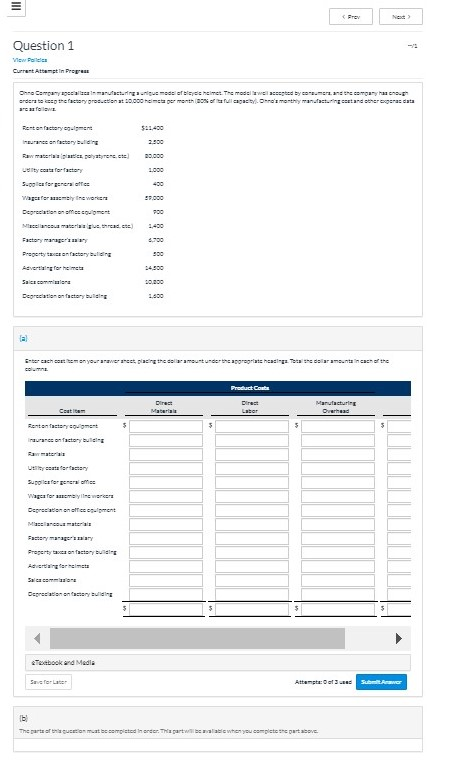

Question: Proy Question 1 View Polls Current Attempt in Propese Che Company species austeringede af de mes Themedewell ested by the company na erderate este factory

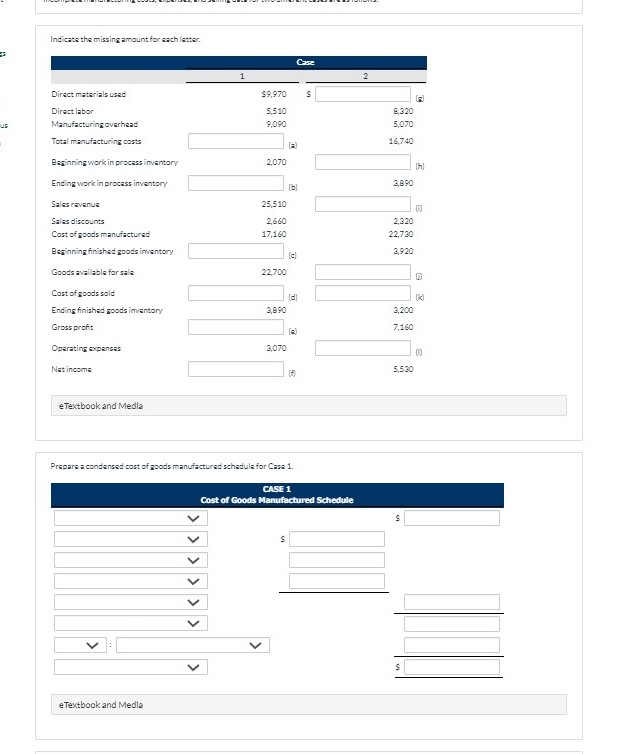

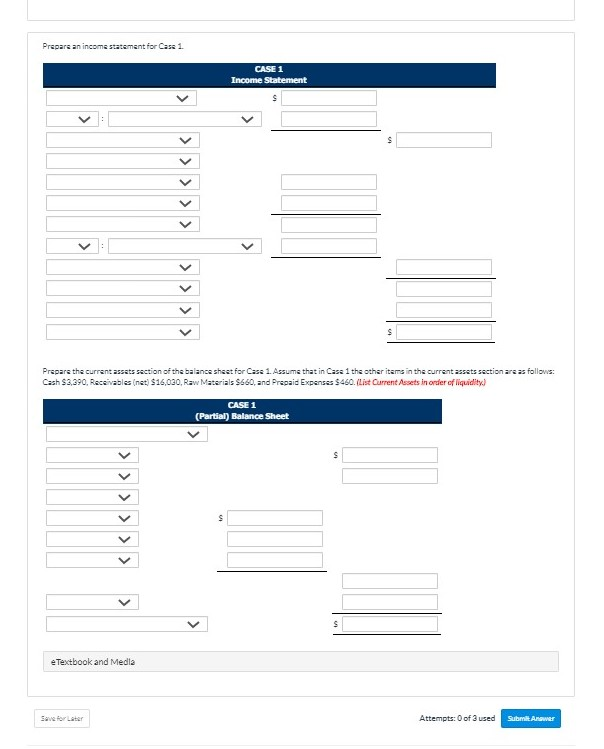

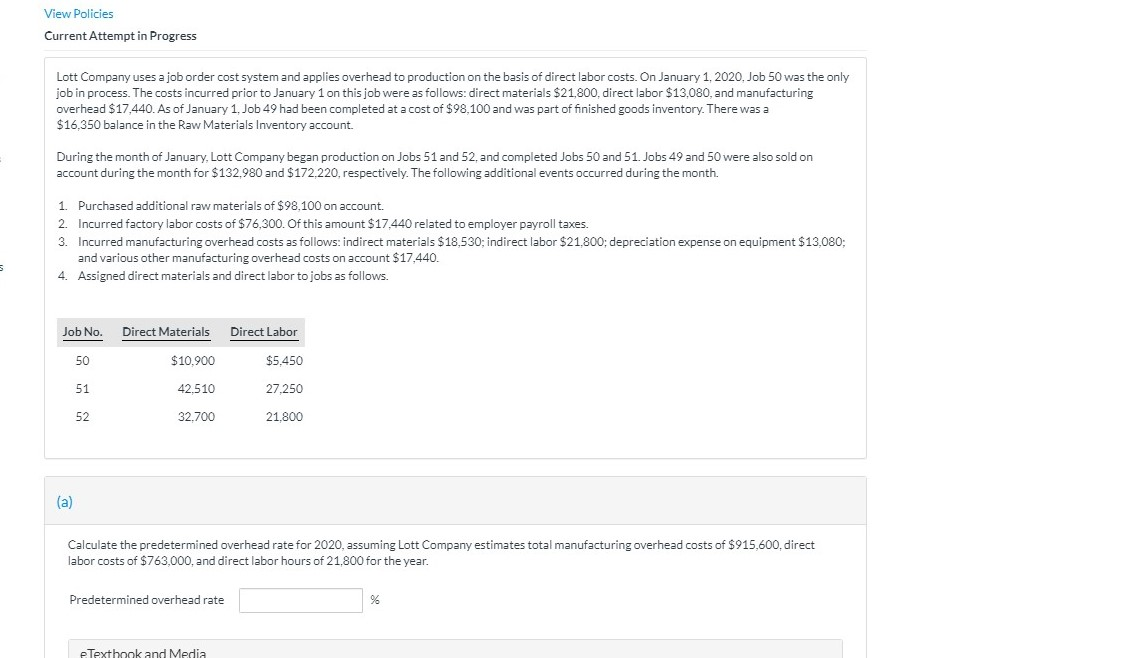

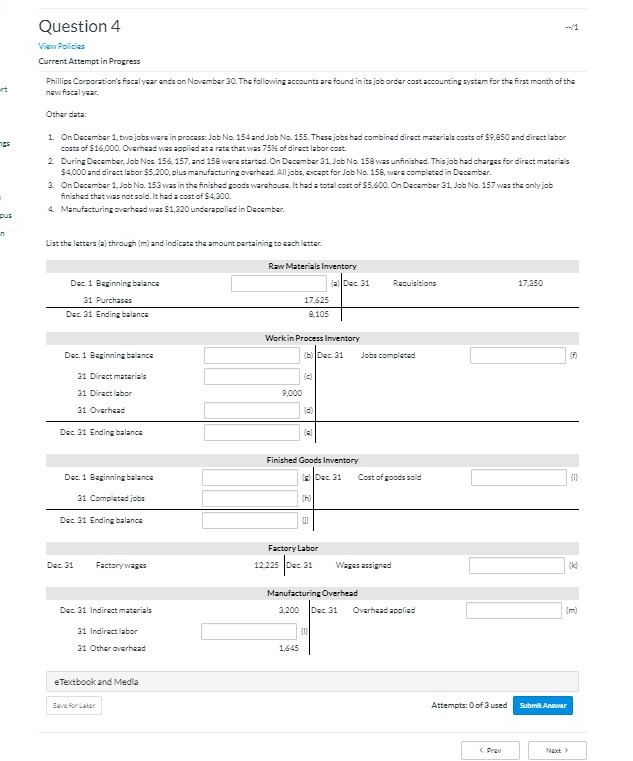

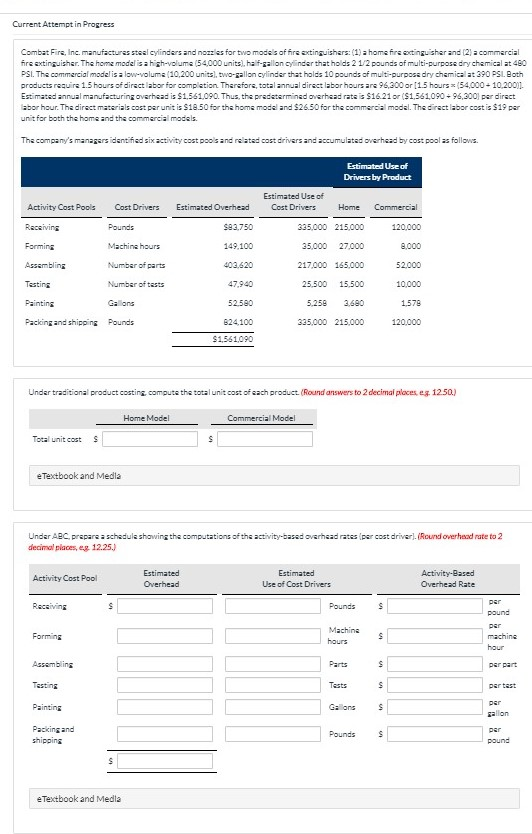

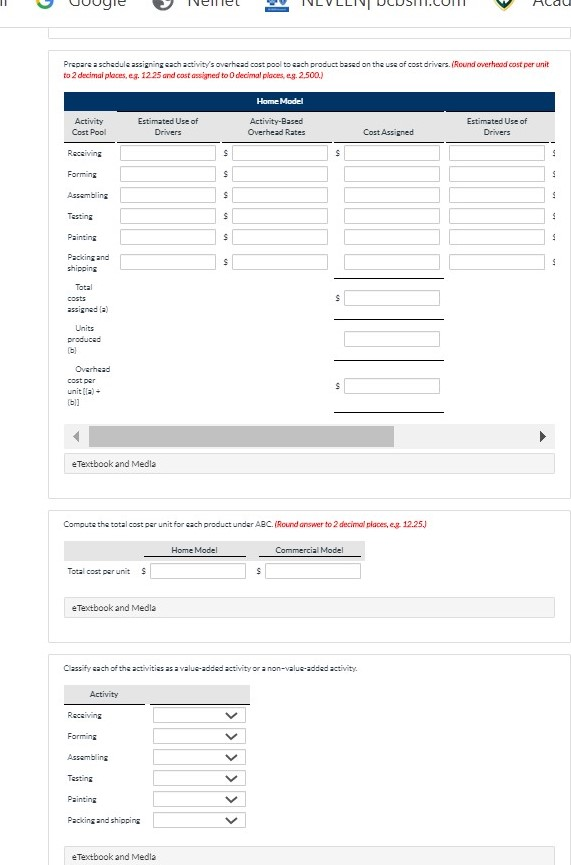

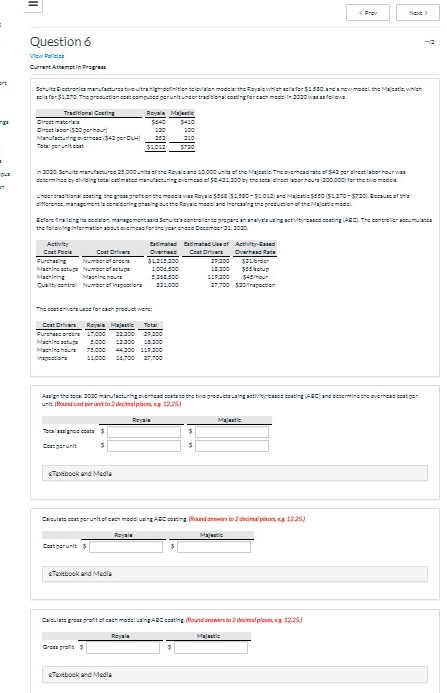

Proy Question 1 View Polls Current Attempt in Propese Che Company species austeringede af de mes Themedewell ested by the company na erderate este factory groc.ction : 00.000 hecta per month of a full capacity's most mandateringeetan bergeras data areas 20.000 99.000 Restoratory agent Innee en stery Raw materia de polyese. welcoy 5.Colleferrera offes Wagerferansese werker Degregationes Wireless Factory manager Preperty tax enfasterylling Advertising for himet Salem 700 1.490 3.700 900 Degree on the 1.600 al berach carton your avereet placing that under the appropriate hacia Torre de la stan och the Product Conte Contem Direct Material Direct Labor Manufacture Overhead Rentenfest 5 5 5 rauares on factory building water Uystery Spoiler forgerais Waga francese wercera Deprecationen effect Maslacematerials Fastery Preperty tax on factory Accrtaling for its Salicaces Depression on tester Tebook and Media Swetera Attempte: Subalter 151 The part of the meat be completed in order. The partwe wat when you complete part above. Indicate the missing amount for each letter Case 2 Direct materials used $9,970 S Direct labor Manufacturing overhead Total manufacturing costs 5.510 9,090 8,320 5,070 a 16,740 Beginning work in process inventory 2,070 hi Ending work in process inventory (b 3,890 Sales revenue Sales discounts Cost of goods manufactured Beginning finished goods inventory 25,510 2,660 17,160 2,320 22,730 3.920 cl Goods available for sale 22,700 G dl Cost of goods sold Encing finished goods inventory Gross profit 3,890 00 3,200 7,160 2 Operating expenses 3,070 Nat income 5,530 e Textbook and Media Prepare a condensed cost of goods manufactured schedule for Case 1. CASE 1 Cost of Goods Manufactured Schedule S $ > e Textbook and Media Prepare an income statement for Case 1 CASE 1 Income Statement S > e Textbook and Media Sve for Later Attempts: 0 of 3 used Submit Answer View Policies Current Attempt in Progress Lott Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2020, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $21,800, direct labor $13,080, and manufacturing overhead $17,440. As of January 1, Job 49 had been completed at a cost of $98,100 and was part of finished goods inventory. There was a $16.350 balance in the Raw Materials Inventory account. During the month of January, Lott Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were also sold on account during the month for $132.980 and $172.220, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $98,100 on account. 2. Incurred factory labor costs of $76,300. Of this amount $17.440 related to employer payroll taxes. 3. Incurred manufacturing overhead costs as follows: indirect materials $18,530; indirect labor $21,800; depreciation expense on equipment $13,080; and various other manufacturing overhead costs on account $17,440. 4. Assigned direct materials and direct labor to jobs as follows. Job No. Direct Materials Direct Labor 50 $10.900 $5.450 51 42.510 27.250 52 32.700 21,800 (a) Calculate the predetermined overhead rate for 2020, assuming Lott Company estimates total manufacturing overhead costs of $915,600, direct labor costs of $763,000, and direct labor hours of 21,800 for the year. Predetermined overhead rate % e Textbook and Media Question 4 View Policies Current Attempt in Progress Phillips Corporation's fiscal year ends on November 20. The following accounts are found in its job order cost accounting system for the first month of the new fiscal year. Other data: 1. On December 1, twojobs were in process: Job No. 154 and Job No. 155. These jobs had combined direct materials costs of $9,850 and direct labor costs of $16,000 Overhead was applied at a rate that was 75% of direct labor cost 2. During December, Job Nos 156, 157, and 158 vers started on December 31. Job No 158 was unfinished. This job had charges for direct materias $4000 and direct labor $5.200, plus manufacturing overhead. All jobs, except for Job No. 158, ware completed in December 3. On December 1, Job No 153 was in the finished goods warehouse. It had a total cost of $5,600. On December 31, Job No. 157 was the onlyjob finished that was not sold. It had a cost of $4,300. 4 Manufacturing overhead was $1,320 underapplied in December pus n List the latters (a) through (m) and indicate the amount pertaining to each latter. Requisitions 17,350 Dec 1 Beginning balance 31 Purchases Dec 31 Ending balance Raw Materials Inventory la Dec 31 17,625 9,105 Workin Process Inventory Dec 31 Jobs completed Dec 1 Beginning balance f) 9,000 31 Direct mataria's 31 Direct labor 31 Overhead Dec 31 Ending balance 10 Finished Goods Inventory Dec 31 Cost of goods sold Dec 1 Beginning balance 0 31 Completed jobs th Dec 31 Ending balance Factory Labor Dec 31 Factory wages 12.225 31 Wages assigned Manufacturing Overhead 3.200 Dec 31 Overhead applied Dec 31 Indirect materials CU 31 Indirect labor 31 Other overhead 1.645 e Textbook and Media Save for Later Attempts: 0 of 3 used Submit Answer Current Attempt in Progress Combat Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The homa model is a high-volume (54000 units). half-gallon cylinder that holds 2 1/2 pounds of multi-purpose dry chemical at 480 PSI. The commercial model is a low-volums (10,200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion Therefore, total annual direct labor hours are 96,300 or (1.5 hours (54.000 - 10.2001- Estimated annual manufacturing overhead is $1.561.090. Thus, the predetermined overhead rate is $16.21 or ($1,561,090 - 95,300 per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models. The company's managers identified six activity cost pools and related cost drivers and accumulated overhead by cost pool as follows. Estimated Use of Drivers by Product Estimated Use of Cost Drivers Activity Cost Pools Cost Drivers Estimated Overhead Home Commercial Receiving Pounds S92.750 335,000 215,000 120,000 Forming Machine hours 149.100 35,000 27.000 8,000 Assembling Number of parts 408.620 217,000 165.000 52.000 Testing Number of tests 25,500 15.500 10.000 47,940 52.580 Painting Gallons 5.250 3.600 1578 Packing and shipping Pounds 325.000 215,000 120,000 624.100 $1.561,090 Under traditional product casting compute the total unit cost of each product (Round answers to 2 decimal places eg. 1250.) Home Model Commercial Model Total unit cost S S e Textbook and Media Under ABC.prepare a schedule showing the computations of the activity based overhead rates per cost driver). (Round overhead rate to 2 decimal places, eg 12.25.) Activity Cost Pool Estimated Overhead Estimated Use of Cost Drivers Activity-Based Overhead Rate Receiving S Pounds S per pound per machine hour Forming Machine hours S Assembling Parts per part $ $ Testing Tests per test Painting Galons s per gallon Packing and shipping Pounds $ per pound S e Textbook and Media Prepare a schedule assigning each activity's overhead cost pool to each product based on the use of cost drivers. (Round overhead cost per unit to 2 decimal places.cg. 12.25 and cost assigned to decimal places eg. 2.500.) Home Model Activity Cost Pool Estimated Use of Drivers Activity-Based Overhead Rates Estimated Use of Drivers Cost Assigned Receiving S . Forming S Assembling . $ . Testing S Painting S 9 Packing and shipping S Total costs S assigneda) Units produced Overhead cost per S e Textbook and Media Compute the total cost per unit for each product under ABC. (Round answer to 2 decimal places, eg 12.25.) Home Model Commercial Model Total cost per units S e Textbook and Media Classify each of the activities as a value-added activity or a non-value-added activity. Activity Receiving Forming Assembling Testing Painting Packing and shipping e Textbook and Media -2 Question 6 View Poller Current Attenti Sentstrenmanfactures tout en televisie medelt the Royals which aller $2.500 and a new model the entie, wielen for $1.270. The gros stien scoputes gerunder transcort forca din 2020 was a Traditional Cette Royale Maja $540 Direct laber $20 ger hour Manufactas 542 per Total gerencoat 31.012 In 2020. Seriatures 25 000 Royacan 10.000 here. The head rater 542 ger street aber was esteriny clientelated recreas of $2.41.200 by the total de beror 200.000 for the remode. Linder traditionat per protestere med at Royal 5.00 5.00 - $2.022) - Male 55.0 $4270 - $720) Deanu diferensmanagements concerning the Realms and creating the presude of the Marded derfragia eden management Schutz's controller to prepare analyzing activity and coating ABC. The controllers the wing information about the force year ended December 21, 2020 Coat Posts Coat Drivers PUPS Norbert Maclesastuse Number ofta ME Mch Quilty centre Nombre ingles Baratas Baratade of Attend Overhea Coat Drivers Overhead 51.2.9.200 29.290 521 1.000.000 Setup 3.000 309.300 27,200 $ The cerveses for each proc. were: Centre Roya Maju Purchase 57.000 Maceste 5.000 Macht 7.000 91.000 in the stai 2020 manufacturing read the reductas coat anders versesater Bundat per un temps, 12.95 Majestic Total presenta 5 Content 5 5 Textbook od Media Cuisits esat geruitef cash dengan and to dep, 12:35 Royale Majale Contents 5 Textbook and Media Calcite prea greit fachmeselnesting and resto dello 12.95 Royale Majele & Textbook and Media Proy Question 1 View Polls Current Attempt in Propese Che Company species austeringede af de mes Themedewell ested by the company na erderate este factory groc.ction : 00.000 hecta per month of a full capacity's most mandateringeetan bergeras data areas 20.000 99.000 Restoratory agent Innee en stery Raw materia de polyese. welcoy 5.Colleferrera offes Wagerferansese werker Degregationes Wireless Factory manager Preperty tax enfasterylling Advertising for himet Salem 700 1.490 3.700 900 Degree on the 1.600 al berach carton your avereet placing that under the appropriate hacia Torre de la stan och the Product Conte Contem Direct Material Direct Labor Manufacture Overhead Rentenfest 5 5 5 rauares on factory building water Uystery Spoiler forgerais Waga francese wercera Deprecationen effect Maslacematerials Fastery Preperty tax on factory Accrtaling for its Salicaces Depression on tester Tebook and Media Swetera Attempte: Subalter 151 The part of the meat be completed in order. The partwe wat when you complete part above. Indicate the missing amount for each letter Case 2 Direct materials used $9,970 S Direct labor Manufacturing overhead Total manufacturing costs 5.510 9,090 8,320 5,070 a 16,740 Beginning work in process inventory 2,070 hi Ending work in process inventory (b 3,890 Sales revenue Sales discounts Cost of goods manufactured Beginning finished goods inventory 25,510 2,660 17,160 2,320 22,730 3.920 cl Goods available for sale 22,700 G dl Cost of goods sold Encing finished goods inventory Gross profit 3,890 00 3,200 7,160 2 Operating expenses 3,070 Nat income 5,530 e Textbook and Media Prepare a condensed cost of goods manufactured schedule for Case 1. CASE 1 Cost of Goods Manufactured Schedule S $ > e Textbook and Media Prepare an income statement for Case 1 CASE 1 Income Statement S > e Textbook and Media Sve for Later Attempts: 0 of 3 used Submit Answer View Policies Current Attempt in Progress Lott Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2020, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $21,800, direct labor $13,080, and manufacturing overhead $17,440. As of January 1, Job 49 had been completed at a cost of $98,100 and was part of finished goods inventory. There was a $16.350 balance in the Raw Materials Inventory account. During the month of January, Lott Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were also sold on account during the month for $132.980 and $172.220, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $98,100 on account. 2. Incurred factory labor costs of $76,300. Of this amount $17.440 related to employer payroll taxes. 3. Incurred manufacturing overhead costs as follows: indirect materials $18,530; indirect labor $21,800; depreciation expense on equipment $13,080; and various other manufacturing overhead costs on account $17,440. 4. Assigned direct materials and direct labor to jobs as follows. Job No. Direct Materials Direct Labor 50 $10.900 $5.450 51 42.510 27.250 52 32.700 21,800 (a) Calculate the predetermined overhead rate for 2020, assuming Lott Company estimates total manufacturing overhead costs of $915,600, direct labor costs of $763,000, and direct labor hours of 21,800 for the year. Predetermined overhead rate % e Textbook and Media Question 4 View Policies Current Attempt in Progress Phillips Corporation's fiscal year ends on November 20. The following accounts are found in its job order cost accounting system for the first month of the new fiscal year. Other data: 1. On December 1, twojobs were in process: Job No. 154 and Job No. 155. These jobs had combined direct materials costs of $9,850 and direct labor costs of $16,000 Overhead was applied at a rate that was 75% of direct labor cost 2. During December, Job Nos 156, 157, and 158 vers started on December 31. Job No 158 was unfinished. This job had charges for direct materias $4000 and direct labor $5.200, plus manufacturing overhead. All jobs, except for Job No. 158, ware completed in December 3. On December 1, Job No 153 was in the finished goods warehouse. It had a total cost of $5,600. On December 31, Job No. 157 was the onlyjob finished that was not sold. It had a cost of $4,300. 4 Manufacturing overhead was $1,320 underapplied in December pus n List the latters (a) through (m) and indicate the amount pertaining to each latter. Requisitions 17,350 Dec 1 Beginning balance 31 Purchases Dec 31 Ending balance Raw Materials Inventory la Dec 31 17,625 9,105 Workin Process Inventory Dec 31 Jobs completed Dec 1 Beginning balance f) 9,000 31 Direct mataria's 31 Direct labor 31 Overhead Dec 31 Ending balance 10 Finished Goods Inventory Dec 31 Cost of goods sold Dec 1 Beginning balance 0 31 Completed jobs th Dec 31 Ending balance Factory Labor Dec 31 Factory wages 12.225 31 Wages assigned Manufacturing Overhead 3.200 Dec 31 Overhead applied Dec 31 Indirect materials CU 31 Indirect labor 31 Other overhead 1.645 e Textbook and Media Save for Later Attempts: 0 of 3 used Submit Answer Current Attempt in Progress Combat Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The homa model is a high-volume (54000 units). half-gallon cylinder that holds 2 1/2 pounds of multi-purpose dry chemical at 480 PSI. The commercial model is a low-volums (10,200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion Therefore, total annual direct labor hours are 96,300 or (1.5 hours (54.000 - 10.2001- Estimated annual manufacturing overhead is $1.561.090. Thus, the predetermined overhead rate is $16.21 or ($1,561,090 - 95,300 per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models. The company's managers identified six activity cost pools and related cost drivers and accumulated overhead by cost pool as follows. Estimated Use of Drivers by Product Estimated Use of Cost Drivers Activity Cost Pools Cost Drivers Estimated Overhead Home Commercial Receiving Pounds S92.750 335,000 215,000 120,000 Forming Machine hours 149.100 35,000 27.000 8,000 Assembling Number of parts 408.620 217,000 165.000 52.000 Testing Number of tests 25,500 15.500 10.000 47,940 52.580 Painting Gallons 5.250 3.600 1578 Packing and shipping Pounds 325.000 215,000 120,000 624.100 $1.561,090 Under traditional product casting compute the total unit cost of each product (Round answers to 2 decimal places eg. 1250.) Home Model Commercial Model Total unit cost S S e Textbook and Media Under ABC.prepare a schedule showing the computations of the activity based overhead rates per cost driver). (Round overhead rate to 2 decimal places, eg 12.25.) Activity Cost Pool Estimated Overhead Estimated