Question: 106 Payroll Accounting Chapter 3: Federal and State ind PSa 3-3 Calculate Federal Income Tax Withholding Using the Wage-Bracket Method Refer to Appendix A,

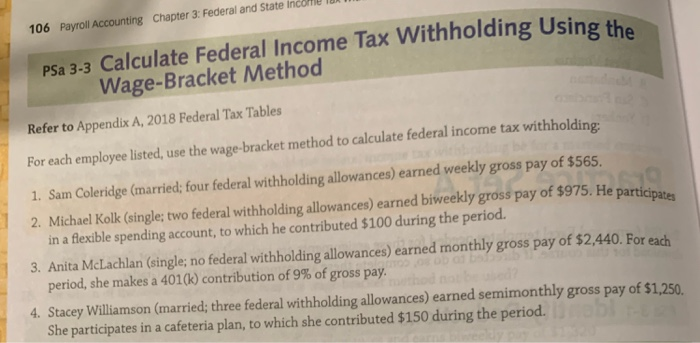

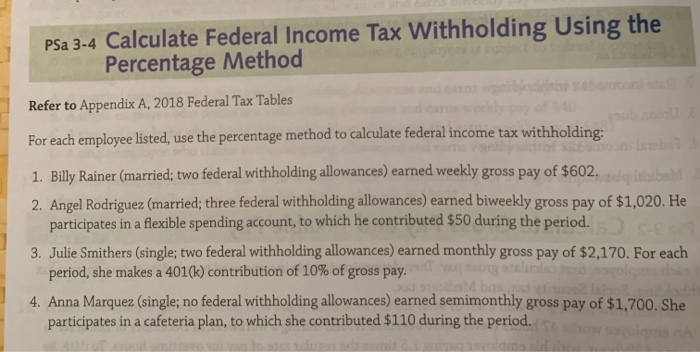

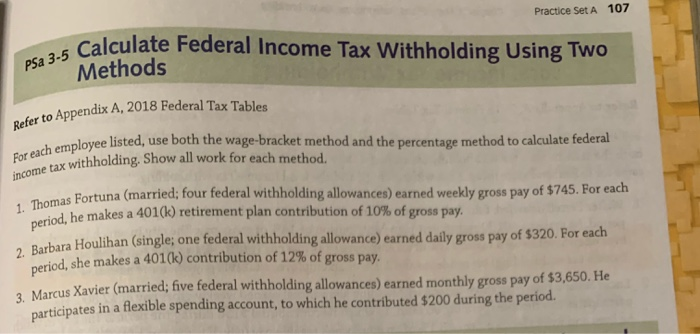

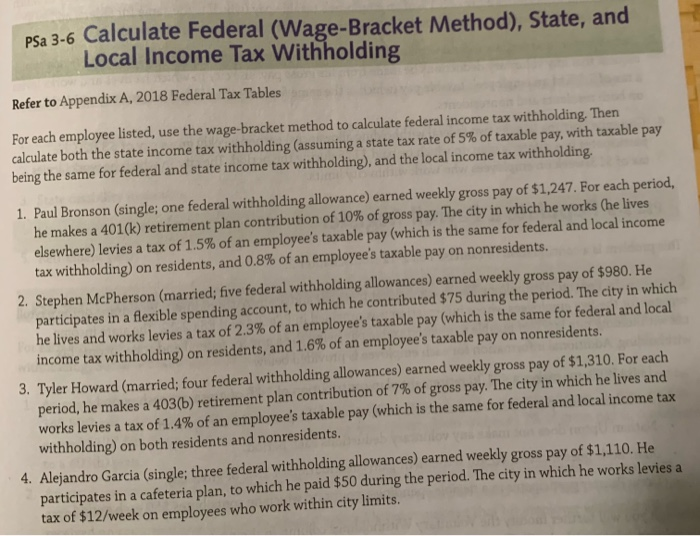

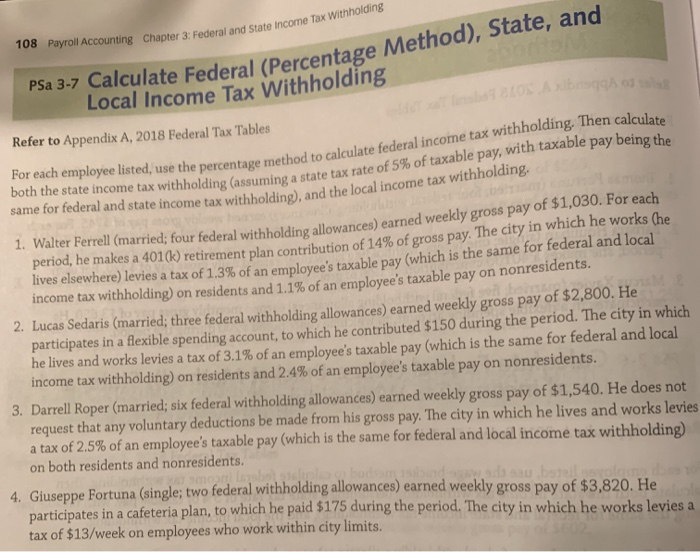

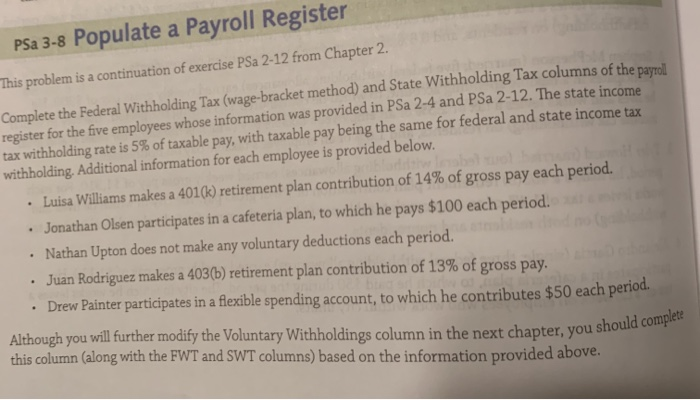

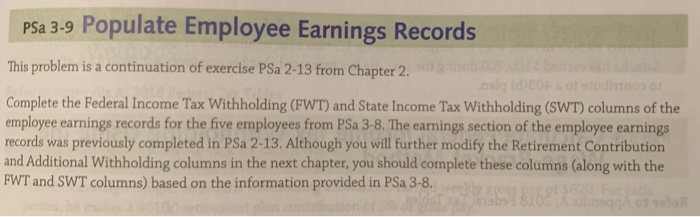

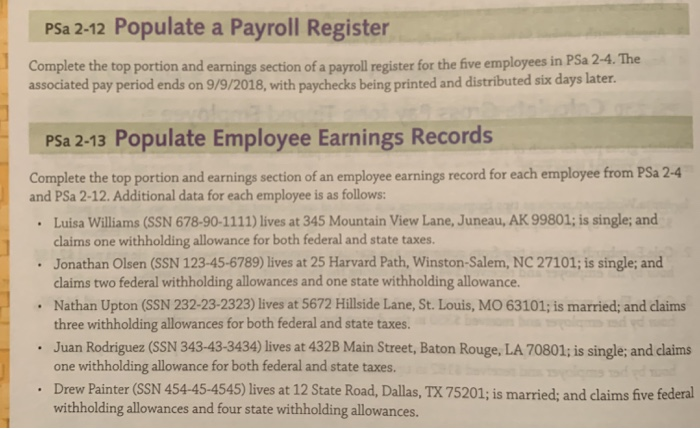

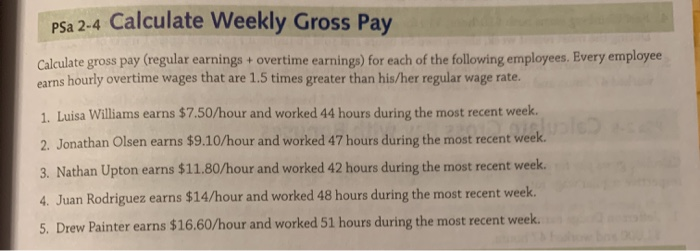

106 Payroll Accounting Chapter 3: Federal and State ind PSa 3-3 Calculate Federal Income Tax Withholding Using the Wage-Bracket Method Refer to Appendix A, 2018 Federal Tax Tables For each employee listed, use the wage-bracket method to calculate federal income tax withholding: of $975. He participa 1. Sam Coleridge (married; four federal withholding allowances) earned weekly gross pay of $565, 2. Michael Kolk (single; two federal withholding allowances) earned biweekly gross pay of $975. He participates in a flexible spending account, to which he contributed $100 during the period. 3. Anita McLachlan (single; no federal withholding allowances) earned monthly gross pay of $2,440. For each bed? period, she makes a 401(k) contribution of 9% of gross pay. 4. Stacey Williamson (married; three federal withholding allowances) earned semimonthly gross pay of $1,250. She participates in a cafeteria plan, to which she contributed $150 during the period.bl eekly pay of $1320 PSa 3-4 Calculate Federal Income Tax Withholding Using the Percentage Method Refer to Appendix A, 2018 Federal Tax Tables of $40 For each employee listed, use the percentage method to calculate federal income tax withholding: dtof 1865mo and earns 1. Billy Rainer (married; two federal withholding allowances) earned weekly gross pay of $602. 2. Angel Rodriguez (married; three federal withholding allowances) earned biweekly gross pay of $1,020. He participates in a flexible spending account, to which he contributed $50 during the period. 3. Julie Smithers (single; two federal withholding allowances) earned monthly gross pay of $2,170. For each period, she makes a 401(k) contribution of 10% of gross pay. you nama oli haM bas xst goed labo bladd 4. Anna Marquez (single; no federal withholding allowances) earned semimonthly gross pay of $1,700. She participates in a cafeteria plan, to which she contributed $110 during the period. A Practice Set A 107 PSa 3-5 Calculate Federal Income Tax Withholding Using Two Methods Refer to Appendix A, 2018 Federal Tax Tables For each employee listed, use both the wage-bracket method and the percentage method to calculate federal income tax withholding. Show all work for each method. 1. Thomas Fortuna (married; four federal withholding allowances) earned weekly gross pay of $745. For each period, he makes a 401(k) retirement plan contribution of 10% of gross pay. 2. Barbara Houlihan (single; one federal withholding allowance) earned daily gross pay of $320. For each period, she makes a 401(k) contribution of 12% of gross pay. 3. Marcus Xavier (married; five federal withholding allowances) earned monthly gross pay of $3,650. He participates in a flexible spending account, to which he contributed $200 during the period. PSa 3-6 Calculate Federal (Wage-Bracket Method), State, and Local Income Tax Withholding Refer to Appendix A, 2018 Federal Tax Tables For each employee listed, use the wage-bracket method to calculate federal income tax withholding. Then calculate both the state income tax withholding (assuming a state tax rate of 5% of taxable pay, with taxable pay being the same for federal and state income tax withholding), and the local income tax withholding. 1. Paul Bronson (single; one federal withholding allowance) earned weekly gross pay of $1,247. For each period, he makes a 401(k) retirement plan contribution of 10% of gross pay. The city in which he works (he lives elsewhere) levies a tax of 1.5% of an employee's taxable pay (which is the same for federal and local income tax withholding) on residents, and 0.8% of an employee's taxable pay on nonresidents. 2. Stephen McPherson (married; five federal withholding allowances) earned weekly gross pay of $980. He participates in a flexible spending account, to which he contributed $75 during the period. The city in which he lives and works levies a tax of 2.3% of an employee's taxable pay (which is the same for federal and local income tax withholding) on residents, and 1.6% of an employee's taxable pay on nonresidents. 3. Tyler Howard (married; four federal withholding allowances) earned weekly gross pay of $1,310. For each period, he makes a 403(b) retirement plan contribution of 7% of gross pay. The city in which he lives and works levies a tax of 1.4% of an employee's taxable pay (which is the same for federal and local income tax withholding) on both residents and nonresidents. 4. Alejandro Garcia (single; three federal withholding allowances) earned weekly gross pay of $1,110. He participates in a cafeteria plan, to which he paid $50 during the period. The city in which he works levies a tax of $12/week on employees who work within city limits. 108 Payroll Accounting Chapter 3: Federal and State Income Tax Withholding aboritoM PSa 3-7 Calculate Federal (Percentage Method), State, and Local Income Tax Withholding Refer to Appendix A, 2018 Federal Tax Tables Tinobe9 840S AxibasqqA For each employee listed, use the percentage method to calculate federal income tax withholding. Then calculate both the state income tax withholding (assuming a state tax rate of 5% of taxable pay, with taxable pay being the same for federal and state income tax withholding), and the local income tax withholding. 1. Walter Ferrell (married; four federal withholding allowances) earned weekly gross pay of $1,030. For each period, he makes a 401(k) retirement plan contribution of 14% of gross pay. The city in which he works (he lives elsewhere) levies a tax of 1.3% of an employee's taxable pay (which is the same for federal and local income tax withholding) on residents and 1.1% of an employee's taxable pay on nonresidents. 2. Lucas Sedaris (married; three federal withholding allowances) earned weekly gross pay of $2,800. He participates in a flexible spending account, to which he contributed $150 during the period. The city in which he lives and works levies a tax of 3.1% of an employee's taxable pay (which is the same for federal and local income tax withholding) on residents and 2.4% of an employee's taxable pay on nonresidents. 3. Darrell Roper (married; six federal withholding allowances) earned weekly gross pay of $1,540. He does not request that any voluntary deductions be made from his gross pay. The city in which he lives and works levies a tax of 2.5% of an employee's taxable pay (which is the same for federal and local income tax withholding) on both residents and nonresidents. sislipla bodam isband agaw ada sau batail svolgime das 4. Giuseppe Fortuna (single; two federal withholding allowances) earned weekly gross pay of $3,820. Hele participates in a cafeteria plan, to which he paid $175 during the period. The city in which he works levies a tax of $13/week on employees who work within city limits. PSa 3-8 Populate a Payroll Register This problem is a continuation of exercise PSa 2-12 from Chapter 2. Complete the Federal Withholding Tax (wage-bracket method) and State Withholding Tax columns of the payroll register for the five employees whose information was provided in PSa 2-4 and PSa 2-12. The state income tax withholding rate is 5% of taxable pay, with taxable pay being the same for federal and state income tax withholding. Additional information for each employee is provided below. Luisa Williams makes a 401(k) retirement plan contribution of 14% of gross pay each period. . . . . . Jonathan Olsen participates in a cafeteria plan, to which he pays $100 each period. Nathan Upton does not make any voluntary deductions each period. Juan Rodriguez makes a 403(b) retirement plan contribution of 13% of gross pay. Drew Painter participates in a flexible spending account, to which he contributes $50 each period. Although you a will further modify the Voluntary Withholdings column in the next chapter, you should complete this column (along with the FWT and SWT columns) based on the information provided above. PSa 3-9 Populate Employee Earnings Records This problem is a continuation of exercise PSa 2-13 from Chapter 2. asiq (d)80P & of studios of Complete the Federal Income Tax Withholding (FWT) and State Income Tax Withholding (SWT) columns of the employee earnings records for the five employees from PSa 3-8. The earnings section of the employee earnings records was previously completed in PSa 2-13. Although you will further modify the Retirement Contribution and Additional Withholding columns in the next chapter, you should complete these columns (along with the FWT and SWT columns) based on the information provided in PSa 3-8. PSa 2-12 Populate a Payroll Register Complete the top portion and earnings section of a payroll register for the five employees in PSa 2-4. The associated pay period ends on 9/9/2018, with paychecks being printed and distributed six days later. PSa 2-13 Populate Employee Earnings Records Complete the top portion and earnings section of an employee earnings record for each employee from PSa 2-4 and PSa 2-12. Additional data for each employee is as follows: .Luisa Williams (SSN 678-90-1111) lives at 345 Mountain View Lane, Juneau, AK 99801; is single; and claims one withholding allowance for both federal and state taxes. . Jonathan Olsen (SSN 123-45-6789) lives at 25 Harvard Path, Winston-Salem, NC 27101; is single; and . . . claims two federal withholding allowances and one state withholding allowance. Nathan Upton (SSN 232-23-2323) lives at 5672 Hillside Lane, St. Louis, MO 63101; is married; and claims three withholding allowances for both federal and state taxes. his gols md yd Juan Rodriguez (SSN 343-43-3434) lives at 432B Main Street, Baton Rouge, LA 70801; is single; and claims one withholding allowance for both federal and state taxes. Drew Painter (SSN 454-45-4545) lives at 12 State Road, Dallas, TX 75201; is married; and claims five federal withholding allowances and four state withholding allowances. PSa 2-4 Calculate Weekly Gross Pay Calculate gross pay (regular earnings + overtime earnings) for each of the following employees. Every employee earns hourly overtime wages that are 1.5 times greater than his/her regular wage rate. 1. Luisa Williams earns $7.50/hour and worked 44 hours during the most recent week. 2. Jonathan Olsen earns $9.10/hour and worked 47 hours during the most recent week. 3. Nathan Upton earns $11.80/hour and worked 42 hours during the most recent week. 4. Juan Rodriguez earns $14/hour and worked 48 hours during the most recent week. 5. Drew Painter earns $16.60/hour and worked 51 hours during the most recent week.

Step by Step Solution

There are 3 Steps involved in it

Part 1 Calculate Weekly Gross Pay PSa 24 Formula GrossPay RegularHours HourlyRate OvertimeHours HourlyRate 15 textGross Pay textRegular Hours times textHourly Rate textOvertime Hours times textHourly ... View full answer

Get step-by-step solutions from verified subject matter experts