Question: PS-5. An analyst is evaluating Wicked Inc. and shared the following projected net cash flows for the next 10 years. Y1 Y2 Y3 Y4

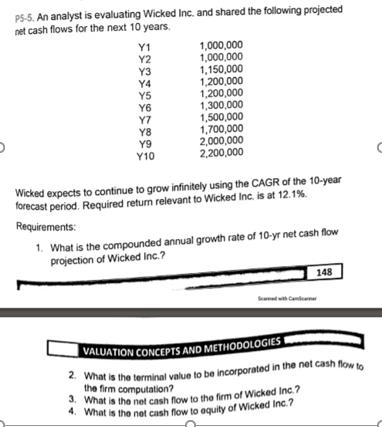

PS-5. An analyst is evaluating Wicked Inc. and shared the following projected net cash flows for the next 10 years. Y1 Y2 Y3 Y4 Y5 Y6 Y7 Y8 Y9 Y10 1,000,000 1,000,000 1,150,000 1,200,000 1,200,000 1,300,000 1,500,000 1,700,000 2,000,000 2,200,000 Wicked expects to continue to grow infinitely using the CAGR of the 10-year forecast period. Required return relevant to Wicked Inc. is at 12.1%. Requirements: 1. What is the compounded annual growth rate of 10-yr net cash flow projection of Wicked Inc.? 148 VALUATION CONCEPTS AND METHODOLOGIES 2. What is the terminal value to be incorporated in the net cash flow to the firm computation? 3. What is the net cash flow to the firm of Wicked Inc.? 4. What is the net cash flow to equity of Wicked Inc.?

Step by Step Solution

There are 3 Steps involved in it

1 To calculate the compounded annual growth rate CAGR of the 10year net cash flow projection for Wic... View full answer

Get step-by-step solutions from verified subject matter experts