Use of Cost Drivers Activity-Based Overhead Rate Receiving S Pounds S per pound per machine hour Forming Machine hours S Assembling Parts per part $ $ Testing Tests per test Painting Galons s per gallon Packing and shipping Pounds $ per pound S e Textbook and Media Prepare a schedule assigning each activity's overhead cost pool to each product based on the use of cost drivers. (Round overhead cost per unit to 2 decimal places.cg. 12.25 and cost assigned to decimal places eg. 2.500.) Home Model Activity Cost Pool Estimated Use of Drivers Activity-Based Overhead Rates Estimated Use of Drivers Cost Assigned Receiving S . Forming S Assembling . $ . Testing S Painting S 9 Packing and shipping S Total costs S assigneda) Units produced Overhead cost per S e Textbook and Media Compute the total cost per unit for each product under ABC. (Round answer to 2 decimal places, eg 12.25.) Home Model Commercial Model Total cost per units S e Textbook and Media Classify each of the activities as a value-added activity or a non-value-added activity. Activity Receiving Forming Assembling Testing Painting Packing and shipping e Textbook and Media -2 Question 6 View Poller Current Attenti Sentstrenmanfactures tout en televisie medelt the Royals which aller $2.500 and a new model the entie, wielen for $1.270. The gros stien scoputes gerunder transcort forca din 2020 was a Traditional Cette Royale Maja $540 Direct laber $20 ger hour Manufactas 542 per Total gerencoat 31.012 In 2020. Seriatures 25 000 Royacan 10.000 here. The head rater 542 ger street aber was esteriny clientelated recreas of $2.41.200 by the total de beror 200.000 for the remode. Linder traditionat per protestere med at Royal 5.00 5.00 - $2.022) - Male 55.0 $4270 - $720) Deanu diferensmanagements concerning the Realms and creating the presude of the Marded derfragia eden management Schutz's controller to prepare analyzing activity and coating ABC. The controllers the wing information about the force year ended December 21, 2020 Coat Posts Coat Drivers PUPS Norbert Maclesastuse Number ofta ME Mch Quilty centre Nombre ingles Baratas Baratade of Attend Overhea Coat Drivers Overhead 51.2.9.200 29.290 521 1.000.000 Setup 3.000 309.300 27,200 $ The cerveses for each proc. were: Centre Roya Maju Purchase 57.000 Maceste 5.000 Macht 7.000 91.000 in the stai 2020 manufacturing read the reductas coat anders versesater Bundat per un temps, 12.95 Majestic Total presenta 5 Content 5 5 Textbook od Media Cuisits esat geruitef cash dengan and to dep, 12:35 Royale Majale Contents 5 Textbook and Media Calcite prea greit fachmeselnesting and resto dello 12.95 Royale Majele & Textbook and Media

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts