Question: prs provide complete CORRECT answer Net Income variance should be $204,000 favorable Chapter 7 (Topics 7.4 &7.5) Little Sluggers Inc., manufacturer of aluminum bats, estimates

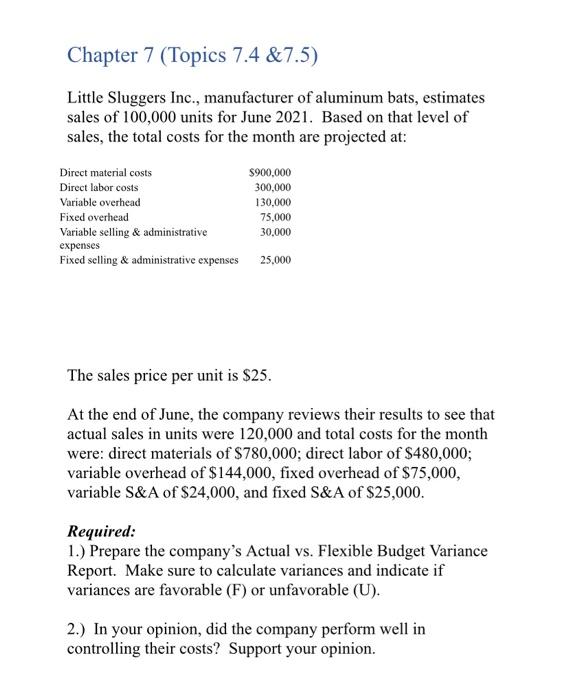

Chapter 7 (Topics 7.4 &7.5) Little Sluggers Inc., manufacturer of aluminum bats, estimates sales of 100,000 units for June 2021. Based on that level of sales, the total costs for the month are projected at: Direct material costs Direct labor costs Variable overhead Fixed overhead Variable selling & administrative expenses Fixed selling & administrative expenses $900,000 300,000 130,000 75,000 30,000 25.000 The sales price per unit is $25. At the end of June, the company reviews their results to see that actual sales in units were 120,000 and total costs for the month were: direct materials of $780,000; direct labor of $480,000; variable overhead of $144,000, fixed overhead of $75,000, variable S&A of $24,000, and fixed S&A of $25,000. Required: 1.) Prepare the company's Actual vs. Flexible Budget Variance Report. Make sure to calculate variances and indicate if variances are favorable (F) or unfavorable (U). 2.) In your opinion, did the company perform well in controlling their costs? Support your opinion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts