Question: Ps: Please Answer all part in easy manners so that i can understand it . try to answer it ASAP Appendix B: Information for the

Ps: Please Answer all part in easy manners so that i can understand it . try to answer it ASAP

Ps: Please Answer all part in easy manners so that i can understand it . try to answer it ASAP

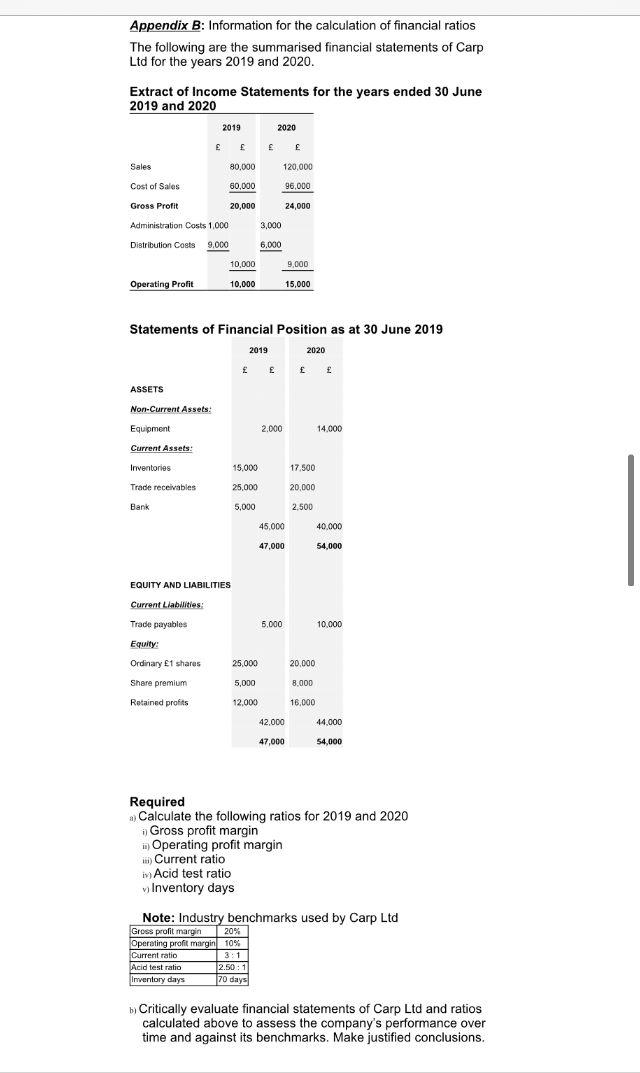

Appendix B: Information for the calculation of financial ratios The following are the summarised financial statements of Carp Ltd for the years 2019 and 2020. Extract of Income Statements for the years ended 30 June 2019 and 2020 2019 2020 Sales 80,000 120,000 Cost of Sales 60,000 96.000 Gross Profit 20,000 24,000 Administration Costs 1,000 3,000 Distribution Costs 9.000 6,000 9,000 10,000 10,000 Operating Profit 15,000 Statements of Financial Position as at 30 June 2019 2019 2020 ASSETS Non-Current Assets: Equipment 2.000 14.000 Current Assets: Inventories 15,000 17.500 Trade receivables 25,000 20,000 Bank 5,000 2.500 45.000 40.000 47,000 54,000 EQUITY AND LIABILITIES Current Liabilities: Trade payables 5,000 10.000 25,000 20,000 Equity: : Ordinary 1 shares Share premium Retained profits 5,000 8.000 12,000 16,000 42.000 44,000 47,000 54,000 Required Calculate the following ratios for 2019 and 2020 Gross profit margin Operating profit margin i. Current ratio iv) Acid test ratio vi Inventory days in) Note: Industry benchmarks used by Carp Ltd Gross profit margin 20% Operating profit margin 10% Current ratio 3:1 Acid test ratio 2.50:1 Inventory days 170 days b) Critically evaluate financial statements of Carp Ltd and ratios calculated above to assess the company's performance over time and against its benchmarks. Make justified conclusions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts