit Equity tatement of Change in Equit Revenues Income Statement Revenues Income Statement Expenses Income Statement Expenses Income Statement Expenses Income Statement Expenses Income Statement Expenses Income Statement Expenses Income Statement Expenses Income Statement 1. JE's 2. TB 3a. IS 3b. SCE 3c. BS Readyx Accessibility. Investigate 4 Type here to search LI 2 Phase 2: Income Statement 3 4 5 Company Name Income Statement Month Ended May 30th, XXX 6 7 Revenues 8 9 10 Net Revenues 11 12 Operating Expenses 13 14 15 16 17 18 19 Instructions Chart of Accounts 1. JE's 2. TB 3a. IS Ready Accorribili - Phase 2: Statement of Changes in Equity B 4. Company Name 5 Statement of Financial Position 6 Month Ended May 30th, XXX 7 8 Opening Balance, May 1 9 10 11 12 13 14 15 Balance, May 30 16 17 ro 18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts