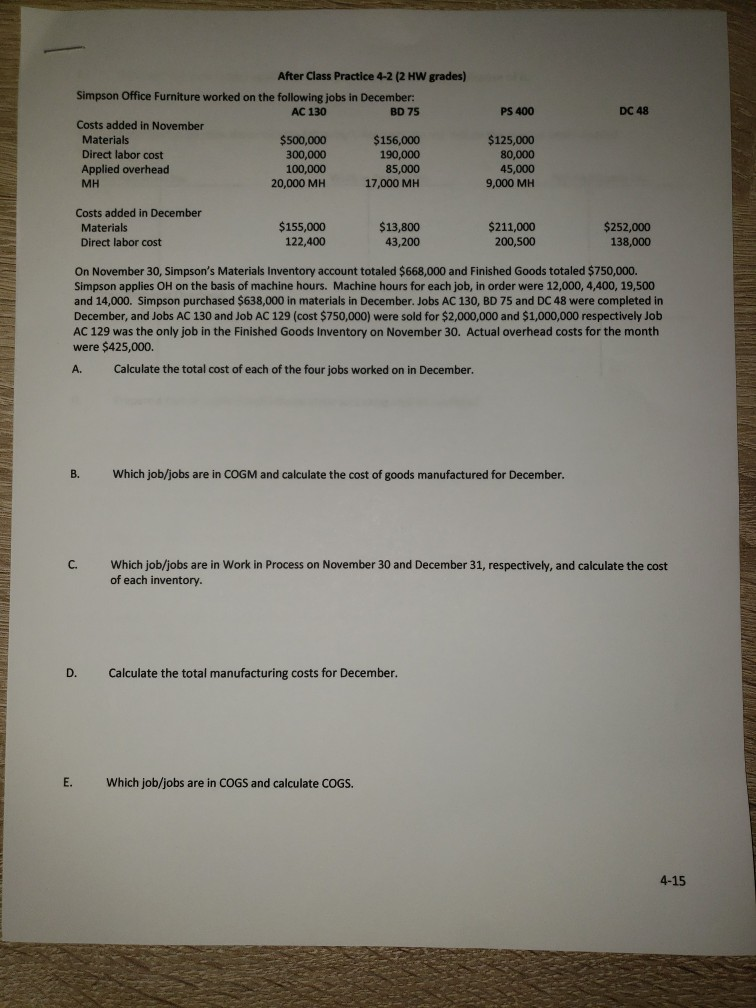

Question: PS 400 DC 48 After Class Practice 4-2 (2 HW grades) Simpson Office Furniture worked on the following jobs in December: AC 130 BD 75

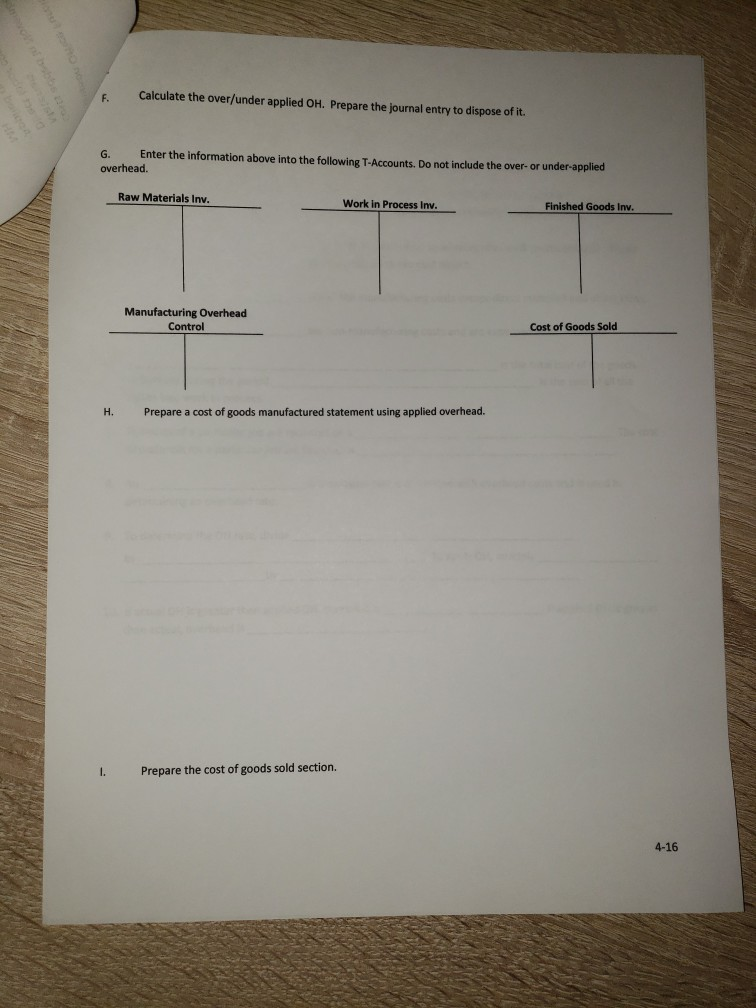

PS 400 DC 48 After Class Practice 4-2 (2 HW grades) Simpson Office Furniture worked on the following jobs in December: AC 130 BD 75 Costs added in November Materials $500,000 $156,000 Direct labor cost 300,000 190,000 Applied overhead 100,000 85,000 MH 20,000 MH 17,000 MH $125,000 80,000 45,000 9,000 MH Costs added in December Materials Direct labor cost $155,000 122,400 $13,800 43,200 $211,000 200,500 $252,000 138,000 On November 30, Simpson's Materials Inventory account totaled $668,000 and Finished Goods totaled $750,000. Simpson applies OH on the basis of machine hours. Machine hours for each job, in order were 12,000, 4,400, 19,500 and 14,000. Simpson purchased $638,000 in materials in December. Jobs AC 130, BD 75 and DC 48 were completed in December, and Jobs AC 130 and Job AC 129 (cost $750,000) were sold for $2,000,000 and $1,000,000 respectively Job AC 129 was the only job in the Finished Goods Inventory on November 30. Actual overhead costs for the month were $425,000. A. Calculate the total cost of each of the four jobs worked on in December. B. Which job/jobs are in COGM and calculate the cost of goods manufactured for December. C. Which job/jobs are in Work in Process on November 30 and December 31, respectively, and calculate the cost of each inventory. D. Calculate the total manufacturing costs for December. E. Which job/jobs are in COGS and calculate COGS. 4-15 F. Calculate the over/under applied OH. Prepare the journal entry to dispose of it. G. Enter the information above into the following T-Accounts. Do not include the over- or under-applied overhead. Raw Materials Inv. Work in Process Inv. Finished Goods Inv. Manufacturing Overhead Control Cost of Goods Sold H. Prepare a cost of goods manufactured statement using applied overhead. 1. Prepare the cost of goods sold section. 4-16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts