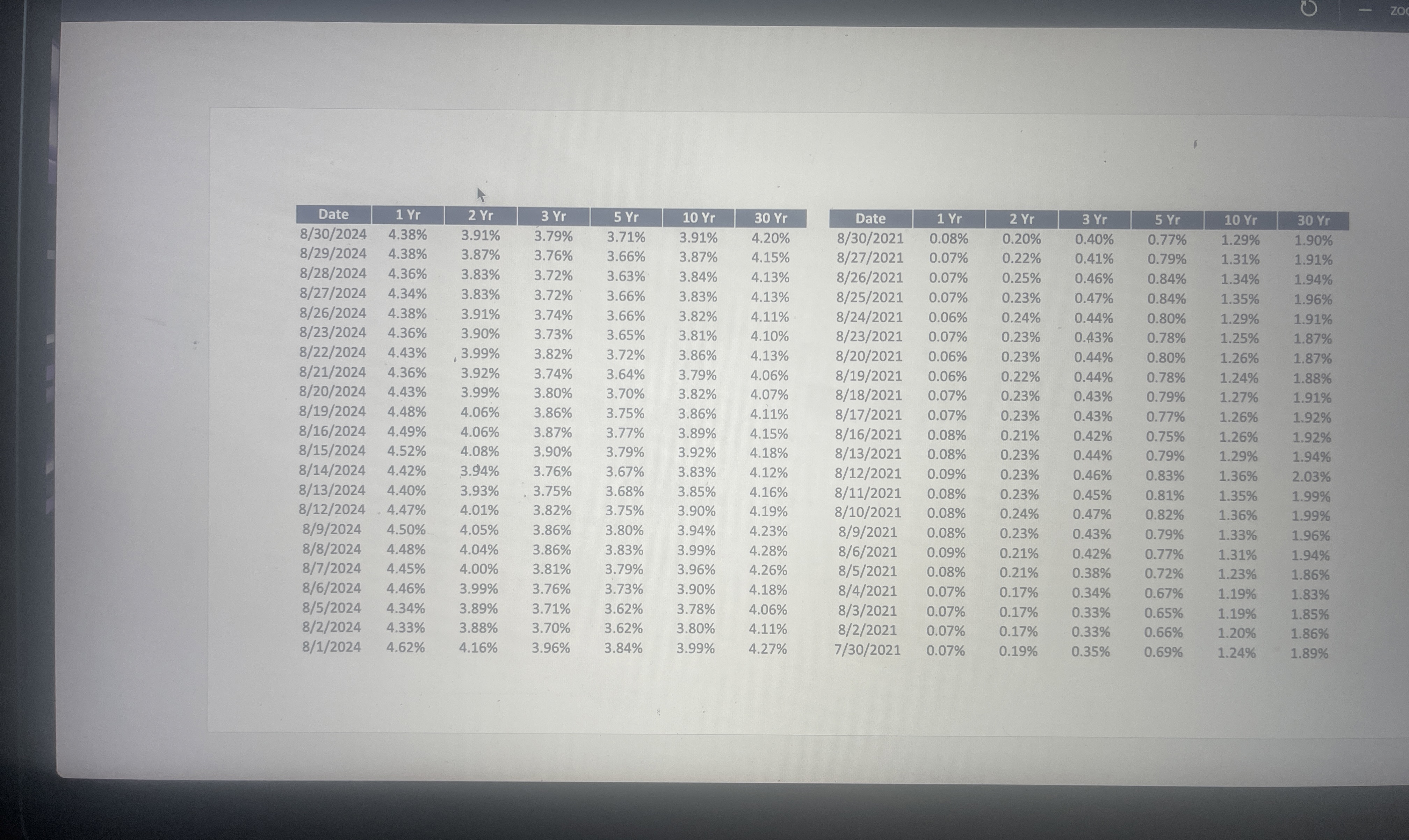

Question: Provided in the excel file are two data sets with rate data for US treasury yields from two different years. Construct a yield curve for

Provided in the excel file are two data sets with rate data for US treasury yields from two different years.

Construct a yield curve for each data set, utilizing the rates from for data set and for

data set

Calculate the spread for all dates in data set and

Define which of the data sets has an inverted yield curve and interpret the inversion.

a What is an inverted yield curve and what does it represent?

b Is there a better predictor of a recession than the year spread?

c Define a recession.

Please submit your excel file with graphs and calculations as well as a pdf writeup that show your answers for each question.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock