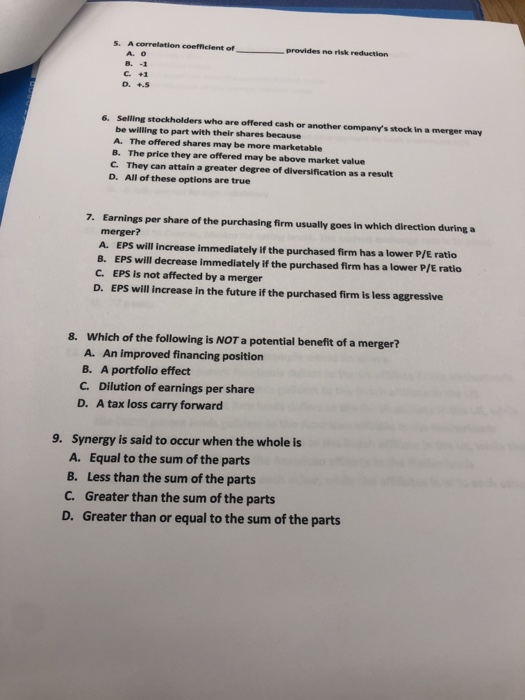

Question: _provides no risk reduction . C. +1 D. +.5 Selling stockholders who are offered cash or another company's stock in a merger may be willing

_provides no risk reduction . C. +1 D. +.5 Selling stockholders who are offered cash or another company's stock in a merger may be willing to part with their shares because A. The offered shares may be more marketable B. The price they are offered may be above market value 6. C. D. They can attain a greater degree of diversification as a result All of these options are true Earnings per share of the purchasing firm usually goes in which direction during a merger? A. EPS will increase immediately if the purchased firm has a lower P/E ratio B. EPS will decrease immediately if the purchased firm has a lower P/E ratilo 7. EPS is not affected by a merger EPS will increase in the future if the purchased firm is less aggressive C. D. Which of the following is NOT a potential benefit of a merger? A. An improved financing position B. A portfolio effect C. Dilution of earnings per share D. A tax loss carry forward 8. Synergy is said to occur when the whole is 9. A. Equal to the sum of the parts B. Less than the sum of the parts C. Greater than the sum of the parts D. Greater than or equal to the sum of the parts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts