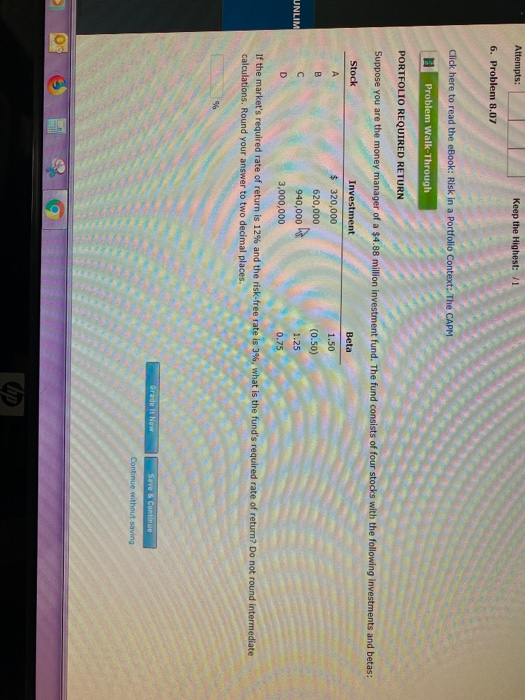

Question: ps. Keep the Highest: 11 6. Problem 8.07 Click here to read the eBook: Risk in a Portfolio Context: The CAPM Problem Walk-Through PORTFOLIO REQUIRED

ps. Keep the Highest: 11 6. Problem 8.07 Click here to read the eBook: Risk in a Portfolio Context: The CAPM Problem Walk-Through PORTFOLIO REQUIRED RETURN Suppose you are the money manager of a $4.88 million Investment fund. The fund consists of four stocks with the following investments and betas: Stock Beta Investment 320,000 620,000 940,000 3,000,000 1.50 (0.50) 1.25 UNLIM If the market's required rate of return is 12% and the risk-free rate is calculations. Round your answer to two decimal places. ex free rate lis 3*, what 0.75 te of return is 129 and what is the fund's required rate of return? Do not round intermediate Grade It Now Save Core GP

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts