Question: PS/0253A%252F%252Fb Saved 2 Problem 6-19 (Algo) Variable Costing Income Statement; Reconciliation [LO,6-1, LO6-2, LO6-3] 6.5 During Heaton Company's first two years of operations, It reported

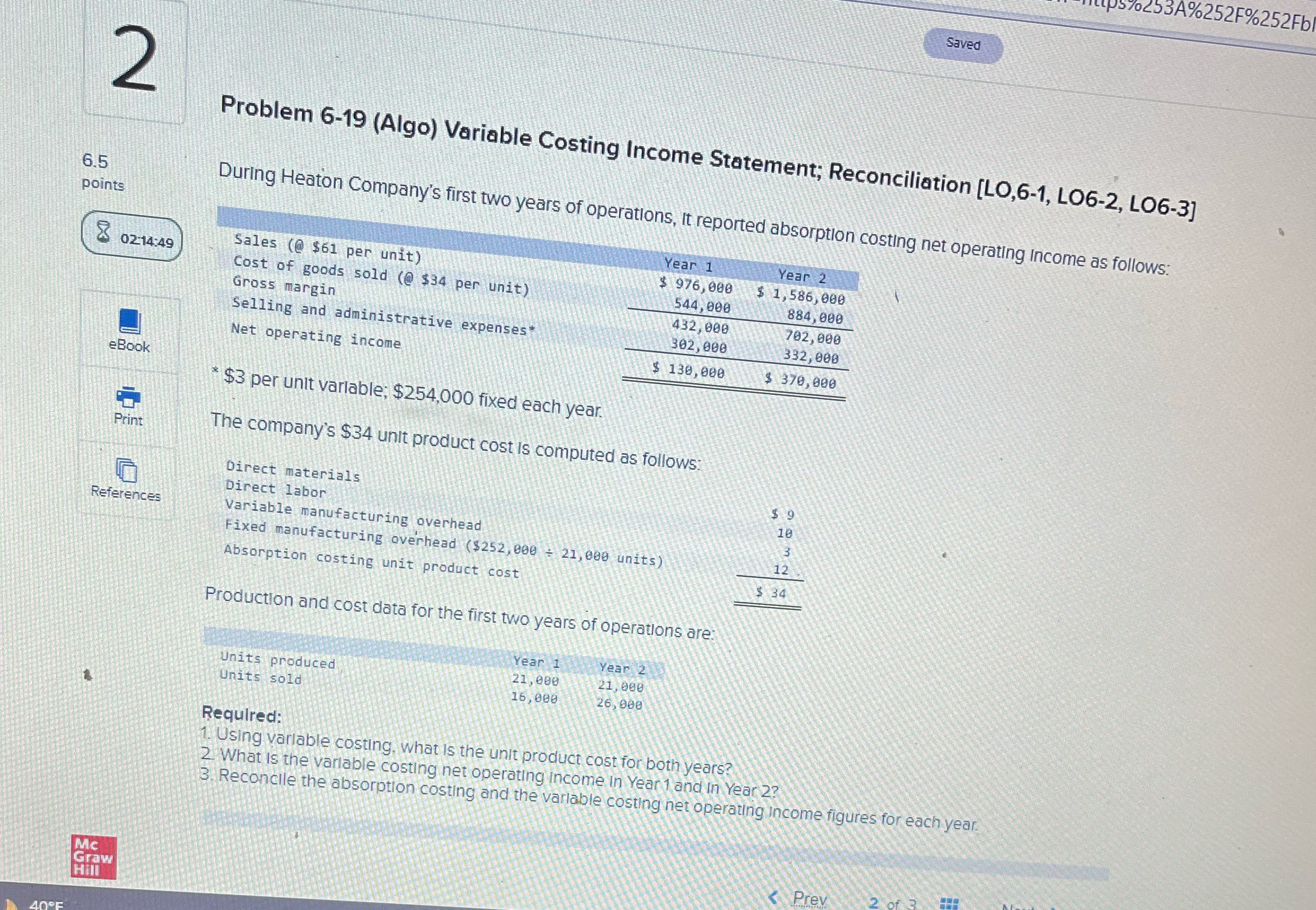

PS/0253A%252F%252Fb Saved 2 Problem 6-19 (Algo) Variable Costing Income Statement; Reconciliation [LO,6-1, LO6-2, LO6-3] 6.5 During Heaton Company's first two years of operations, It reported absorption costing net operating Income as follows: points Year 1 Year 2 02:14:49 Sales (@ $61 per unit) $ 976, 000 $ 1,586, 080 Cost of goods sold (@ $34 per unit) 544, 090 884, 090 Gross margin 432, 090 702, 090 Selling and administrative expenses 302,080 332, 090 Net operating income $ 130, 090 $ 370, 000 Book $3 per unit variable; $254,000 fixed each year. Print The company's $34 unit product cost is computed as follows Direct materials $ 9 Direct labor 10 References Variable manufacturing overhead Fixed manufacturing overhead ($252, 006 + 21,090 units) 12 Absorption costing unit product cost 3 34 Production and cost data for the first two years of operations are Year 1 Year 2 Units produced 21, 080 21, 060 Units sold 16, 090 26, 900 Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and In Year 2? 3. Reconcile the absorption costing and the variable costing net operating Income figures for each year. Mc Prev Graw

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts